Prediction: The next 3-6 months are again going to hit the low-income worker very hard, driving greater wealth gaps, which will drive further social unrest.

Hope I'm wrong.

My two guesses why:

👇

Hope I'm wrong.

My two guesses why:

👇

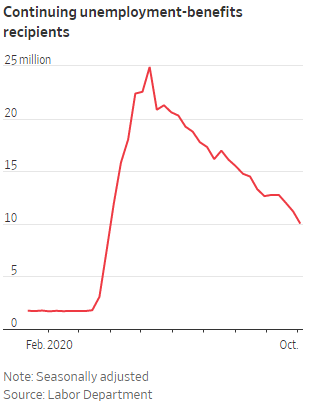

1.Small business unemployment is increasing.

This weeks claims are a slight uptick, plus many of my small business calls in last 2 weeks included discussions about pending layoffs or reduction of hours.

Winter will not be kind to restaurants/entertainment either.

This weeks claims are a slight uptick, plus many of my small business calls in last 2 weeks included discussions about pending layoffs or reduction of hours.

Winter will not be kind to restaurants/entertainment either.

2.The stimulus bill will miss.

All we need is another round of PPP and extension of unemployment benefits.

But, IF a stimulus bill passes, those two components will be less than before and more will go to those who don’t need it (stable businesses and employed workers).

All we need is another round of PPP and extension of unemployment benefits.

But, IF a stimulus bill passes, those two components will be less than before and more will go to those who don’t need it (stable businesses and employed workers).

In summary, I believe we are going to need another short term fix (stimulus) and I do not think it will address those who need it. I hope I'm wrong.

All that said, the economy will probably still thrive. We will just see more wealth and income gaps enabled.

All that said, the economy will probably still thrive. We will just see more wealth and income gaps enabled.

• • •

Missing some Tweet in this thread? You can try to

force a refresh