Never in the last few years have we seen more Reset-news than in the last 24 hours. A monetary reset is a set of events over a period in time, and not a binary one. Only in the rear view mirror a monetary reset can be recognized clearly ..

we have to look for signs of ever increasing stress in the current monetary systems ..

let’s name a few:

- TIC report show more and more foreigners have stopped buying US treasuries in recent years ( U$ banking structures now have to buy 2/3 of all new treasuries)

let’s name a few:

- TIC report show more and more foreigners have stopped buying US treasuries in recent years ( U$ banking structures now have to buy 2/3 of all new treasuries)

ever increasing pressure to dollar-system, now extreme stimulus is needed. US Budget deficit $3 Trilion and counting

- repo(funding)-crisis started in September 2019, 2 months after BoE chief Carney said (Jackson Hole) we needed to find a successor for the $ for coming reset ..

- repo(funding)-crisis started in September 2019, 2 months after BoE chief Carney said (Jackson Hole) we needed to find a successor for the $ for coming reset ..

The speed in which central banks hurry to prepare their digital currencies in advance of the coming changes ..

They know direct funding will be needed for consumers and businesses in the next crisis (which actually started in March 2020)

They know direct funding will be needed for consumers and businesses in the next crisis (which actually started in March 2020)

The Covid19 crisis is actually a blessing in disguise, because unprecedented changes (reset) to the monetary system now can be sold/spinned, as the result of this once in a lifetime crises (see IMF call this week)

It’s no surprise gold started to seriously move up since last summer, after Carney’s speech and Ray Dalio’s ‘Paradigm Shift’ essay.

The number of billionaires turned to gold is ever increasing ... even gold-hater Buffett recently joined the gold-bull

The number of billionaires turned to gold is ever increasing ... even gold-hater Buffett recently joined the gold-bull

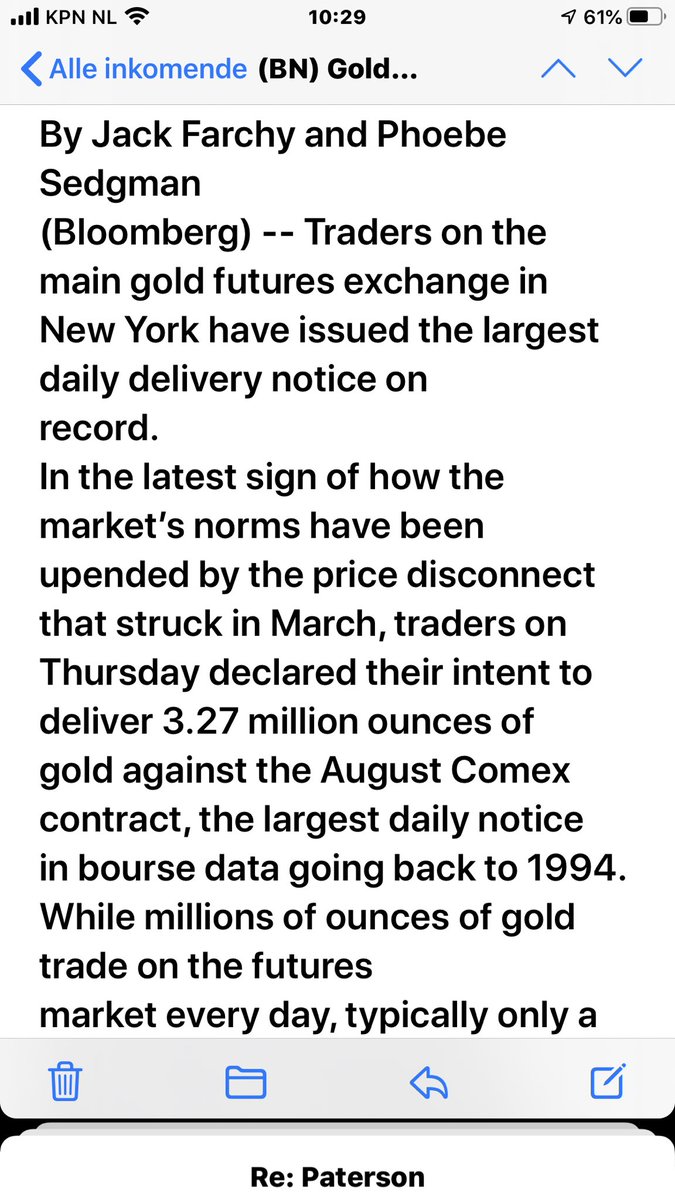

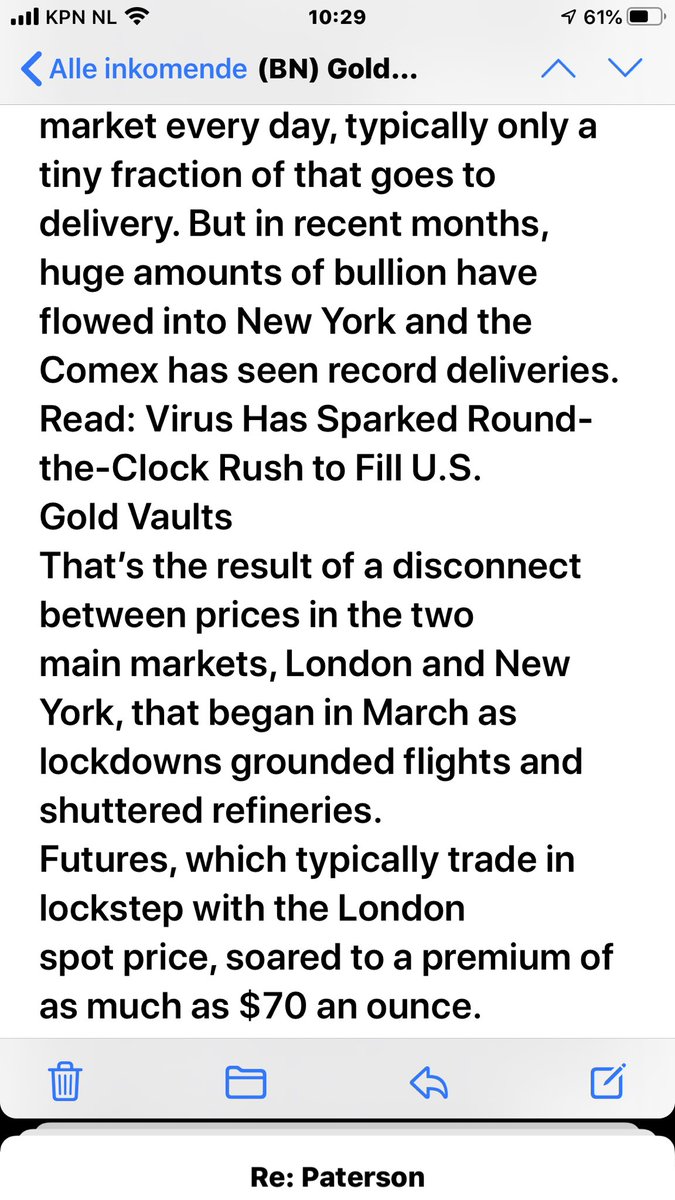

Wall Street is starting to lose control over precious metal prices, especially since the March-Corona-Crash.

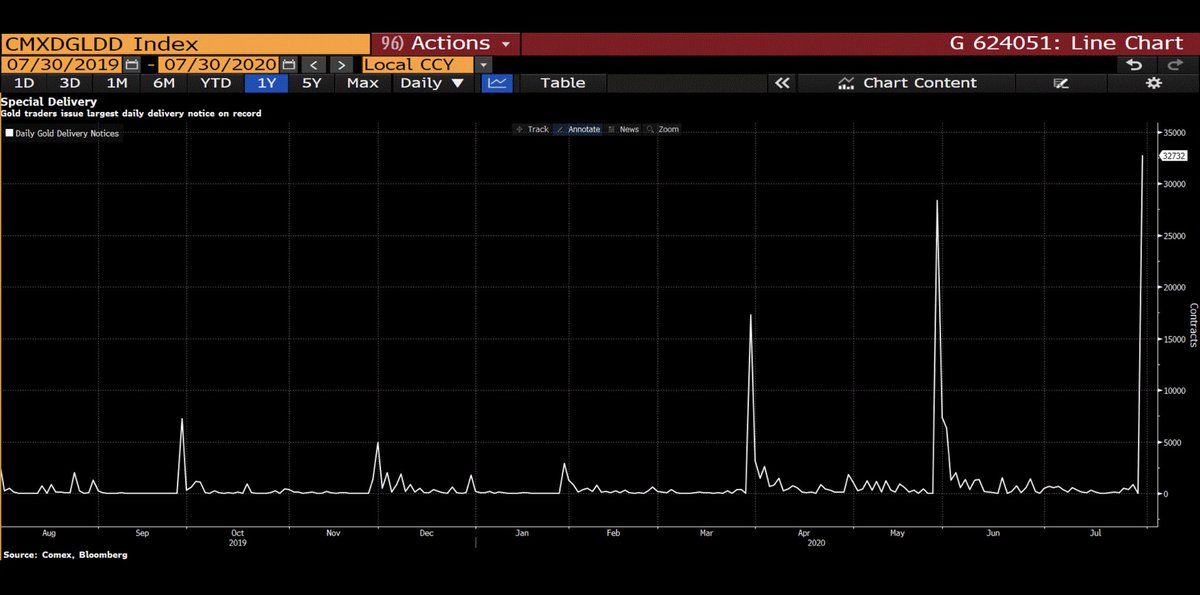

Ever increasing amounts of physical deliveries every month in the last six months, while CFTC feels more pressure to act against the usual suspects (short sellers)

Ever increasing amounts of physical deliveries every month in the last six months, while CFTC feels more pressure to act against the usual suspects (short sellers)

IMF knows they need more funding to save/help dozens of countries, who can’t survive on their own

IMF-reserves down to the last Trillion, while $5-10 Trillion will be needed.

China already called for mass creation of SDR by the IMF, since even rich countries will need help.

IMF-reserves down to the last Trillion, while $5-10 Trillion will be needed.

China already called for mass creation of SDR by the IMF, since even rich countries will need help.

Etc etc etc

Please add your examples ... 😄

• • •

Missing some Tweet in this thread? You can try to

force a refresh