A recap of the hat trick of scoops published by the @FT in the last 2 weeks based on leaked documents showing how hundreds of millions of Vatican charity funds were invested in luxury London property via offshore companies, complex "time bomb" derivatives, and pledged for loans.

These investments were overseen by Cardinal Giovanni Angelo Becciu, one of the most powerful and feared men in the Vatican who was stunningly forced to resign by Pope Francis late last month over allegations Becciu described as “embezzlement”. He has denied any wrongdoing.

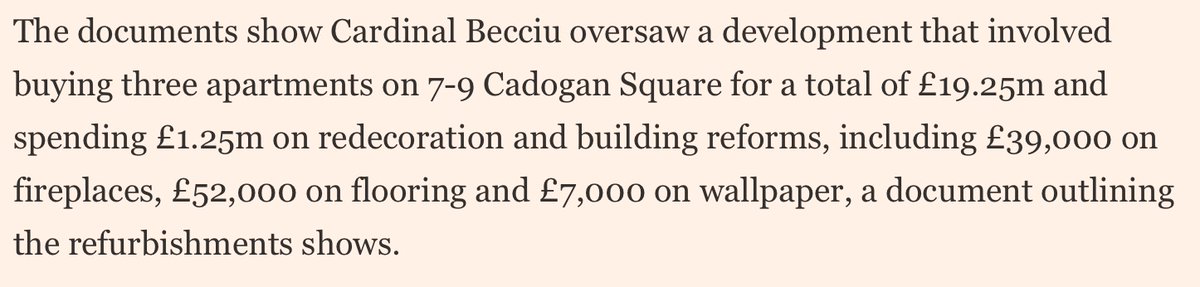

Firstly, we revealed an additional £100m of investments into ultra-prime London property in Cadogan Square overseen by Cardinal Becciu. These were made through a complicated and anonymous offshore structure of Jersey shell companies. Some of them underwent expensive refurbs.

Secondly, we revealed that the €528m portfolio of Vatican assets derived from donations and overseen by Becciu invested in derivatives that bet on the creditworthiness of Hertz. In 2018 Pope Francis called these derivatives “a ticking time bomb”.

Thirdly we revealed that the Vatican had sold off charity assets it had pledged to Credit Suisse to repay a €242m loan taken out to fund the investments overseen by Cardinal Becciu, some of which prosectors now claim resulted in “huge losses” for the Holy See.

• • •

Missing some Tweet in this thread? You can try to

force a refresh