1/ The next wave of DeFi innovations will be very interesting. We are replicating the entire suite of traditional financial markets in crypto. On the lending side, we have crypto collateralized loans which are more efficient than any collateralized loans in traditional finance.

2/ Interest rates are now mostly variable per block and the next wave of innovations will be projects looking to provide solutions to have fixed i/r over time. @AaveAave have some fixed i/r options but we are starting to see other methods being implemented to have fixed rates.

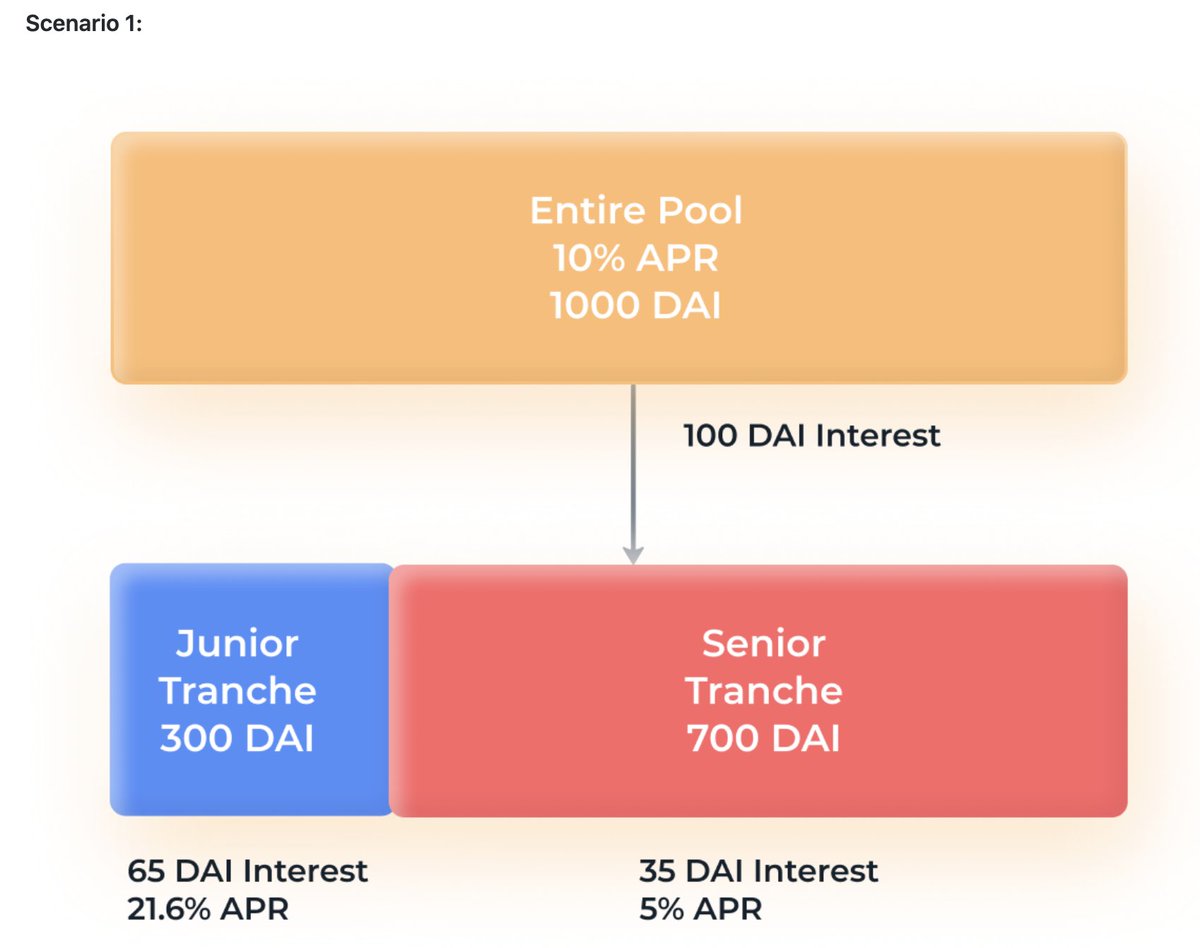

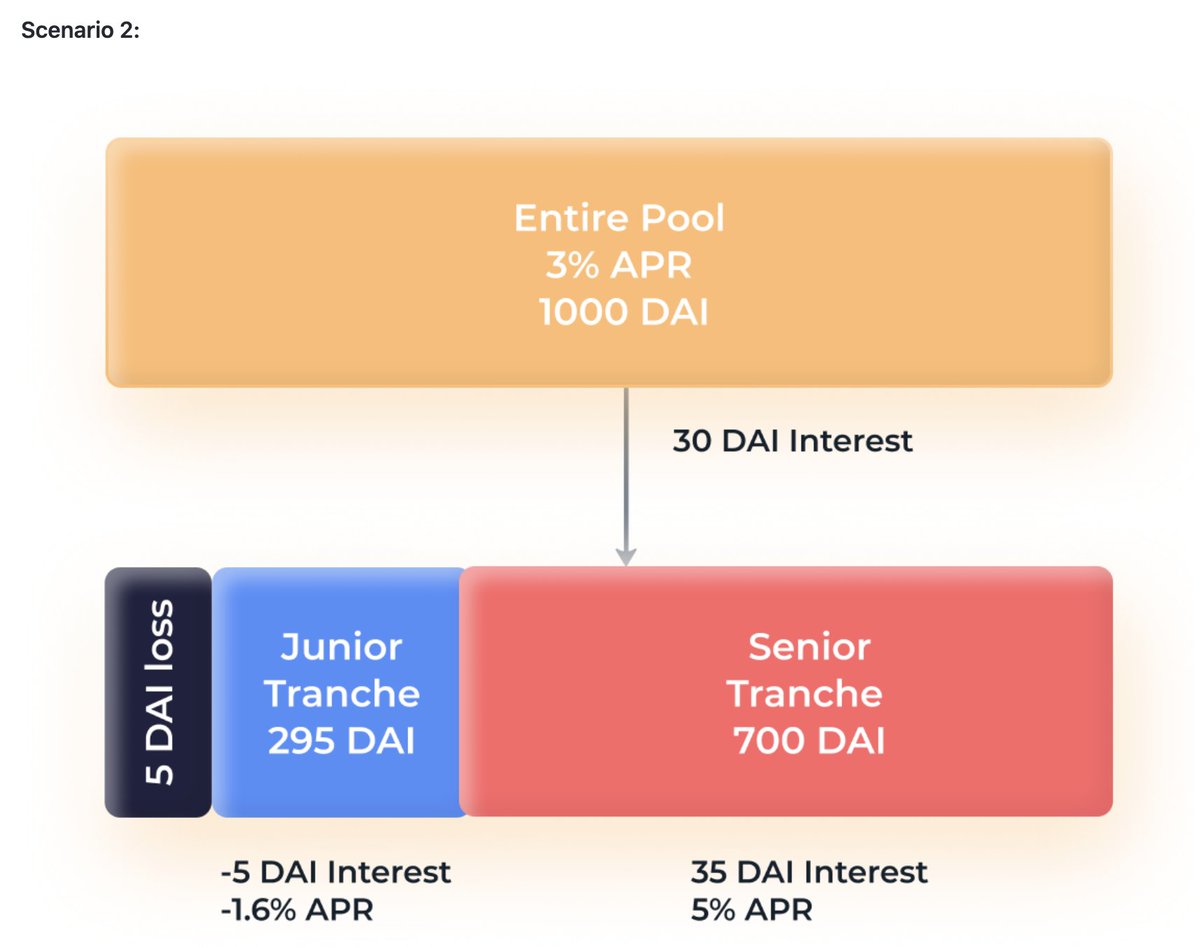

3/ The solution could be i/r swaps or by classifying the cashflow into senior/mid/junior tranches. I read @barn_bridge whitepaper ytd and soon we will be seeing more teams come around with innovative solutions to carve up the variable i/r to fixed i/r. github.com/BarnBridge/Bar…

4/ Barnbridge has an interesting solution but this also looks very similar to the Collateralized Debt Obligations (CDO) that caused the 2007-2008 global financial crisis. Subprime mortgages were packaged and repackaged into various tranches to marginally get the AAA-rating.

5/ We are not near any similar crisis because most crypto loans today are fully collateralized. Non-secured loans are not popular yet though this could change soon. We have seen @deversifi taking on an unsecured loan on @AaveAave and I expect this to grow. medium.com/aave/first-cre…

6/ Soon we will be seeing the various crypto loans being packaged into different tranches. There may be a credit rating agency rating these different trances to give a score. How we do this in a decentralized manner is another question altogether.

7/ We can also imagine these junior/senior tranches being repackaged with other tranches to form CDOs of CDOs. Then things will truly get complicated in crypto. It may get hard to untangle and see who owns what though this may theoretically be more efficient and easier to track.

8/ If you think this is crazy and won't happen, wait till these packaged offerings start giving 1000% APY and I bet you crypto degens will not bat an eye to buy these CDOs of CDOs. Crypto degens have participated in unaudited yield farms so this is just yet another asset class.

9/ I think the insurance industry is super underdeveloped in crypto right now. For the longest time, we only have @NexusMutual and I can never buy any coverage for all my lending pools / farms! We will need more insurance providers to help cover the risks inherent in crypto.

10/ I have no idea how things will develop, but these are some of my observations. I am optimistic that things will be more efficient but it is getting increasingly complex. There will be a lot of demand for tools to make sense of things. What an interesting time to be in DeFi!

• • •

Missing some Tweet in this thread? You can try to

force a refresh