1/Ok y’all, this @jasonbordoff piece is just fantastic. His boldest, and in my opinion accurate, claim is that petrostates will be winners of climate change policy. So let’s unpack that with a THREAD.

foreignpolicy.com/2020/10/05/cli…

foreignpolicy.com/2020/10/05/cli…

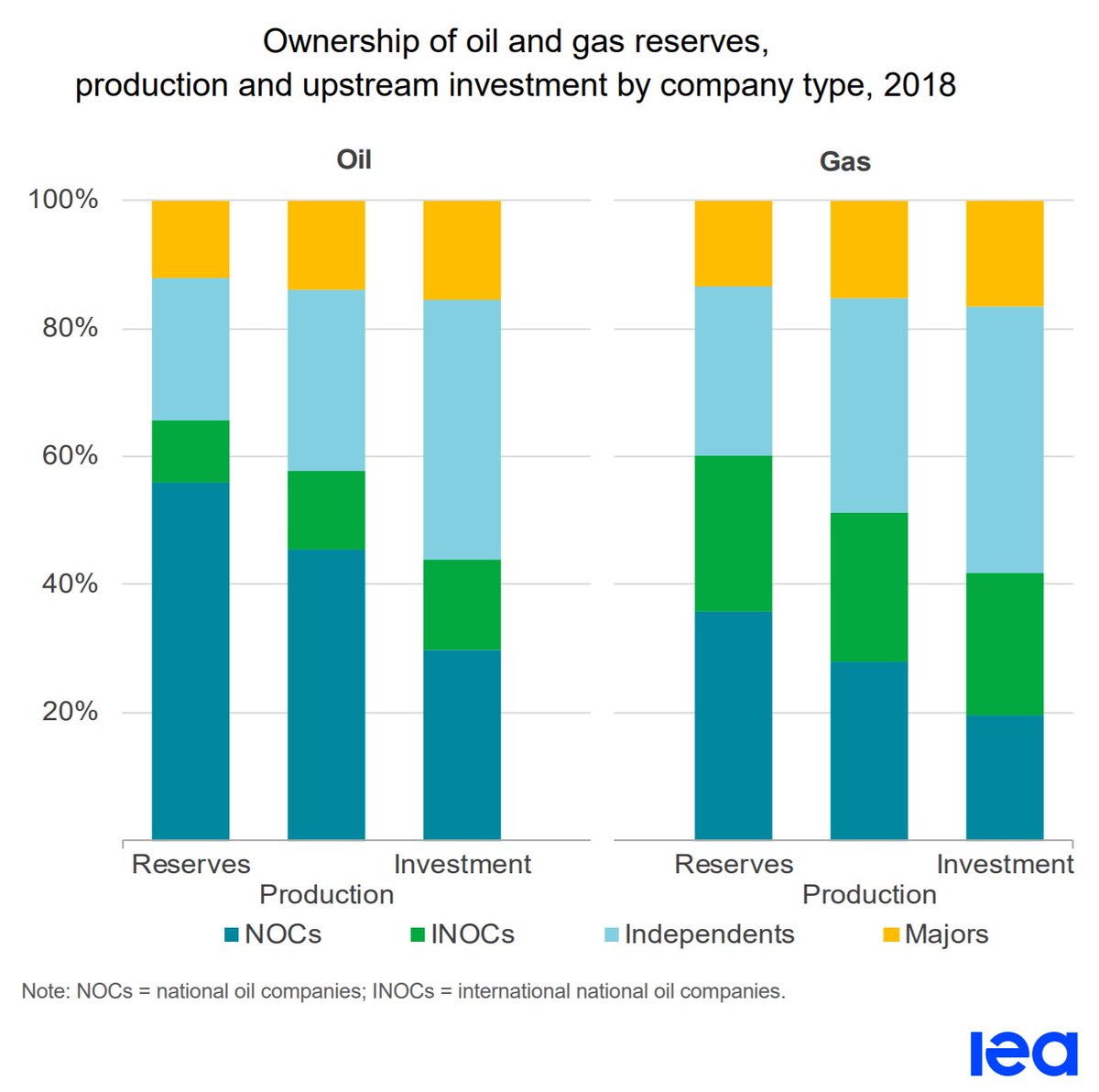

2/The first principle you need to understand is the nature of current oil production and reserves:

Big Oil (Majors) makes the most headlines, but National Oil Companies (NOCs) have the most oil. Big Oil only controls ~10% of global oil reserves.

webstore.iea.org/download/direc…

Big Oil (Majors) makes the most headlines, but National Oil Companies (NOCs) have the most oil. Big Oil only controls ~10% of global oil reserves.

webstore.iea.org/download/direc…

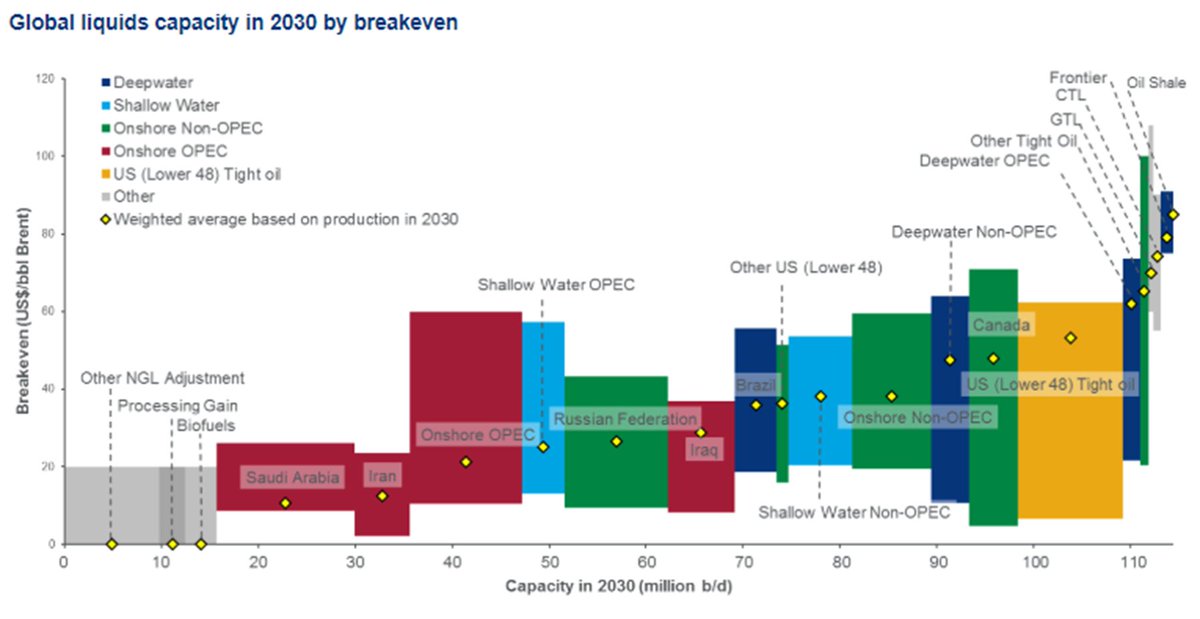

3/And beyond that, not all reserves are equal. Check out WoodMac’s estimate on breakevens by resource. Notice something? The VAST MAJORITY of low cost oil is controlled by NOCs.

woodmac.com/reports/upstre…

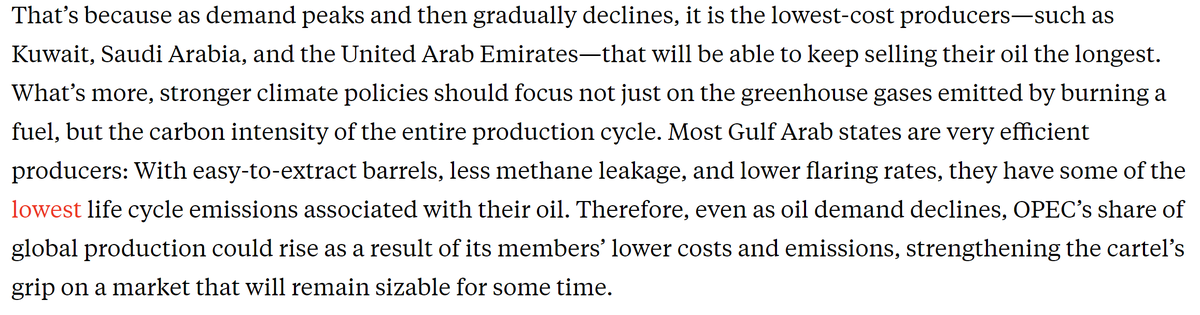

woodmac.com/reports/upstre…

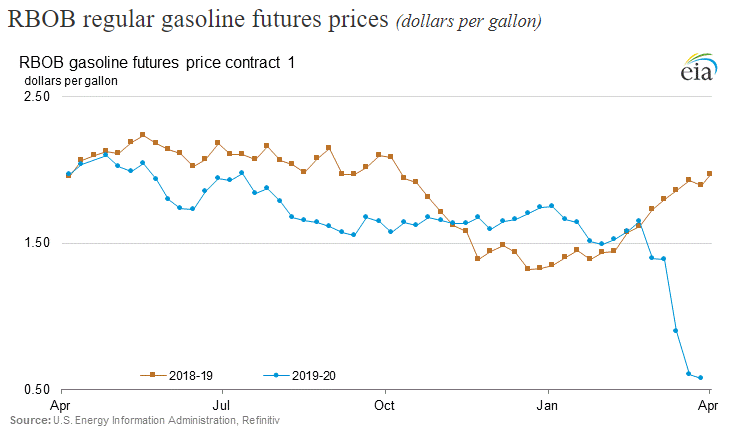

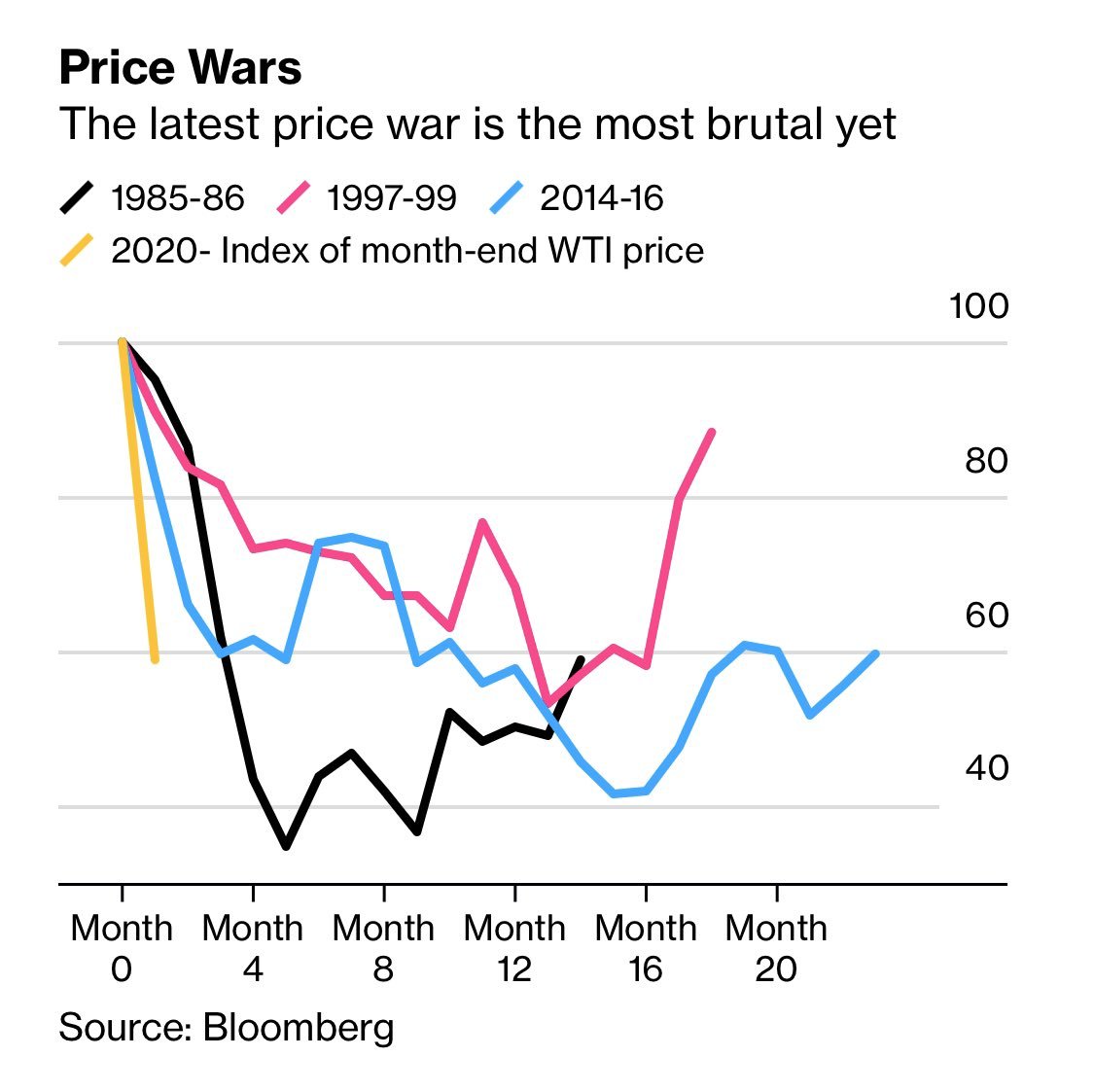

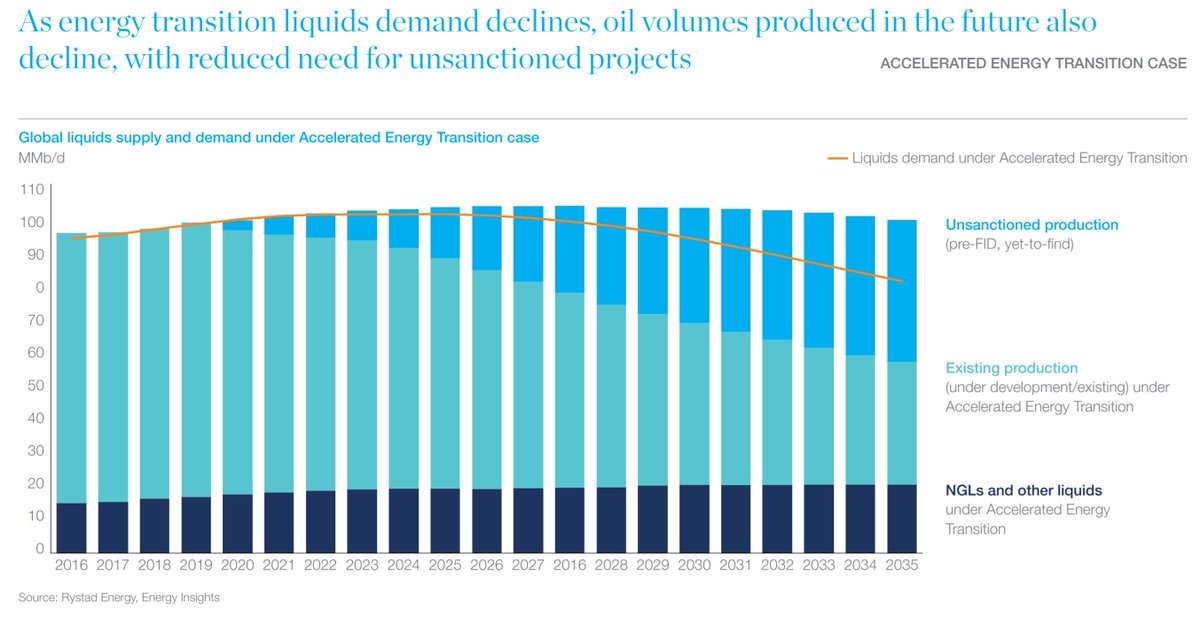

4/This dynamic is important as we enter the energy transition and oil begins to decline. Often cited by the oil industry are charts like this, from McKinsey, show that even in transition scenarios, new investment is still needed to offset decline.

mckinsey.com/solutions/ener…

mckinsey.com/solutions/ener…

5/So yes, more investment is needed, but the TRILLION dollar question is, which investment? Historically, OPEC countries, and NOCs more broadly, have balanced priorities of volume of production with strategic considerations and a desire to maintain pricing power.

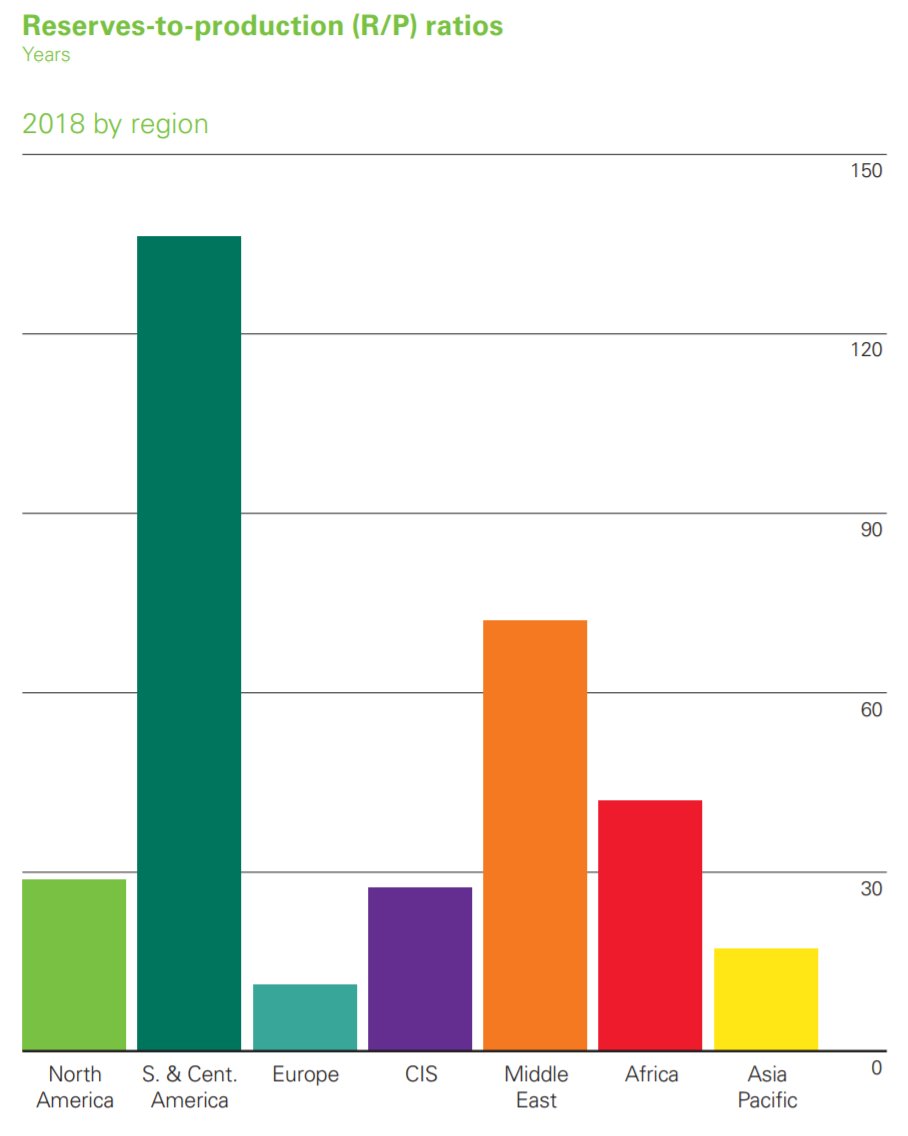

6/But if the world starts shifting away from oil, the rules will be rewritten entirely. Let’s take a look at an important metric: Reserve-to-Production (R/P) ratio. Notice two regions, C. and S. America and Middle East, are dominant.

bp.com/content/dam/bp…

bp.com/content/dam/bp…

7/At 130 and 75, the R/P of these regions implies they have decades of oil, even before accounting for new discoveries (reserves replacement). These numbers are so high for a mix of economic, strategic, and geopolitical reasons, but make for a useful thought experiment.

8/So here is the thought experiment: let’s say the world gets serious about climate change, to the point that we move off of fossil fuels in a timeframe like what China has proposed, by 2060.

bbc.com/news/science-e…

bbc.com/news/science-e…

9/If you are a country with 75 years worth of oil reserves, but the market only remains for the next 40 years, what to do? Well in this simple thought experiment, you better at least double production.

10/This gets to the crux of @jasonbordoff prediction: that low cost oil from the NOCs will enable them to keep producing the longest. And in fact, their incentives may be to RAMP UP production as global oil demand declines.

11/And prices may not necessarily be low. There will still be volatility on the way down, and Big Oil, with higher cost resources and increasingly harsh conditions for policy and financing, may not be able to respond. Leaving remaining profits for the NOCs.

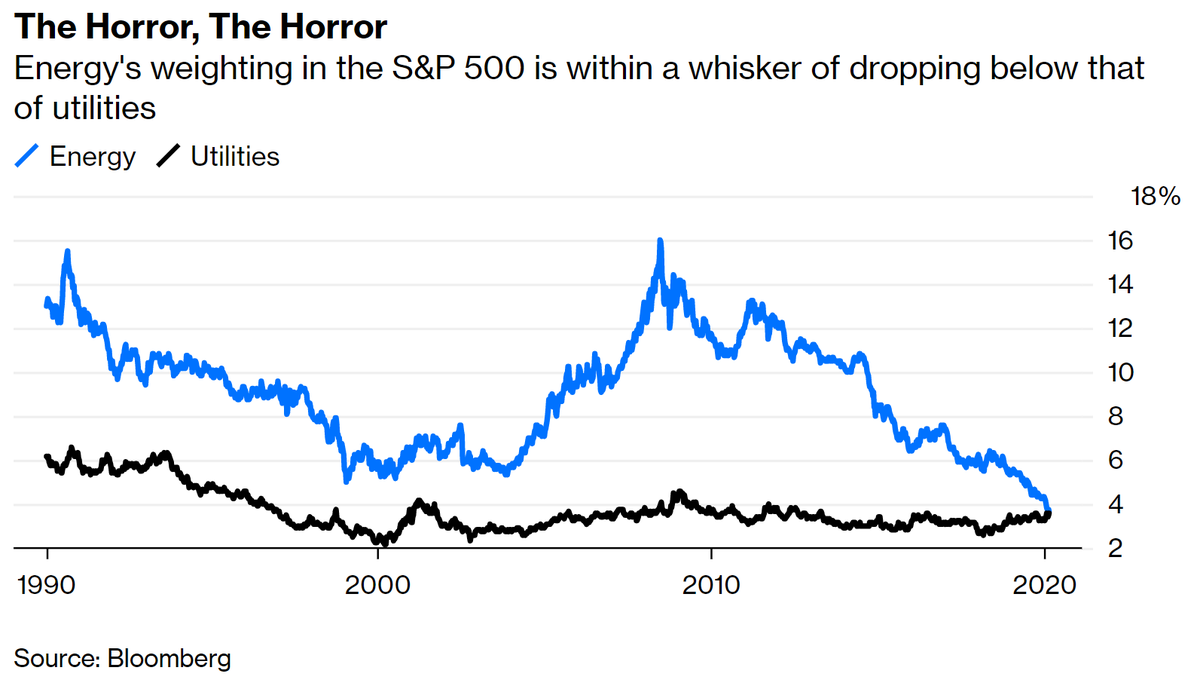

12/This goes a long way to explain financial markets generally souring on Big Oil, to the point that it’s just a tiny fraction of the S&P. It’s not just about how much oil the world needs in the energy transition, it’s about where it will come from.

bloomberg.com/opinion/articl…

bloomberg.com/opinion/articl…

13/So the Big Oil vs. NOC dynamic has always underpinned the energy sector, but as we enter the energy transition, everyone might act quite differently than they have in the past to prevent being the only one without a chair when the music stops.

14/And that means NOCs may actually RAMP production in the face of oil demand decline. After all, they don’t want to be sitting on decades worth of stranded assets if the world moves away from oil this century.

15/So give the @jasonbordoff article a read and rethink how you see the energy transition. Big Oil is in a precarious position, and the conversation on oil production and emissions must be broadened with more focus on NOCs. END.

foreignpolicy.com/2020/10/05/cli…

foreignpolicy.com/2020/10/05/cli…

• • •

Missing some Tweet in this thread? You can try to

force a refresh