I have a Viewpoint out in JAMA with my colleague @Cutler_econ – The COVID-19 Pandemic and the $16 Trillion Virus. It is particularly relevant today ja.ma/3diC0U9

1/13

1/13

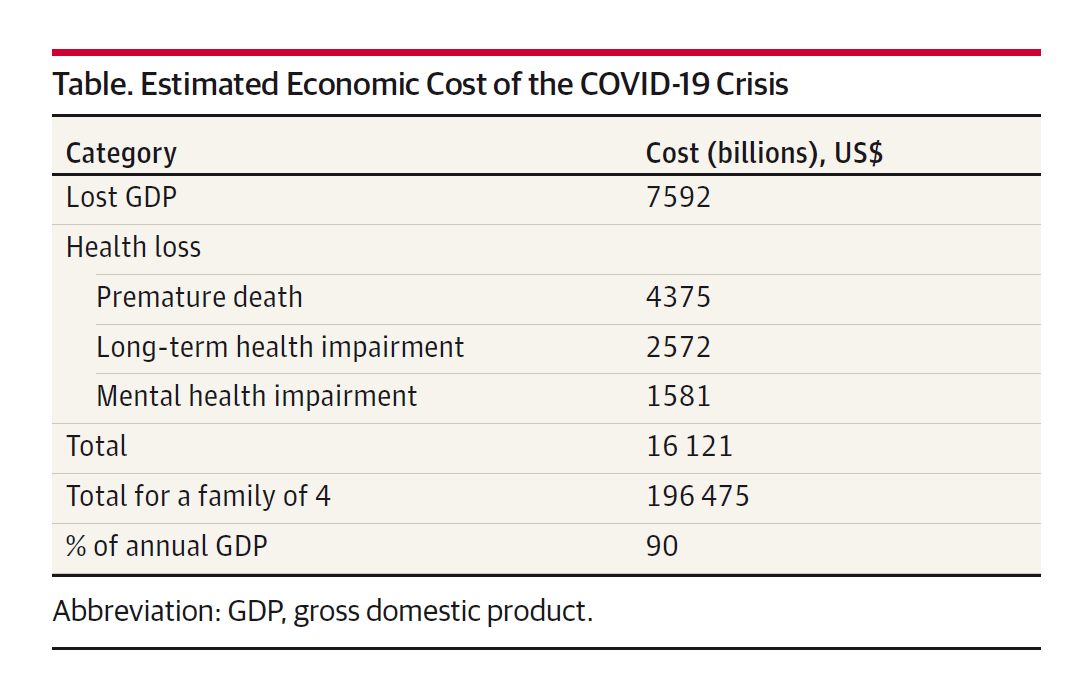

We estimate the cost of the COVID virus for the US. Bottom line cost: $16 trillion. This is $200,000 per family or 90% of a year’s GDP.

2/13

2/13

Some other metrics: this is 4x the output loss of the Great Recession, 2x the cost of all wars since 9/11, and roughly the cost of climate change in the next 50 years. Let me explain the estimates.

3/13

3/13

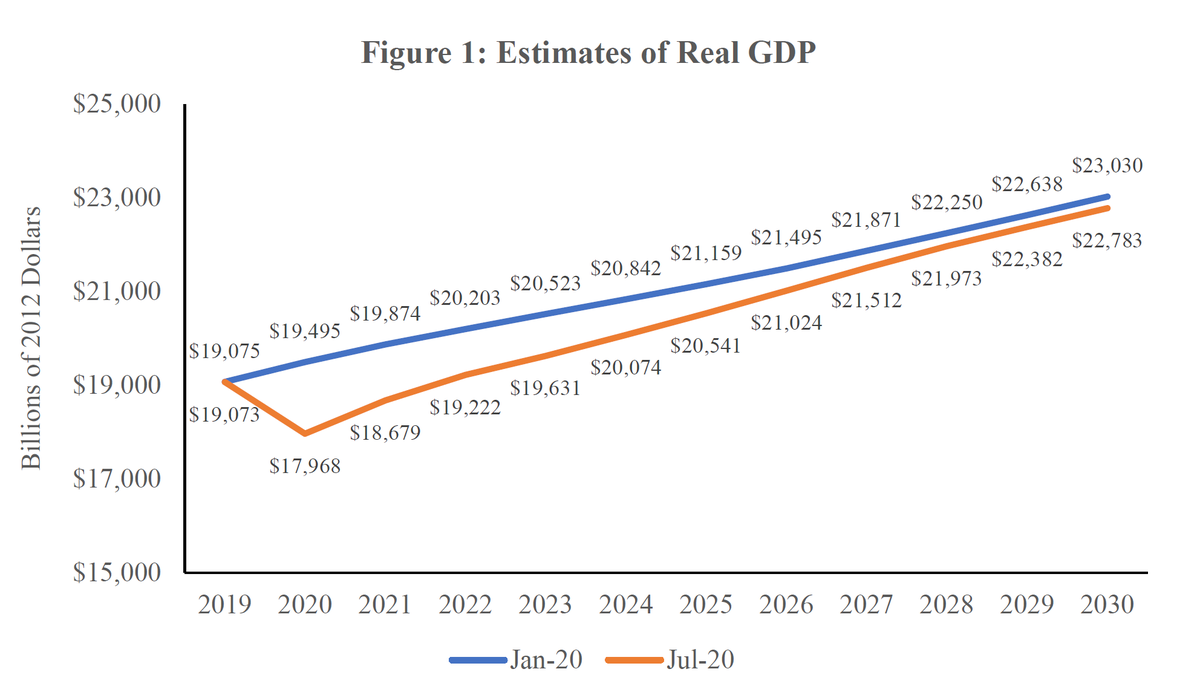

There are two major parts. First part is lost GDP. This is estimated by CBO at $7.6 trillion over the next decade.

4/13

4/13

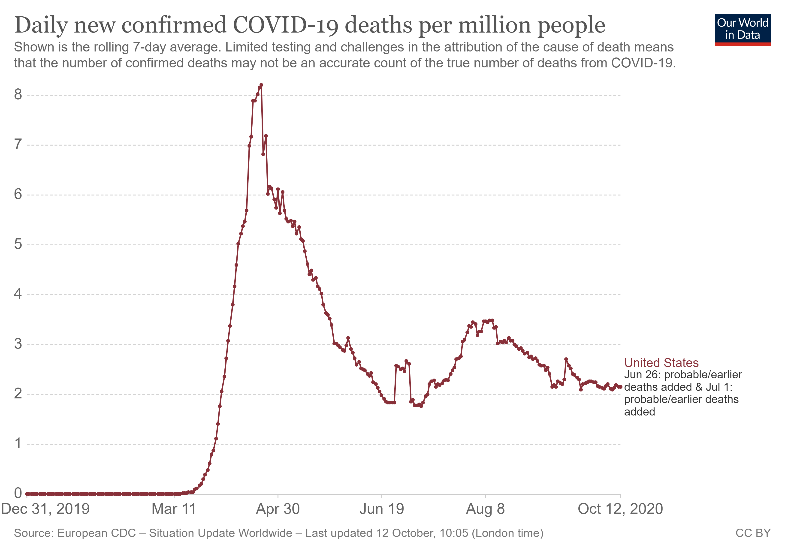

Second part is lost health. We do this in stages. 1st, we take estimates of loss of life assuming number of deaths stays constant at today’s level for next year – a conservative assumption. This amounts to @ 625,000 deaths total, incl COVID and non-COVID excess deaths.

5/13

5/13

Conventional economic work values a statistical life at about $7 million per life. Thus, economic loss from premature mortality = $4.4 trillion.

6/13

6/13

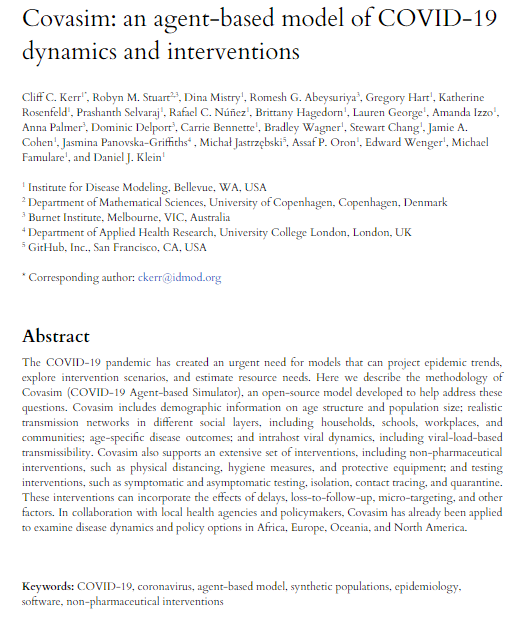

There will also be long-term health impairments. The extent of this is not known entirely. We use estimates from COVASIM by Kerr et al. to get ratio of people with severe disease to deaths. Then use experience from SARS to get share of those who will suffer impairment.

7/13

7/13

Assuming surviving COVID with complications is like having COPD, this is a loss of about one-third of QALY, or $2.6 trillion total

8/13

8/13

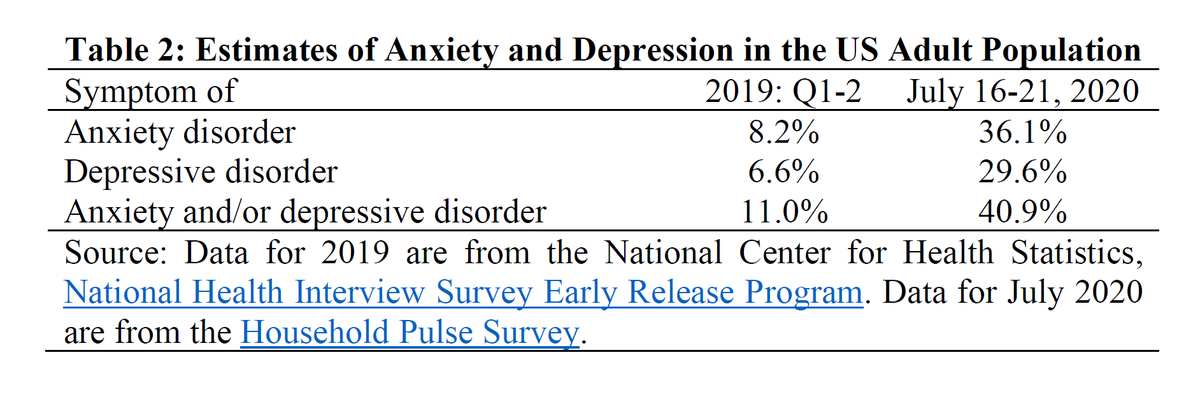

Finally, population mental health has been severely adversely affected. Symptoms of anxiety & depression went from 11% of the population pre-COVID to 41% now. This is 80 million people.

9/13

9/13

Using a low-end estimate of the QALY loss from this and the low end of values per QALY, this amounts to $1.6 trillion total loss just for one year.

10/13

10/13

Add it up and the total is $16 trillion – assuming the virus only affects health for the next year. Half of this is lost output; the other half is health impairment.

11/13

11/13

The fact that this number is so high implies that investments in reducing COVID are hugely valuable. We estimate the value of testing to be AT LEAST 30 times the cost.

12/13

12/13

Congress is currently debating a second economic support measure. Our suggestion: at least 5% of any such bill should be devoted to testing and contact tracing. 13/13

• • •

Missing some Tweet in this thread? You can try to

force a refresh