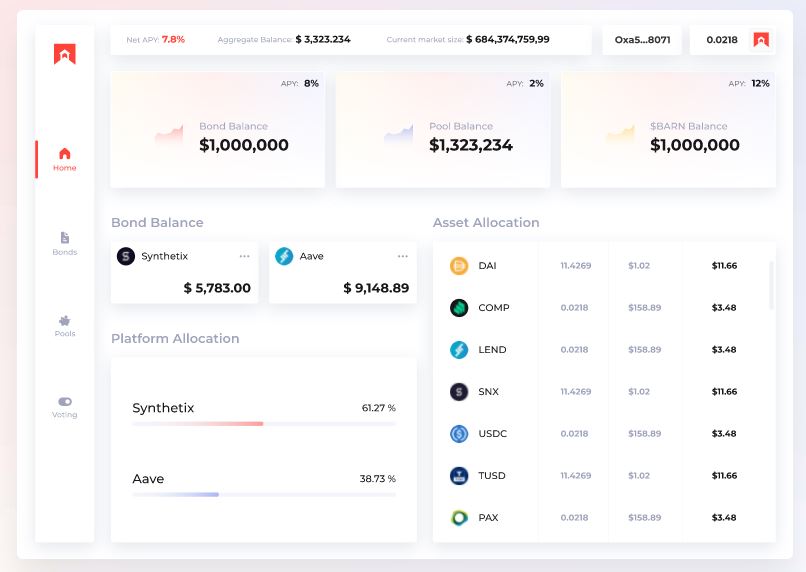

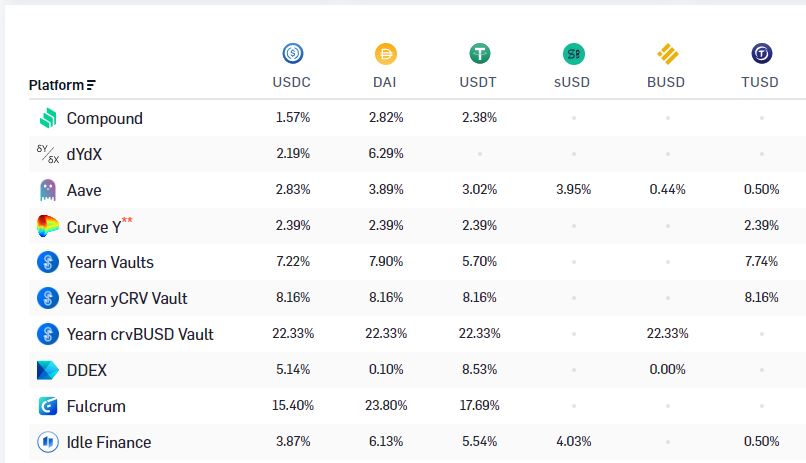

Whoever is farming @barn_bridge / (starting in 24 hrs), I made a spreadsheet with the annualized yields of the stablecoin pool. USDC, DAI, and sUSD accepted.

Not an endorsement - seems to be one of the better, relatively safe stablecoin yield farms, though.

Not an endorsement - seems to be one of the better, relatively safe stablecoin yield farms, though.

Here's a matrix for the yields on the / Uniswap LP pool, starting in eight days.

Yields are much higher as I assume TVL will be much lower due to potential impermanent loss risks.

Yields are much higher as I assume TVL will be much lower due to potential impermanent loss risks.

Pool #1 (stablecoins) will be open for 25 weeks, with 32,000 BOND released a week.

Pool #2 (BOND/USDC LP) will be open for 100 weeks, with 20,000 BOND released a week.

In total, 2,800,000 tokens—28% of the total supply—will be distributed through these pools.

More data below:

Pool #2 (BOND/USDC LP) will be open for 100 weeks, with 20,000 BOND released a week.

In total, 2,800,000 tokens—28% of the total supply—will be distributed through these pools.

More data below:

BarnBridge as a project is pretty interesting IMO.

It's attempting to tokenize risk in DeFi through tranched derivatives.

Those that want to earn higher yields must take on more risk through junior tranches. Those that want to play it safe can stick with senior tranches.

It's attempting to tokenize risk in DeFi through tranched derivatives.

Those that want to earn higher yields must take on more risk through junior tranches. Those that want to play it safe can stick with senior tranches.

• • •

Missing some Tweet in this thread? You can try to

force a refresh