My thoughts on $TWLO 's Segment acq after listening to the conf call:

- Makes sense

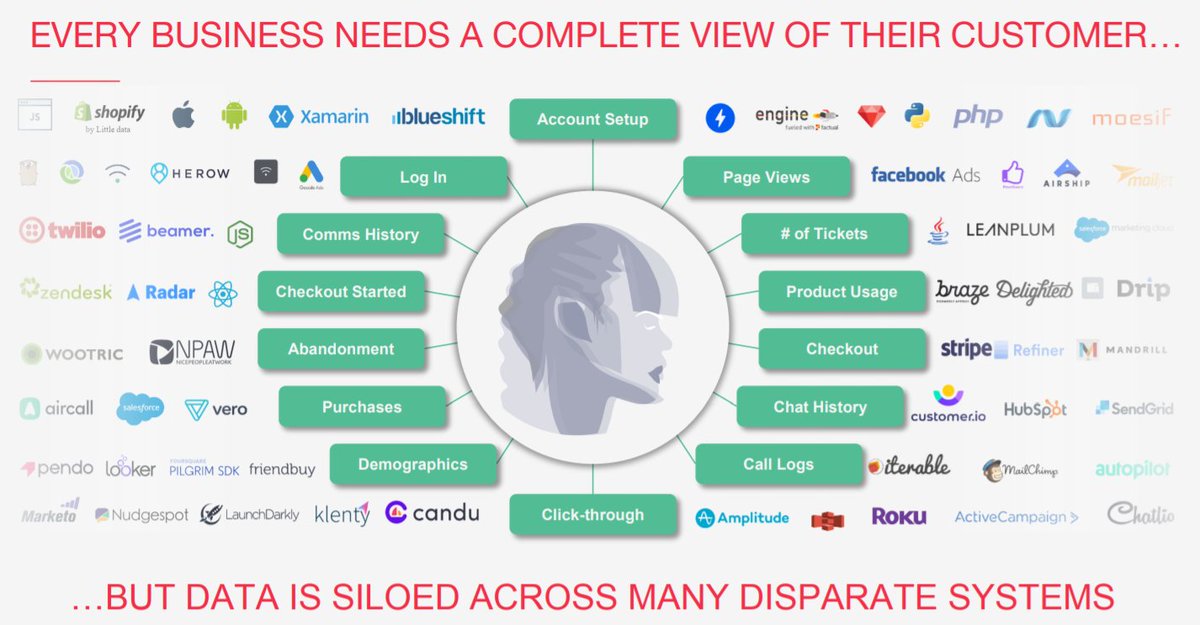

- Solving something important - single view of customer

- Buying a leader in a related high growth space

- Raises TAM from $62-79B (27%)

- Accretive to $TWLO - paying lower mult

1/11

- Makes sense

- Solving something important - single view of customer

- Buying a leader in a related high growth space

- Raises TAM from $62-79B (27%)

- Accretive to $TWLO - paying lower mult

1/11

2/11

The CEOs of $TWLO (@jeffiel) & Segment (@reinpk) seem very good together.

Similar developer focus & vision

Could hear the excitement as they answered the conf call qs

All share deal makes sense to me

They're both young & talented so can do GREAT things from here

The CEOs of $TWLO (@jeffiel) & Segment (@reinpk) seem very good together.

Similar developer focus & vision

Could hear the excitement as they answered the conf call qs

All share deal makes sense to me

They're both young & talented so can do GREAT things from here

3/11

They're solving something very important - to get a single view of the customer.

This helps co's to do more personalised and targeted engagement with their customers.

In an increasing digital world, relevant customer engagement is critical.

They're solving something very important - to get a single view of the customer.

This helps co's to do more personalised and targeted engagement with their customers.

In an increasing digital world, relevant customer engagement is critical.

4/11

The Segment business helps companies to collect customer data from many apps, dbs & silos & put it together so they can see a single view.

Their platform already integrates to 300 sources. Others are now approaching them to integrate to their platform.

The Segment business helps companies to collect customer data from many apps, dbs & silos & put it together so they can see a single view.

Their platform already integrates to 300 sources. Others are now approaching them to integrate to their platform.

5/11

What I like is that both companies are developer led and focus on enabling developers in their customers (with APIs & building blocks)

If the developers can easily pull the info together, they can make good solutions for the marketing folk & business people

What I like is that both companies are developer led and focus on enabling developers in their customers (with APIs & building blocks)

If the developers can easily pull the info together, they can make good solutions for the marketing folk & business people

6/11

$TWLO has the underlying communication platform to act on customer insights but didn't have the ability to integrate with all the silos to build the single customer view.

That's what Segment gives them.

$TWLO has the underlying communication platform to act on customer insights but didn't have the ability to integrate with all the silos to build the single customer view.

That's what Segment gives them.

7/11

They didnt directly answer questions on competition with Salesforce.

But what they are doing is different. Their platform will integrate with all the other apps that store customer data (eg. Salesforce) and pull it together.

They didnt directly answer questions on competition with Salesforce.

But what they are doing is different. Their platform will integrate with all the other apps that store customer data (eg. Salesforce) and pull it together.

8/11

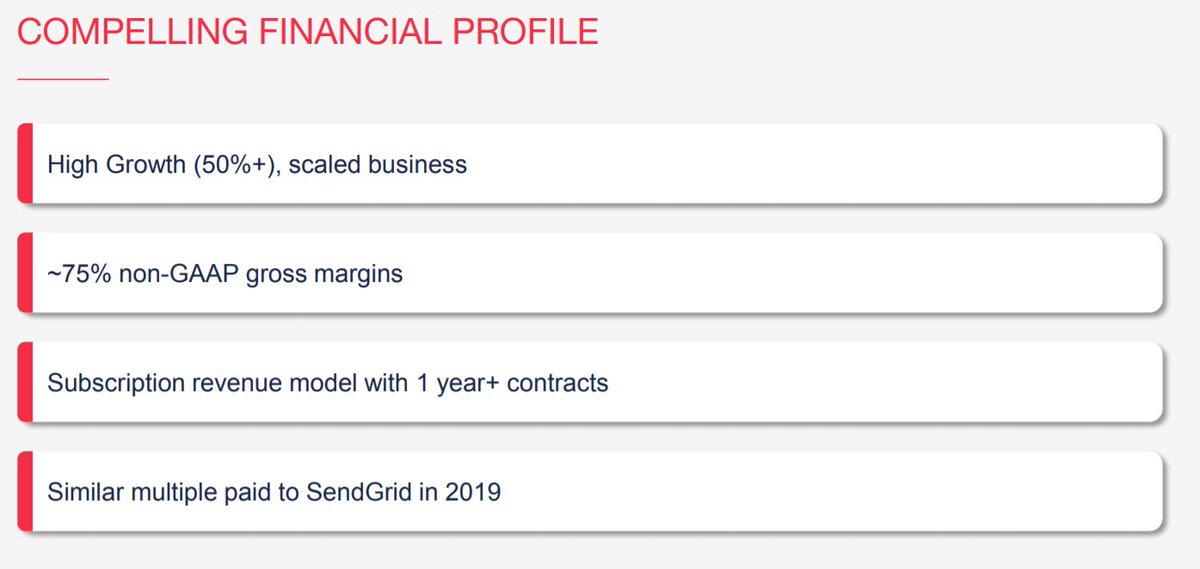

Segment has ~9% (IDC) of the Customer Data Platform space ($2B in total), so I est ~$180M Rev

So they're about 10-15% of size of $TWLO (for FY20 est $1.6B)

At $3.2B deal, its a P/S of ~18 times. Less than $TWLO's current P/S of 33

And Segment is growing at ~50%

Segment has ~9% (IDC) of the Customer Data Platform space ($2B in total), so I est ~$180M Rev

So they're about 10-15% of size of $TWLO (for FY20 est $1.6B)

At $3.2B deal, its a P/S of ~18 times. Less than $TWLO's current P/S of 33

And Segment is growing at ~50%

9/11

I felt the CEOs answered the analysts questions on the call very well. It was positive. The vibe was good. No uncomfortable moments.

Its clear they have a plan, know what they're doing and they going to go for it.

Overall this deal looks good to me

I felt the CEOs answered the analysts questions on the call very well. It was positive. The vibe was good. No uncomfortable moments.

Its clear they have a plan, know what they're doing and they going to go for it.

Overall this deal looks good to me

10/11

Just a word of thanks to @saxena_puru because I initially discovered $TWLO from him and have since spent time trying to understand it better.

Full disclosure, I have held @Twlo shares for a while and continue to do so.

Just a word of thanks to @saxena_puru because I initially discovered $TWLO from him and have since spent time trying to understand it better.

Full disclosure, I have held @Twlo shares for a while and continue to do so.

11/11

Also tagging @MichaelRenzon to have a look. Mike is a long-time friend (& outstanding person).

He founded & heads up @inQubaCX, a leading & very successful global customer journey company.

Also tagging @MichaelRenzon to have a look. Mike is a long-time friend (& outstanding person).

He founded & heads up @inQubaCX, a leading & very successful global customer journey company.

Adding the superb Q3 update on $TWLO from @StackInvesting

- Q3

- iOT

- investor day

- Segment acq

- competitive positioning with respect to $MSFT

Well worth reading

- Q3

- iOT

- investor day

- Segment acq

- competitive positioning with respect to $MSFT

Well worth reading

https://twitter.com/stackinvesting/status/1325503122907803648

• • •

Missing some Tweet in this thread? You can try to

force a refresh