Mind the (PR) Gap - While we wait for the G20 announcement on the DSSI, thought it could be useful to pull together all the discrepancies pointed out by independent research on the statements and policies of the G20/IMF/WB - A thread 🧵

We are set to hear the wonderful achievements of the DSSI and the courageous efforts of the G20 to extend it for a full 6 months. @ifresnillo explains in her new @eurodad report the myriad of contradictions and problems with the DSSI approach #mindthePRgap

https://twitter.com/ifresnillo/status/1316352494423945220?s=20

In the meantime, the IMF and countries worry that participation in the DSSI might increase borrowing costs. @davidmihalyi @a_presbitero show that the DSSI leads to lower borrowing costs does not seem to produce borrower stigma #mindthePRgap

https://twitter.com/a_presbitero/status/1314645608452550657?s=20

We hear Malpass worry about not enough being done to tackle the crisis. Yet, the World Bank so far has been a part of the problem. As highlighted by @ma_jose_romero most of the WB financing has been channeled through the IFC (private sector arm)

https://twitter.com/eurodad/status/1315973515632357376?s=20

In the meantime, folks at @CGDev show that the World Bank is going about its business as usual. Evidence points that the WB will be able to disburse only half of the promised US$ 160 billion in emergency financing #mindthePRgap

https://twitter.com/JustinSandefur/status/1315658906300043264?s=20

We have also heard how the World Bank is unable to participate of the debt suspension for fear of damaging its credit rating. @tim_jones6 shows a clear way to finance the participation of multilaterals in debt relief #mindthePRgap

https://twitter.com/dropthedebt/status/1315613428803928066?s=20

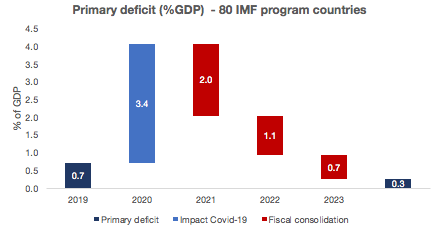

Across the street in DC, things are not better. The @IMFNews is now against austerity. Or so, the managing director says. However, a look to country programs shows a rather different IMF. Who to believe? #mindthePRgap

https://twitter.com/nadiadaar/status/1316000722354417665?s=20

Wealthy countries are being encouraged by the @IMFNews to spend and invest in the aftermath of the pandemic. Developing countries? They need to be "careful". What does that mean in practice? Cuts accross the board #mindthePRgap

https://twitter.com/danielmunevar/status/1313400393444007939?s=20

While @IMFNews is optimistic that a contractual based approach to sovereign debt crisis resolution will suffice, the truth is that information on holdings of sovereign debt and creditors is a black hole. Restructurings will be a messy affair #mindthePRgap

https://twitter.com/nickdearden75/status/1316305155822964738?s=20

We have also heard that the @IMFNews is doing everything it can to provide support to countries in need. @ChristinaLaska1 shows that as it has been the case with the WB, the financial response of the IMF leaves much to be desired

https://twitter.com/ChristinaLaska1/status/1306259489360879616?s=20

And last but not least, have you heard that we are having a Green recovery from Covid-19? The efforts to actually include measures to address climate change as part of emergency responses leave a lot to be desired.

https://twitter.com/GDPC_BU/status/1310928309426028544?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh