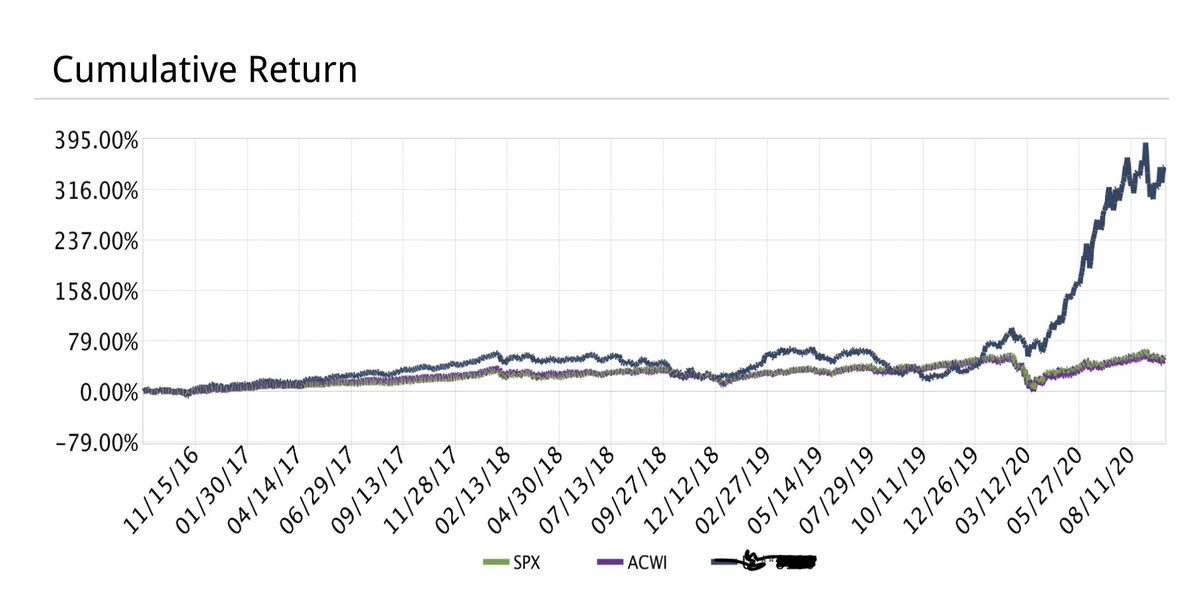

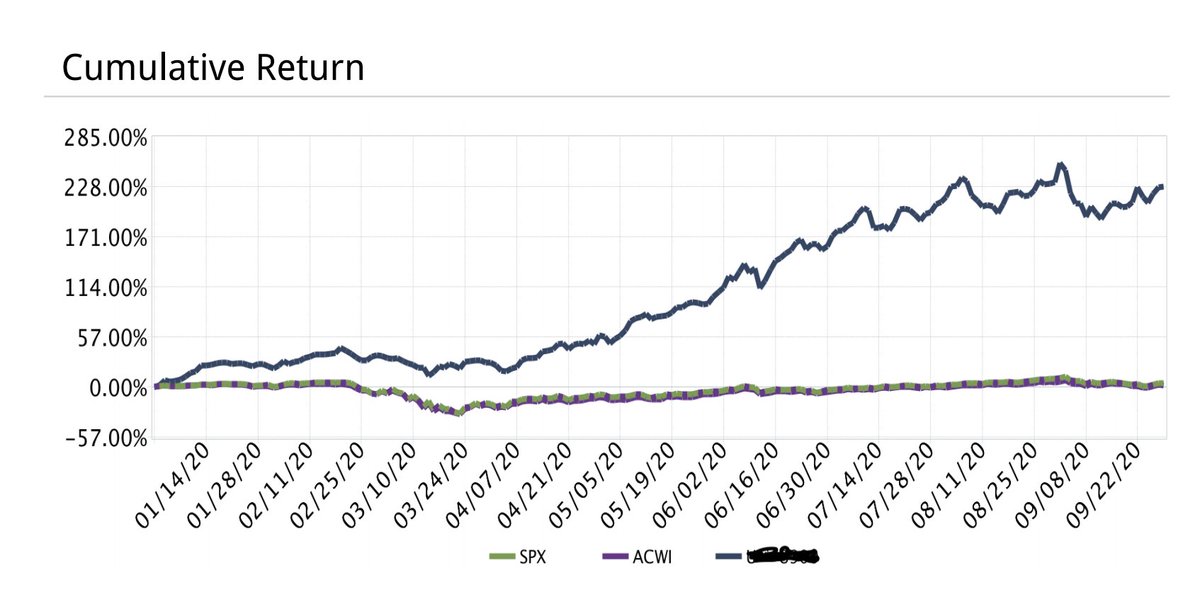

Portfolio update (mid-month) -

New position -

Sold -

New position -

Sold -

Why I grabbed shares of and sold out of -

is an iconic business which I've followed for years and up until recently, I didn't like its customer concentration and reliance on the public sector. However, after reading the company's S-1, press releases and...

is an iconic business which I've followed for years and up until recently, I didn't like its customer concentration and reliance on the public sector. However, after reading the company's S-1, press releases and...

...discussions with @cperruna , I changed my mind and picked up shares.

appears to be a solid business with a durable 'moat' i.e. customer switching costs, network effects, brand intangibles and mgt. has guided for 40%+ revenue growth in '20 and 30%+ growth in '21...

appears to be a solid business with a durable 'moat' i.e. customer switching costs, network effects, brand intangibles and mgt. has guided for 40%+ revenue growth in '20 and 30%+ growth in '21...

...Currently, 47% of its revenue comes from the public sector and 60% of the business is done overseas. is now focusing on expanding its business within the private sector.

In terms of valuation, in my view the business is currently trading at a reasonable price tag and..

In terms of valuation, in my view the business is currently trading at a reasonable price tag and..

...it has ~US$1.5 billion cash on its balance-sheet. Finally, the co-Founders are top-notch and they have 'skin in the game'.

In order to fund this investment and add to , I've booked my gains in (YOY growth will slow significantly from next year onwards).

In order to fund this investment and add to , I've booked my gains in (YOY growth will slow significantly from next year onwards).

• • •

Missing some Tweet in this thread? You can try to

force a refresh