There's been a bunch of buzz about @barn_bridge over recent days. The project's stablecoin seed pool has $180m just 24 hours after its launch. This makes it one of the biggest Ethereum yield farms ever.

But what exactly is BarnBridge?

An ELI5 Thread - 👇

But what exactly is BarnBridge?

An ELI5 Thread - 👇

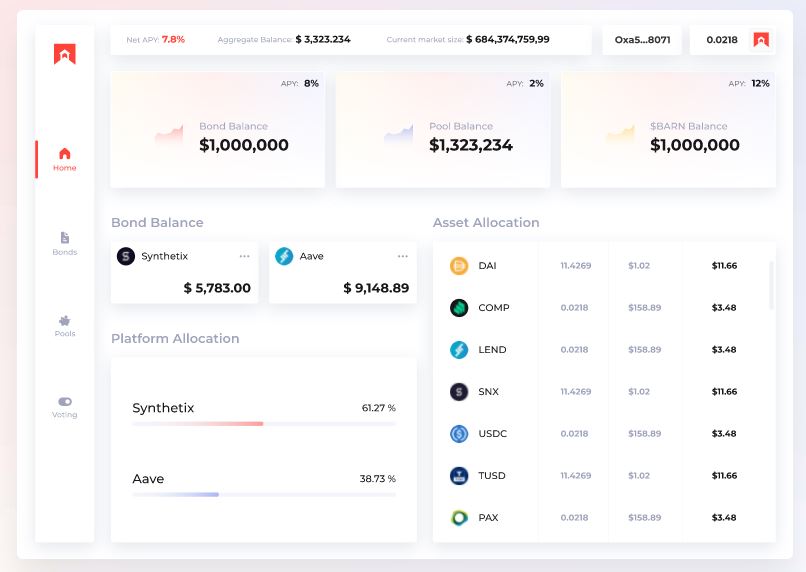

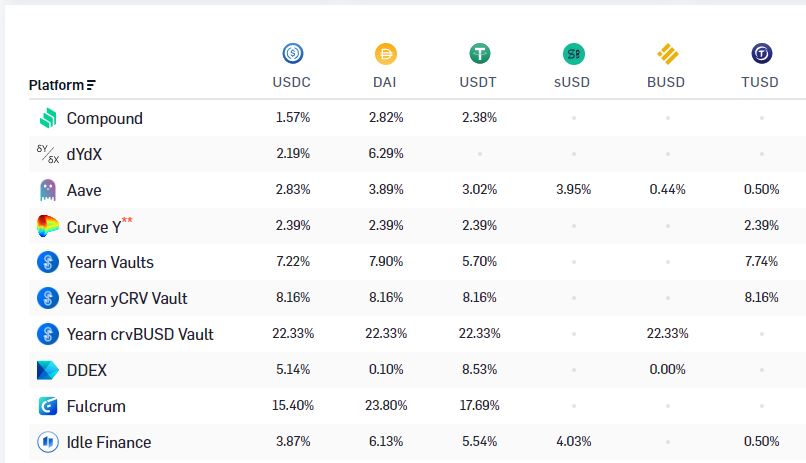

DeFi is currently disjointed and risky compared to TradFi.

Yields differ wildly (see below), there are no fixed yield products, there is no yield curve, crypto is high vol, etc.

Those are issues that "degens" can disregard. But big money, maybe not so much.

Yields differ wildly (see below), there are no fixed yield products, there is no yield curve, crypto is high vol, etc.

Those are issues that "degens" can disregard. But big money, maybe not so much.

There's no doubt that capital is entering DeFi at a rapid clip. DeFi Pulse is reporting that TVL has reached $11 billion — a 1,000% gain in just over six months.

But the aforementioned inefficiencies are preventing the next wave of capital.

Enter BarnBridge.

But the aforementioned inefficiencies are preventing the next wave of capital.

Enter BarnBridge.

BarnBridge introduces more complex investment vehicles into DeFi to allow investors to hedge risks and make this market more efficient.

BarnBridge is focusing first on yield sensitivity and market price volatility, which are two key risks today for DeFi users.

BarnBridge is focusing first on yield sensitivity and market price volatility, which are two key risks today for DeFi users.

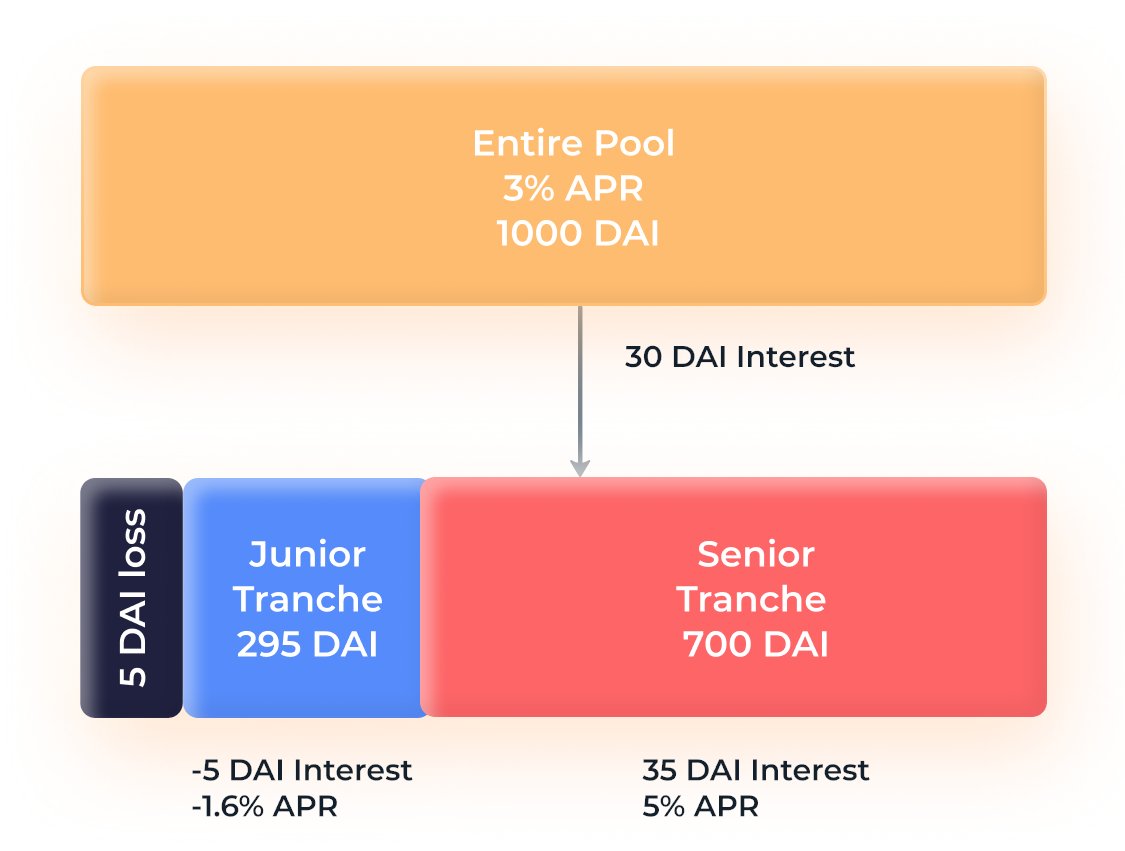

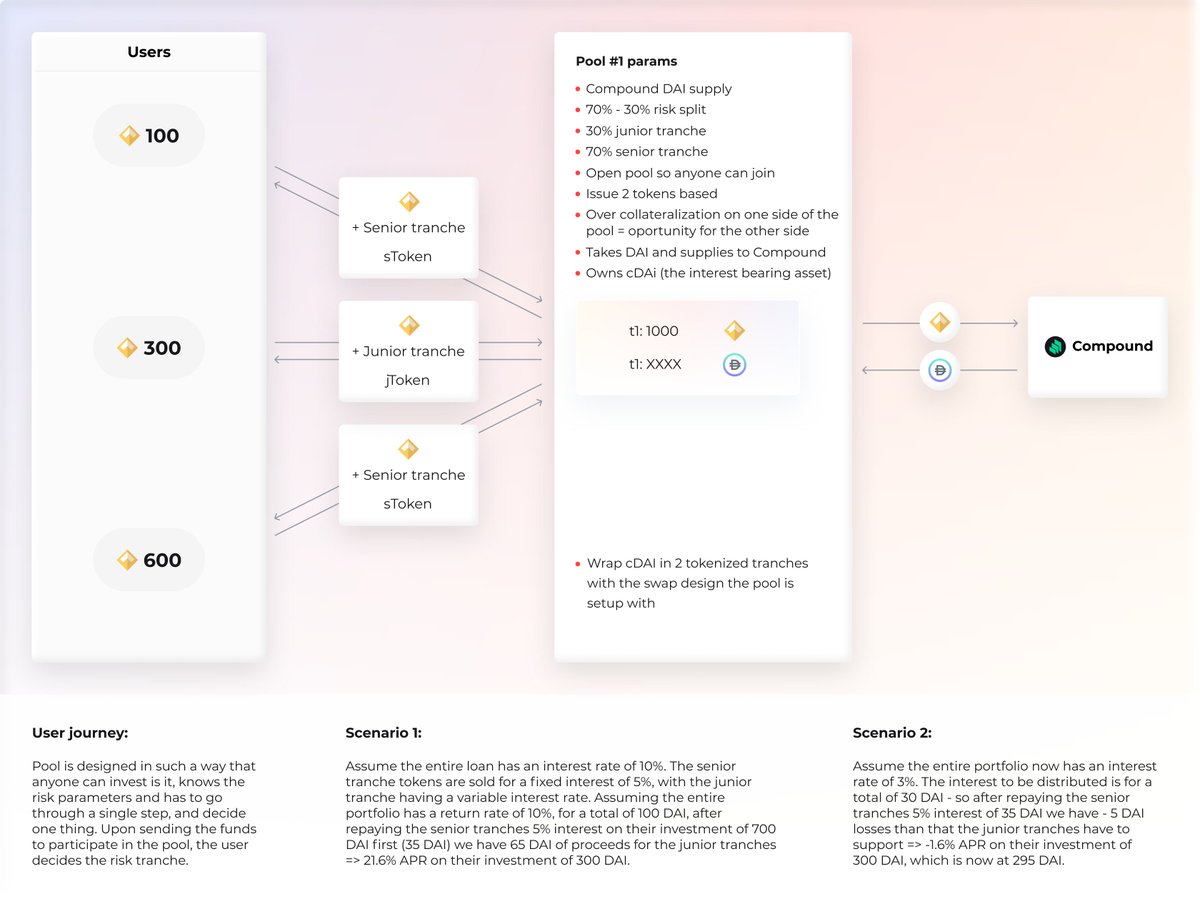

Yield sensitivity: to hedge movements in yields, BarnBridge proposes the introduction of tranched, fixed-yield derivatives.

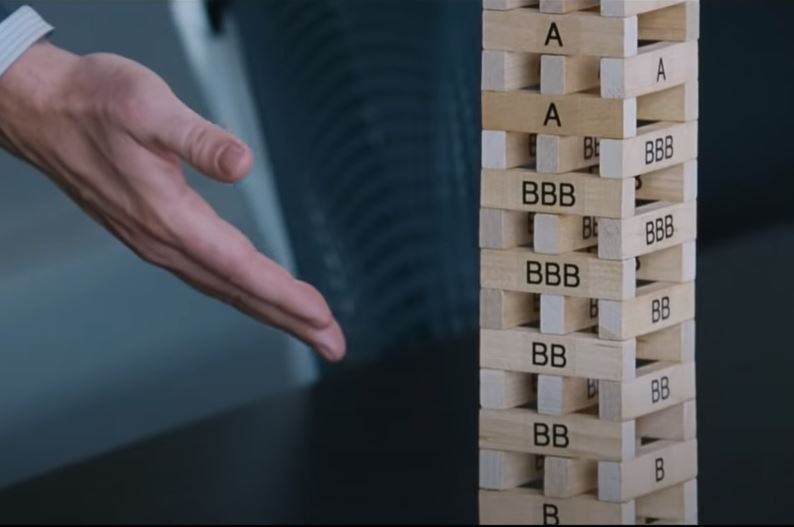

Tranches are how certain debt securities are split up to give investors access to diff levels of risk and returns.

Think Wolf of Wall Street Jenga.

Tranches are how certain debt securities are split up to give investors access to diff levels of risk and returns.

Think Wolf of Wall Street Jenga.

You have junior tranches and senior tranches.

Junior tranches = higher risk, higher returns.

Senior tranches = lower risk, lower returns.

Senior tranches get first dibs on repayments if there's a default, etc.

Junior tranches = higher risk, higher returns.

Senior tranches = lower risk, lower returns.

Senior tranches get first dibs on repayments if there's a default, etc.

Enter BarnBridge's "SMART Bonds."

Say you're a risk-off investor that wants some of those sweet DeFi yields, you buy the senior tranche.

Say you have a higher risk tolerance, you buy the junior tranche. Your yields are higher but you're vulnerable to most of the default risk.

Say you're a risk-off investor that wants some of those sweet DeFi yields, you buy the senior tranche.

Say you have a higher risk tolerance, you buy the junior tranche. Your yields are higher but you're vulnerable to most of the default risk.

Market price volatility: to hedge vol in the price of crypto assets, BarnBridge proposes the use of tranched volatility derivatives.

There will be "risk ramps" where every tranche will have different exposure to movements in the price of Ethereum, for ex.

It's leverage-esque.

There will be "risk ramps" where every tranche will have different exposure to movements in the price of Ethereum, for ex.

It's leverage-esque.

Junior tranche token holders will have more exposure to an asset's price action.

If Ethereum jumps 10%, the junior tranche would get most of the upside. If Ethereum drops 10%, the junior tranche would take most of the downside.

If Ethereum jumps 10%, the junior tranche would get most of the upside. If Ethereum drops 10%, the junior tranche would take most of the downside.

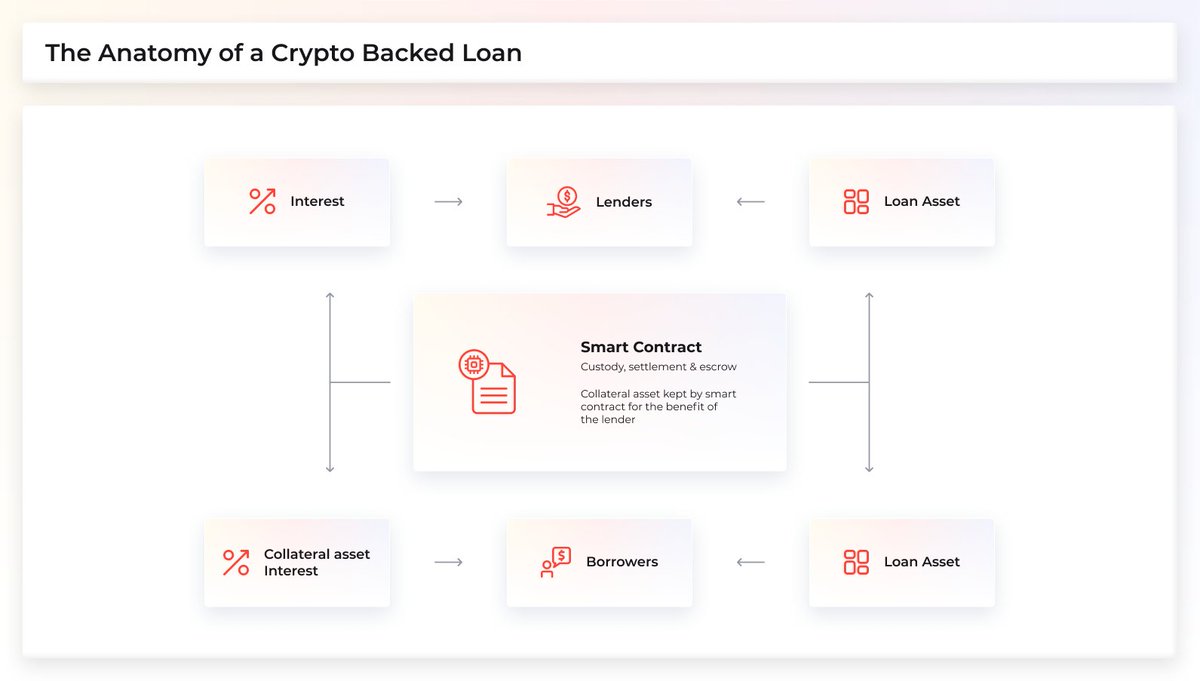

On top of these two concepts, smart contracts, DAOs, and algorithms allow for more flexibility in the creation of financial products, along with better transparency and security.

We could see derivatives that haven't been launched in TradFi.

We could see derivatives that haven't been launched in TradFi.

BarnBridge won't only allow DeFi to emulate TradFi.

Even with the risks BarnBridge is mitigating, DeFi yields should naturally be higher than TradFi yields.

If you remove the middlemen (custody, settlement, escrow, etc.), yields improve as rent-seeking is minimalized.

Even with the risks BarnBridge is mitigating, DeFi yields should naturally be higher than TradFi yields.

If you remove the middlemen (custody, settlement, escrow, etc.), yields improve as rent-seeking is minimalized.

It's especially interesting that BarnBridge is protocol and asset agnostic.

We may see derivatives that encapsulate synthetic assets (sAXU/Synthetix Gold, for instance) or IRL asset-backed tokens.

If there are higher yields, we could see massive inflows.

DeFi eating TradFi?

We may see derivatives that encapsulate synthetic assets (sAXU/Synthetix Gold, for instance) or IRL asset-backed tokens.

If there are higher yields, we could see massive inflows.

DeFi eating TradFi?

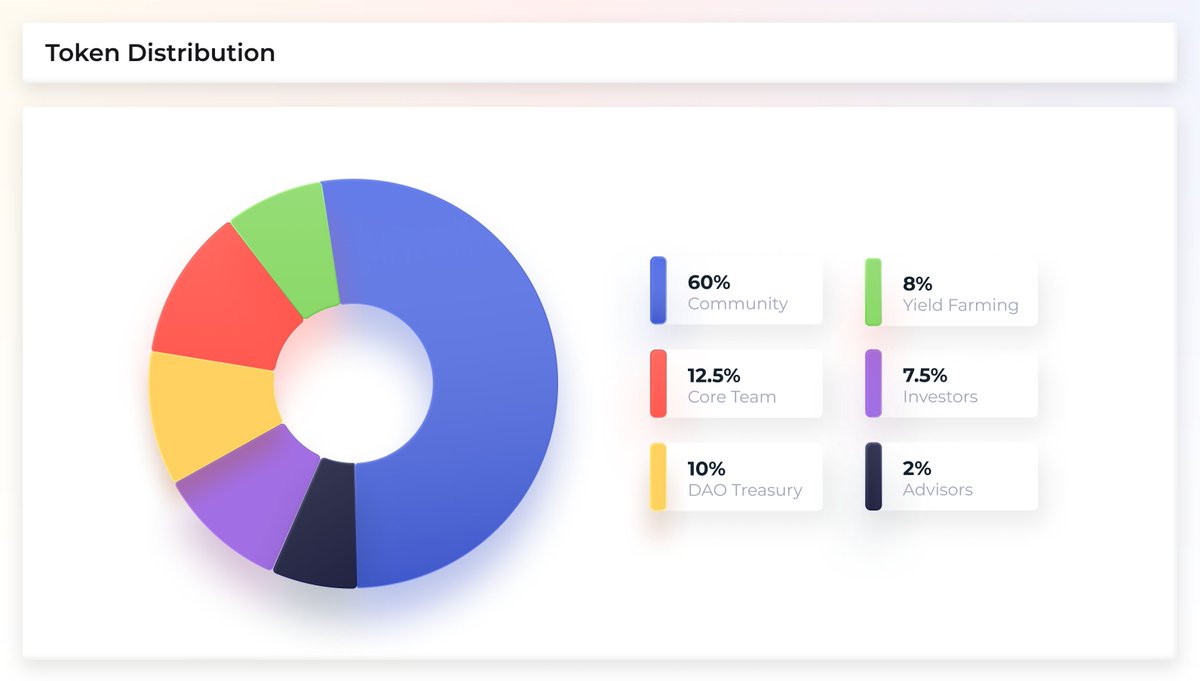

Governing BarnBridge will be holders of the BOND token.

Rather fair distribution IMO - 22.5% to "insiders," the rest to community and yield farmers.

Rather fair distribution IMO - 22.5% to "insiders," the rest to community and yield farmers.

In short: BarnBridge is a system trying to iron out inefficiencies and risk in DeFi through derivatives.

Should the project turn out, we could see an influx of capital from big money as investors realize they can capture higher yields in DeFi for similar/less risk than TradFi.

Should the project turn out, we could see an influx of capital from big money as investors realize they can capture higher yields in DeFi for similar/less risk than TradFi.

Disclaimer: I am farming BOND and was lucky enough to be offered a BOND NFT by @LordTylerWard!

I'm personally very excited to see what happens with BarnBridge.

It's a product that could take DeFi to the next level.

Plus, the design is sick.

I'm personally very excited to see what happens with BarnBridge.

It's a product that could take DeFi to the next level.

Plus, the design is sick.

• • •

Missing some Tweet in this thread? You can try to

force a refresh