Some selected tweets from @naval's most recent appearance on The Tim Ferriss Show that specifically reference how he is currently thinking about Bitcoin + crypto.

tim.blog/2020/10/14/nav…

tim.blog/2020/10/14/nav…

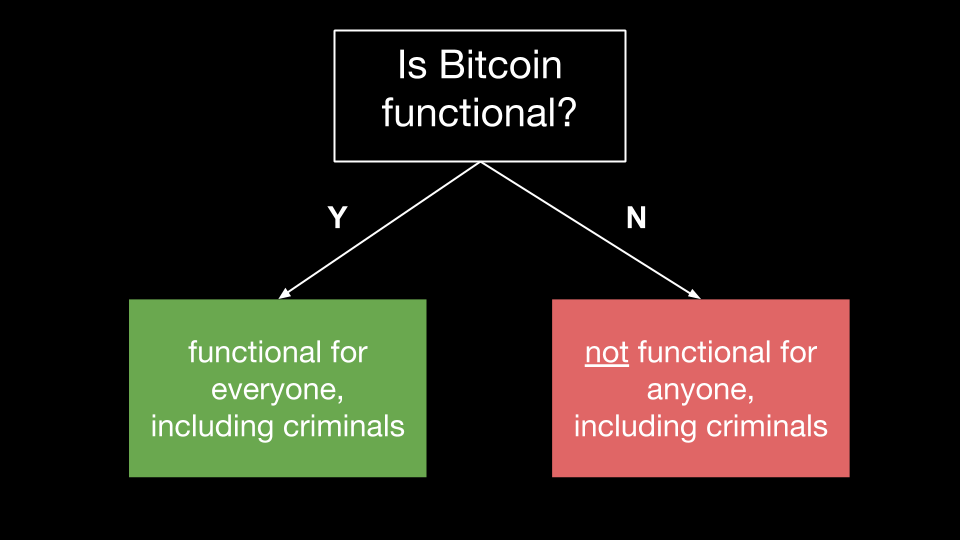

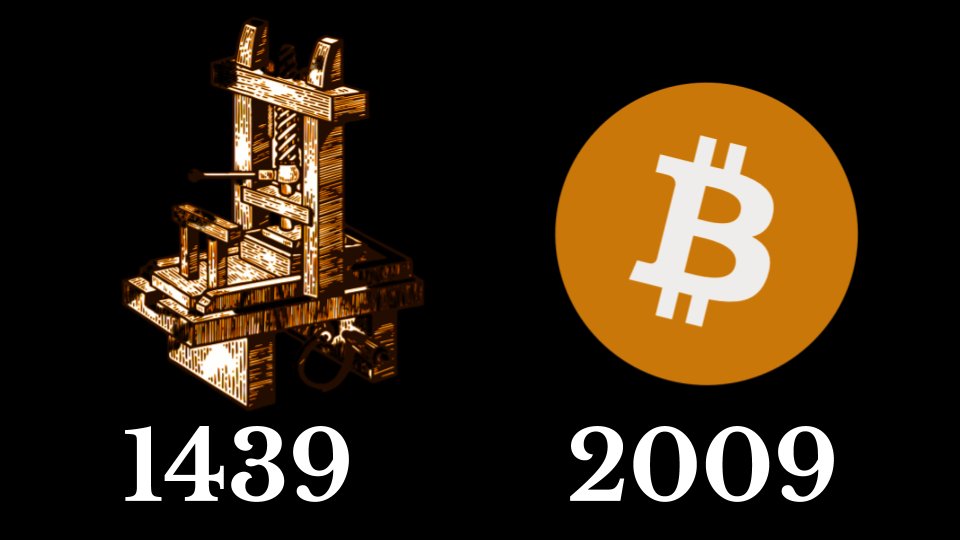

1/ "I think cryptocurrencies are probably one of the greatest inventions in human history and the reason why they’re interesting is because if you look to the technology industry, technology plays in unregulated spaces."

2/ "It is a digital frontier that is being created, now that the physical frontiers are all closed and the new world has been colonized and the wild west has been tamed."

3/ "Where do you go to create new things, free of interference and regulation, and the kind of exercise of maximum creativity. And so that’s been done mostly in the technology space."

https://twitter.com/anilsaidso/status/1309630472272535552?s=20

4/ "And one of the areas that has been protected from technological innovation is Wall Street because there, they have regulatory capture, very bureaucratic, the money industrial complex that runs a lot of our economy and runs a lot of Washington, DC..."

5/ "you have to understand, you’re replacing the banking system, you are literally replacing the government, all the guns and the police, that backup the banking system."

https://twitter.com/anilsaidso/status/1205226353223557120?s=20

6/ "you’re literally creating extra sovereign money. You’re creating money where if you ever have to flee the country, like the Jews that fled Vienna back in the 1930s, you’re not scrambling for gold, you’re using crypto."

7/ "If you’re living in some country where they tend to seize all the money in your bank account, then you have unseizable money. If you’re worried about hyperinflation, as we print too many dollars, then you have a hedge against MMT.."

8/ "Probably the scariest thing that happened in 2020, from a financial perspective, is both the Republican and the Democratic party figured out that, 'Oh, actually we can just print lots and lots of money.'"

https://twitter.com/anilsaidso/status/1311138984471400448?s=20

9/ "when we print a dollar, 70 percent of that inflationary attack effect cost is borne by the rest of the world, not born by us. And so the US government’s figured this out.."

10/ "Money used to be gold-backed and that went away. So it’s not inconceivable that it’ll happen and, if it were to happen, then you would basically have the true reckoning."

https://twitter.com/anilsaidso/status/1295447753946849280?s=20

11/ "people are realizing this and there is a flight into hard assets to get away from inflation."

https://twitter.com/anilsaidso/status/1280971054479900673?s=20

12/ "Bitcoin is trying to be the new gold or the new Swiss bank account, all rolled into one. And it has some advantages, as a store of value, it can be stored digitally, so it’s hard to seize, it’s very easy to verify,.."

13/ "CEO Michael Saylor was quoted as saying something along the lines of, 'I can’t believe people are willing to sell me Bitcoin.' He figured out what it was and then he was just like, 'I want to get as much as possible.'"

https://twitter.com/anilsaidso/status/1306340908065935361?s=20

14/ "And there are lots of people like him, there are lots and lots of people like him and they exist in every major country in the world."

15/ "the beauty of Bitcoin is that there are these diehard maximalists,... they are actually the core of what makes Bitcoin always tradable, always valuable. There’s always some guy.. somewhere in the world, who will give you his house for Bitcoin."

16/ "And as long as that is true and I don’t see why it would stop being true because if anything, more and more people are being added to that list every day, it has real value and has redeemable value."

17/ "when Paul Tudor Jones or MicroStrategy buy Bitcoin, the story’s becoming stronger, the set of believers is increasing, the validation is increasing and now more people can come in and hang their hat on this.."

18/ "one way to think about a Bitcoin, in particular, is, or even actually any of the cryptocurrencies, is it’s a Swiss bank account but... with finite space and if you want shelf space...you have to buy out one of the existing holders."

19/ " I would say the number of people who’ve gotten involved in crypto recently, as a true wealth protection mechanism, is the largest I’ve ever seen. So I do think that the holder base has gone up."

20/ "I don’t know if we’re going to see $3,000 Bitcoin ever again, in my lifetime, we might see zero if something breaks completely, but I don’t think we’re going to see a bunch of people leaving and losing faith in it and that’s why it goes to $3K."

21/ "I don’t want to make price predictions, but I feel like there’s a stronger base of holders now than there has ever been."

https://twitter.com/anilsaidso/status/1303156822090510336?s=20

22/ "Paul Tudor Jones validates it, for other hedge fund managers, hedge fund managers validated it for sovereign wealth funds, sovereign wealth funds, we’ll validate it for central banks."

https://twitter.com/anilsaidso/status/1258488867335942145?s=20

23/ "Eventually, some country out there is going to say, we inflated our currency too much, our currency collapsed, nobody trusts us anymore. We have to adopt a new national currency,...let’s use Bitcoin or let’s use some other cryptocurrency."

24/ "or let’s be clever and buy up a bunch of Bitcoin and then announce we’re going to use Bitcoin and then Bitcoin will skyrocket and we’re all rich."

25/ "I had a friend...He’s like, 'if I ever have to flee the country, I’ll just buy Bitcoin then.' And I said, yeah, when you have to flee the country, your entire fortune is going to buy you one Bitcoin.."

https://twitter.com/anilsaidso/status/1268211283507073029?s=20

26/ "So you can’t, it’s like anything else, a store of value, it’s a hedge, you can’t wait till the last second. And I do think more and more smart people are coming into it every single day."

https://twitter.com/anilsaidso/status/1234645600269819904?s=20

27/ "Look, if two computers [or] two mini-AIs are talking to each other in high speed, exchanging resources to run a company, how are they going to exchange money? You think they’re going to send US dollars through PayPal or through Fedwire? Hell no."

https://twitter.com/anilsaidso/status/1305192802439950336?s=20

28/ "That ability to create scarcity and transmit scarcity and value through the internet is just as important as the ability to create abundance and transmit that through the internet."

https://twitter.com/anilsaidso/status/1291394425302597637?s=20

/END

If you enjoyed this thread, you might also like this-

If you enjoyed this thread, you might also like this-

https://twitter.com/anilsaidso/status/1281677133685768192?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh