I've been observing @barn_bridge token price since it started trading on Monday morning. The price seems to be going only up and at $185, it is nearly 140x seed round price of $1.33. I am fully anticipating the price to go down next week so do be careful. Thread below 👇

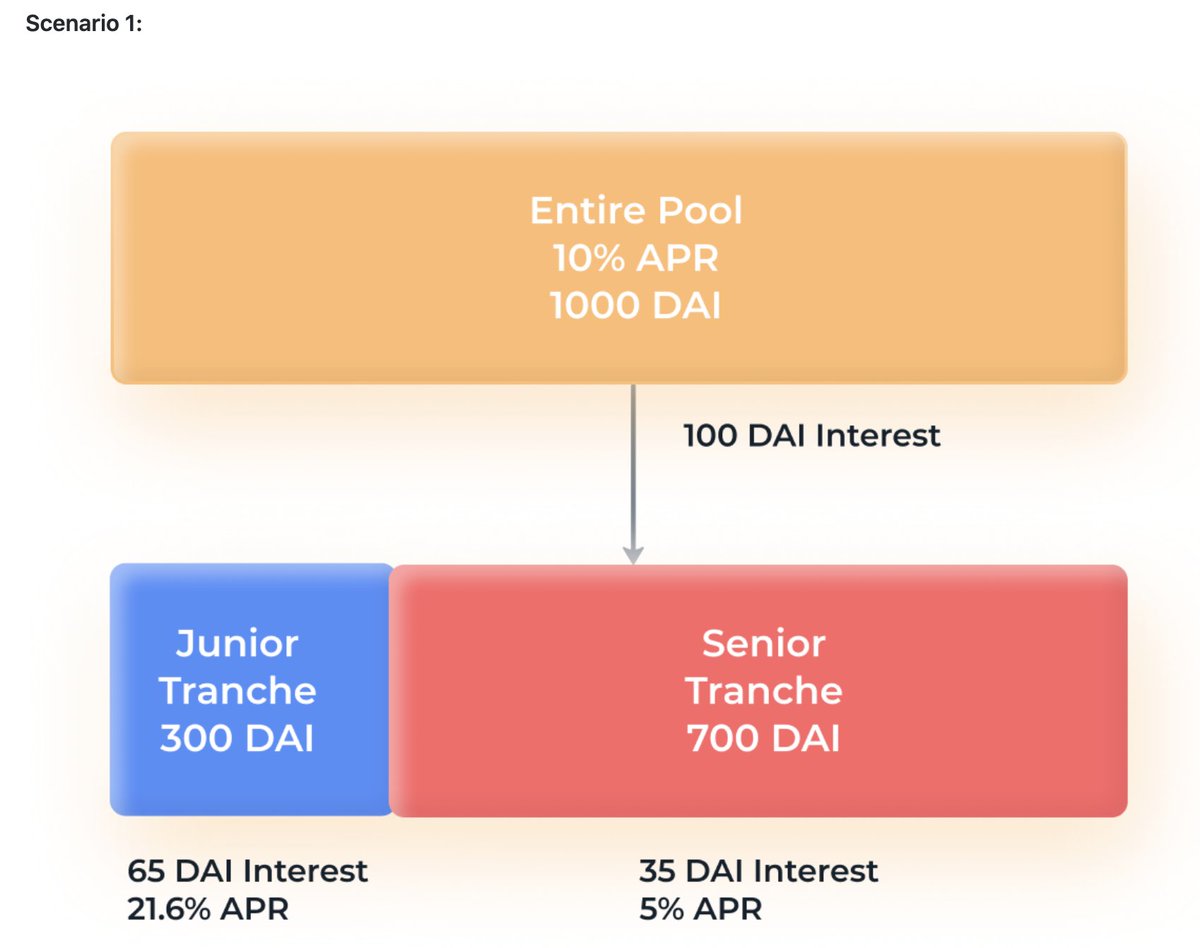

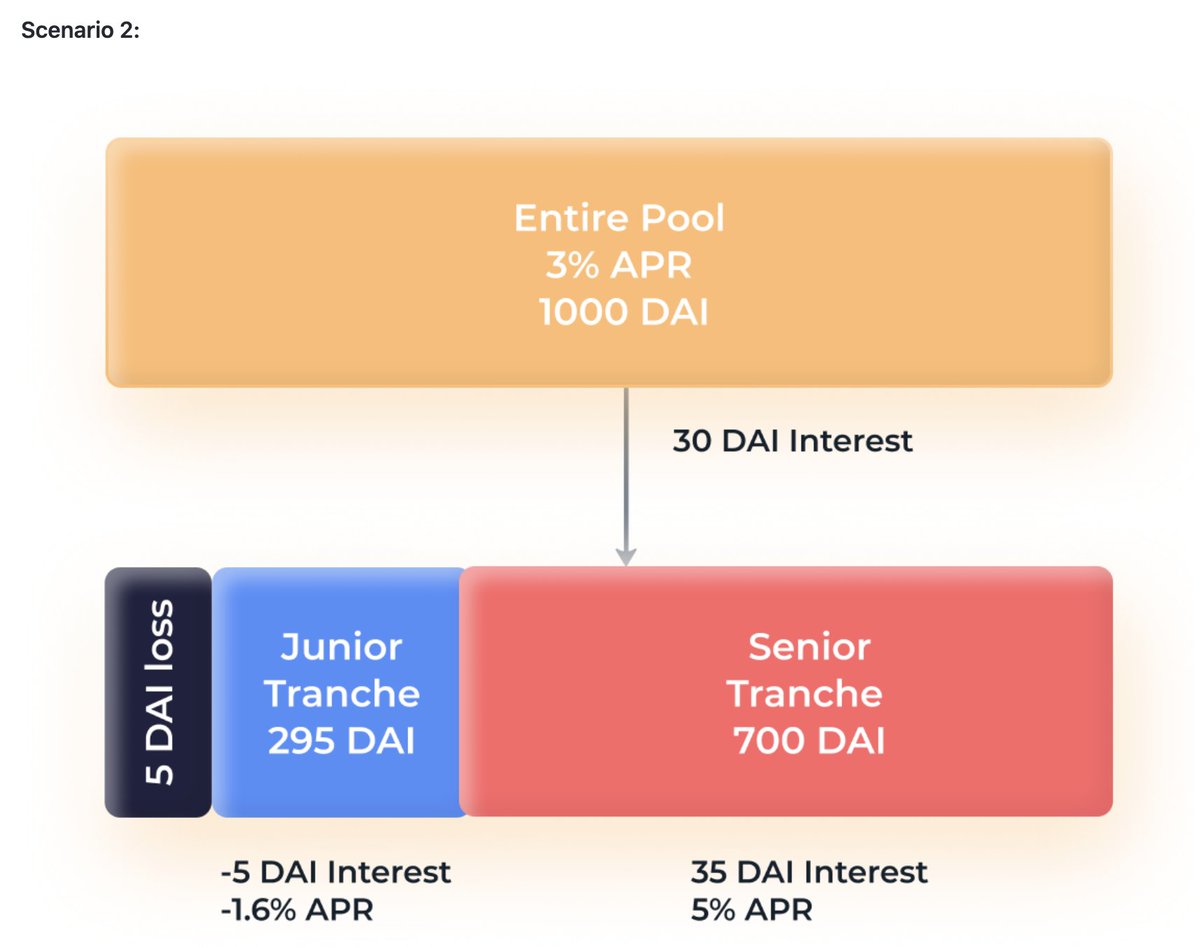

Let's be clear: I am interested in Barnbridge's fixed interest rate solution. Their method of splitting variable interest rates into junior/mid/senior tranche is innovative and I look forward to seeing this team launching their product. I wrote more here:

https://twitter.com/bobbyong/status/1318141385740931073

Their way of distributing $BOND via farming seems quite fair. I like that Pool 1 lasts for 25 weeks & Pool 2 lasts for 100 weeks. The long farming period allows people who may have missed the initial news to join the farming later. I am generally not a fan of short farming period

However, allowing only farmers to harvest their proceeds at the end of each week (Monday, 8am GMT+8) has created very low circulation in the market during this first week and no efficient price discovery resulting in very low sell pressure causing price to move upwards.

A lot of the outstanding supply harvested from Pool 1 is also locked into Pool 2 (Uniswap LP pool) further reducing available tokens for sale. Circulating supply at the moment is roughly 44k (Pool 1's Week 1 harvest and some extra tokens unlocked from vesting contracts).

In my opinion, supply in the market could have been smoothed out if the team had allowed for per block harvesting after Week 1 instead of allowing only harvesting at the end of each week. This allows farmers to better estimate their APY and take profit aiding price discovery.

At $160/BOND, Barnbridge will have a Fully Diluted Valuation of $1.6b. In my opinion, this is too high for a project that does not have a working product, although the idea & team seems promising. When Week 2's harvest is ready from Pool 1 & 2, farmers may decide to take profit.

I believe the Barnbridge's team is aware of the situation and @LordTylerWard has written a pretty comprehensive article on the risks involved with yield farming and impermanent loss: medium.com/barnbridge/yie…

Let's talk about the returns from farming. @Wangarian1 prepared an excellent model for Barnbridge APY & sensitivity analysis. This model was prepared last week anticipating BOND price to be trading around $10 range and had to be updated to $150-180 range.

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

For Pool 1, with TVL at $333m and BOND ~$160, APY is roughly 80%. 80% APY for stablecoins is very juicy now! Don't think this will stay long and TVL may increase and/or BOND price may go down as more people exploit this. Week 1 farmers who held would have realized very high yield

Pool 2 is crazier. In my mind, BOND at $160 is just extremely dangerous as there will be insane impermanent loss as BOND price eventually goes down. So why farm Pool 2? Turns out it may not be so crazy coz APY can be anywhere between 1000-2000%. At this rate, it can beat IL

So yea there you have it some numbers for @barn_bridge yield farming. I am farming Pool 1 and chose not to farm Pool 2 now because of the impermanent loss. My strategy is to wait for some price discovery and then decide then if I would like to farm Pool 2 for the longer haul.

If you are interested in seeing the live APY for Barnbridge's Pool 1 and 2, you can see the live rate on CoinGecko's yield farming page here: coingecko.com/en/yield-farmi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh