I thought this podcast of @rorysutherland w @patrick_oshag was really good.

Learnt about psychological moonshots, hypothecated pricing, and why you should do mass advertising. Clippings fm my notes.

investorfieldguide.com/rory-sutherlan…

Learnt about psychological moonshots, hypothecated pricing, and why you should do mass advertising. Clippings fm my notes.

investorfieldguide.com/rory-sutherlan…

Psychological moonshots (as opposed to regular engineering-led moonshots).

Great Q fm Rory - are we in startupland predisposed to more expensive engineering moonshots?

Great Q fm Rory - are we in startupland predisposed to more expensive engineering moonshots?

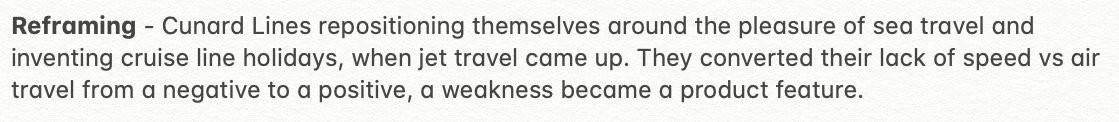

How reframing a negative as a feature, basis our understanding of human psychology, helps. A faster ship would have been harder to pull off & would have still meant slower speed vs an airplane. Instead they focused on slowness and the romance of sea travel.

This is good advice for startups - start with one specific customer friction to be solved; do that well. Then 'land and expand'.

Remember, marketplace / Platform is an outcome of your product success. It is only a way to solve your customer's problem.

Remember, marketplace / Platform is an outcome of your product success. It is only a way to solve your customer's problem.

Remembering @arnav_kumar's wonderful tweet in this regard.

https://twitter.com/arnav_kumar/status/1295366630705225730

...and other pricing innovations which come out as thinking hard about consumer problems and desires.

Sudhir Sitapati in his book, The CEO Factory, says much the same thing as Rory albeit from a different perspective. “There is not much else to understand in media planning other than: Reach more people fewer number of times than reach fewer people more times or impactfully.”

A great way to look at your marketing department, as the repository of all the interesting behavioural insights of your stakeholders.

There is lots more than the above. As always @rorysutherland is a fascinating mind. For those of you prefer a set of distilled notes, please check out my public notes here = linkedin.com/pulse/psycholo…

And for those of you prefer the audio version, here is the podcast link again as I sign off.

investorfieldguide.com/rory-sutherlan…

investorfieldguide.com/rory-sutherlan…

• • •

Missing some Tweet in this thread? You can try to

force a refresh