🚨 The DOJ's antitrust complaint against Google is out!

Thread with some of my initial reactions as I go through it...

Thread with some of my initial reactions as I go through it...

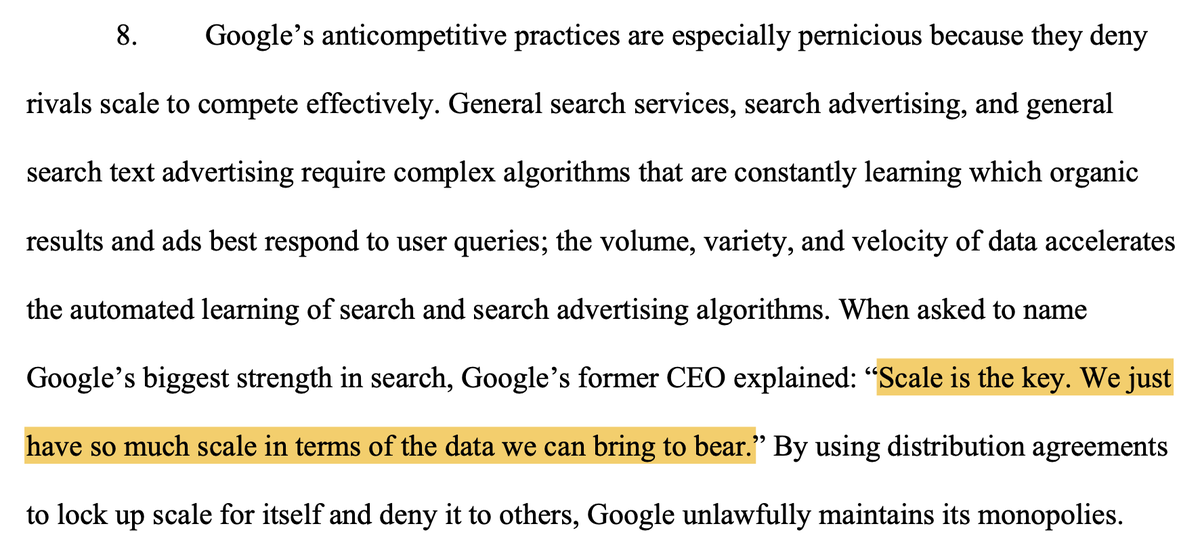

Economies of scale are at the heart of this case:

The pro-competitive story: scale economies mean it's efficient (and good for consumers) to have only 1 or 2 large providers.

The anti-competitive story: Google locks up the market to prevent rivals from reaching adequate scale.

The pro-competitive story: scale economies mean it's efficient (and good for consumers) to have only 1 or 2 large providers.

The anti-competitive story: Google locks up the market to prevent rivals from reaching adequate scale.

Scale matters, but how much?

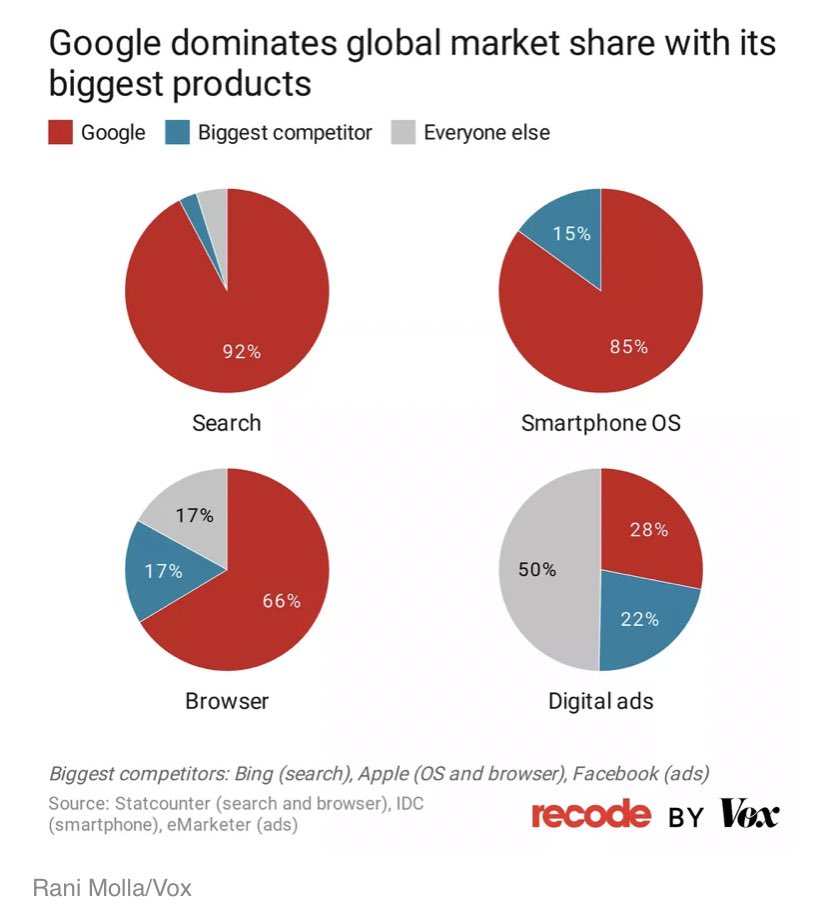

Data has rapidly diminishing returns (see chart).

Google has about 90% market share.

Microsoft powers search results for the other 10% of the market (Bing, Yahoo & DuckDuckGo).

Microsoft is a $1.6 trillion company — it can afford to compete.

Data has rapidly diminishing returns (see chart).

Google has about 90% market share.

Microsoft powers search results for the other 10% of the market (Bing, Yahoo & DuckDuckGo).

Microsoft is a $1.6 trillion company — it can afford to compete.

Here's another section that can be interpreted in 1 of 2 ways:

The pro-competitive story: Android has strict technical & design standards bc consumers will hold Google accountable for bad UI/UX.

The anti-competitive story: Google wants to lock manufacturers into its ecosystem.

The pro-competitive story: Android has strict technical & design standards bc consumers will hold Google accountable for bad UI/UX.

The anti-competitive story: Google wants to lock manufacturers into its ecosystem.

This point might also work against the DOJ — if innovation (in hardware and software) is constantly creating new distribution channels for consumers to conduct searches, then Google is still at risk for losing its dominant position in the market.

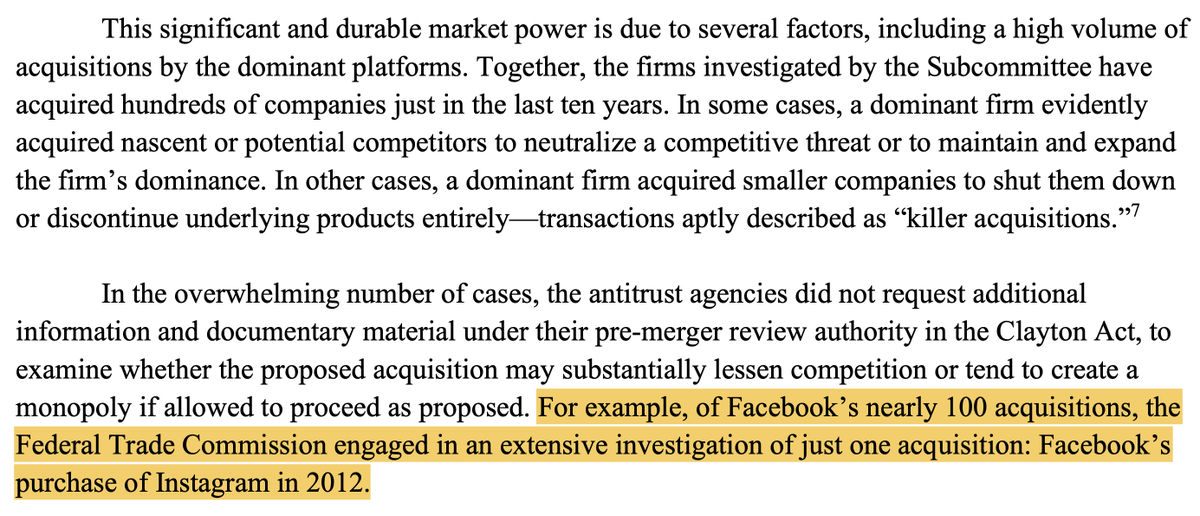

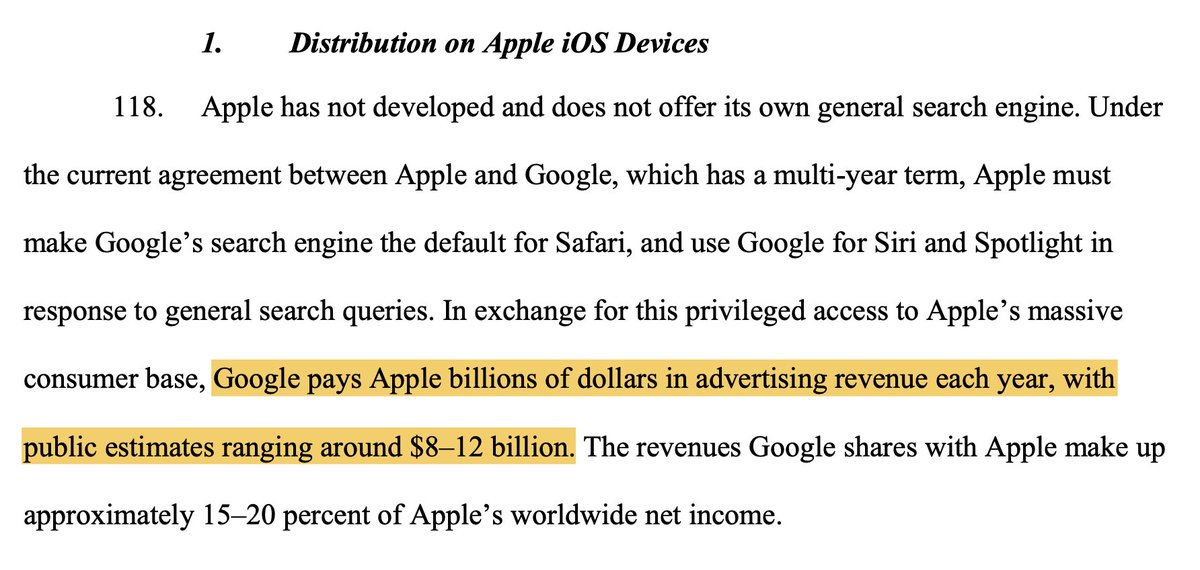

The complaint makes a lot of hay out of Google's deal with Apple to be the default search engine on Safari.

Of course, being the default helps increase market share.

But Tim Cook has also said that Google is the best search engine.

Should the default be an inferior product?

Of course, being the default helps increase market share.

But Tim Cook has also said that Google is the best search engine.

Should the default be an inferior product?

Here's a potential unintended consequence of the case:

Google currently has revenue sharing agreements with Firefox, Opera, and other browsers.

Those deals pay for the development of competitors to Chrome.

If the deals are banned, Google might increase browser market share.

Google currently has revenue sharing agreements with Firefox, Opera, and other browsers.

Those deals pay for the development of competitors to Chrome.

If the deals are banned, Google might increase browser market share.

A funny implication of the complaint is that Google is *not* responsible for the decline of the news industry.

The DOJ argues that search ads are not reasonably substitutable with newspaper ads.

News publishers claim the opposite when they say Google is taking their ad money!

The DOJ argues that search ads are not reasonably substitutable with newspaper ads.

News publishers claim the opposite when they say Google is taking their ad money!

The complaint talks a lot about how rivals just need more data to be able to compete.

This underrates the importance of building better systems for organizing all that data.

When Google was founded in 1998, it was at a data disadvantage. Media said Yahoo had won the search wars

This underrates the importance of building better systems for organizing all that data.

When Google was founded in 1998, it was at a data disadvantage. Media said Yahoo had won the search wars

Important point:

If Google needs to pay Apple billions of dollars per year to be the default search engine on Apple devices, that's indicative of Apple's market power over distribution, not Google's.

If Google needs to pay Apple billions of dollars per year to be the default search engine on Apple devices, that's indicative of Apple's market power over distribution, not Google's.

In contrast to the recent HJC report, this complaint is generally well written.

But there are still a few silly points, like:

"Consumers are harmed because Android users can't delete pre-installed Google apps!"

*checks app sizes on Android*

Oh, it's only a GB or two total.

But there are still a few silly points, like:

"Consumers are harmed because Android users can't delete pre-installed Google apps!"

*checks app sizes on Android*

Oh, it's only a GB or two total.

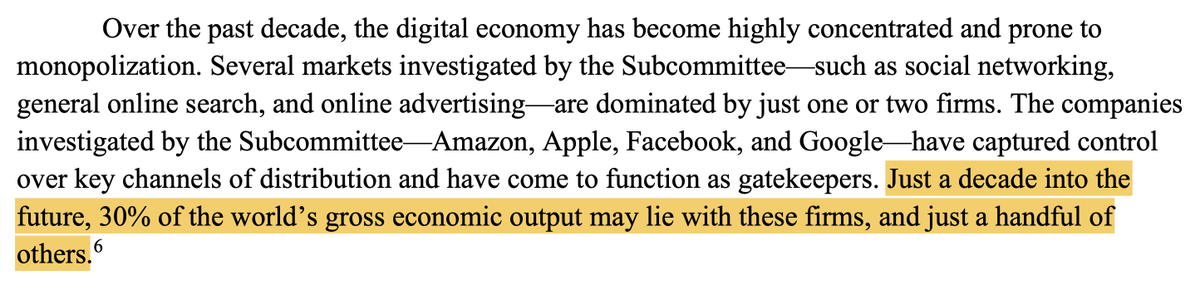

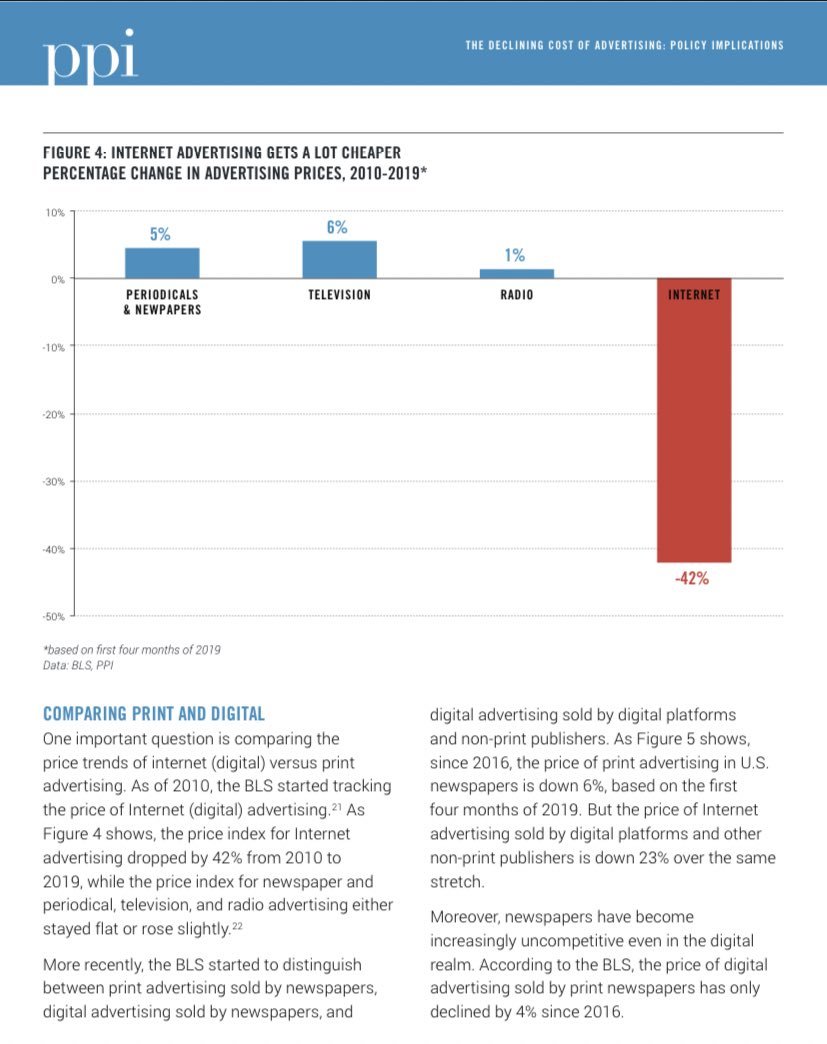

The complaint claims that taking enforcement action against Google would lead to lower ad prices.

But digital ad prices have fallen by more than 40% over the last decade.

Of course, maybe prices could have fallen even faster, but that seems like a tough argument to make.

But digital ad prices have fallen by more than 40% over the last decade.

Of course, maybe prices could have fallen even faster, but that seems like a tough argument to make.

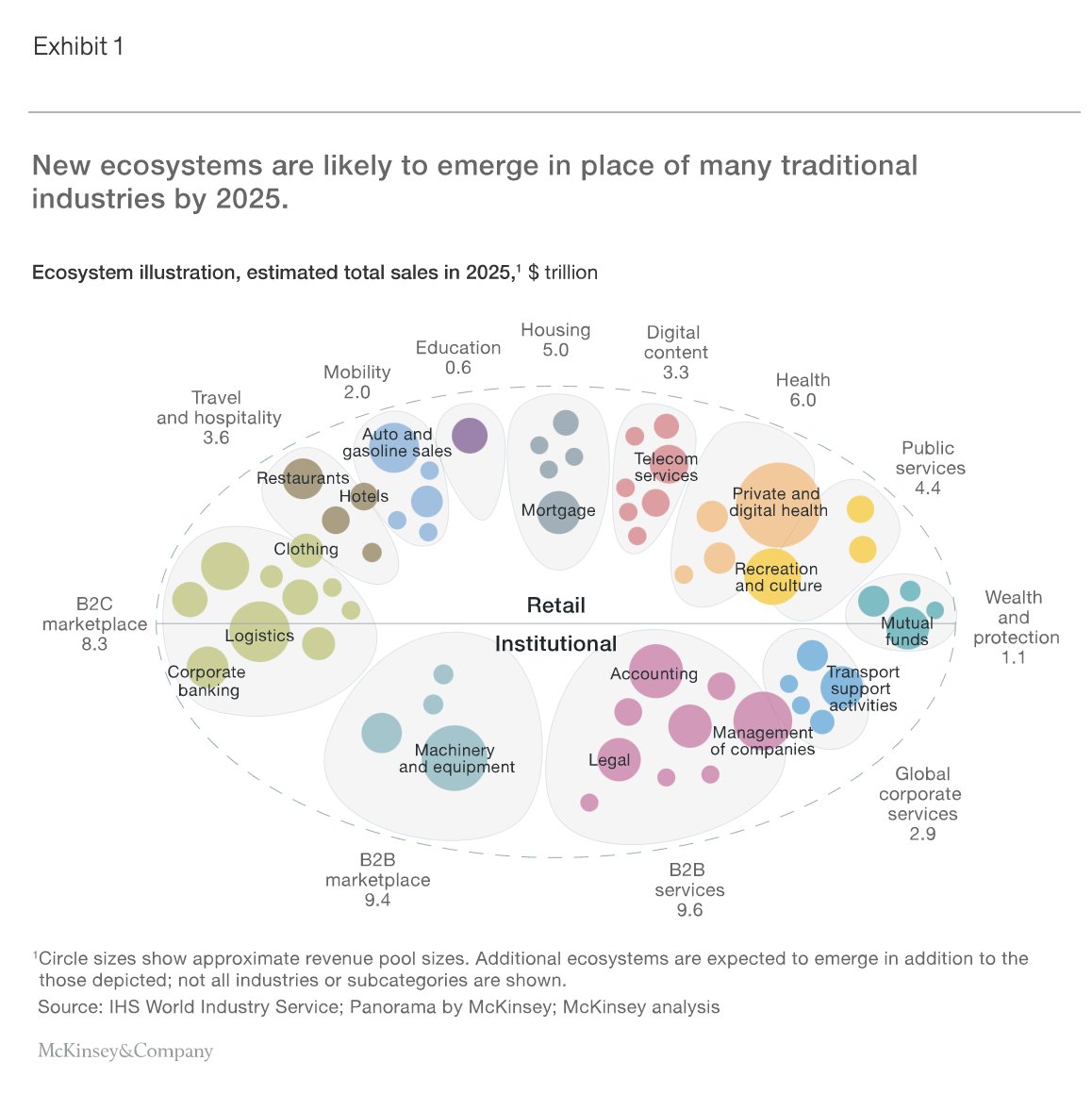

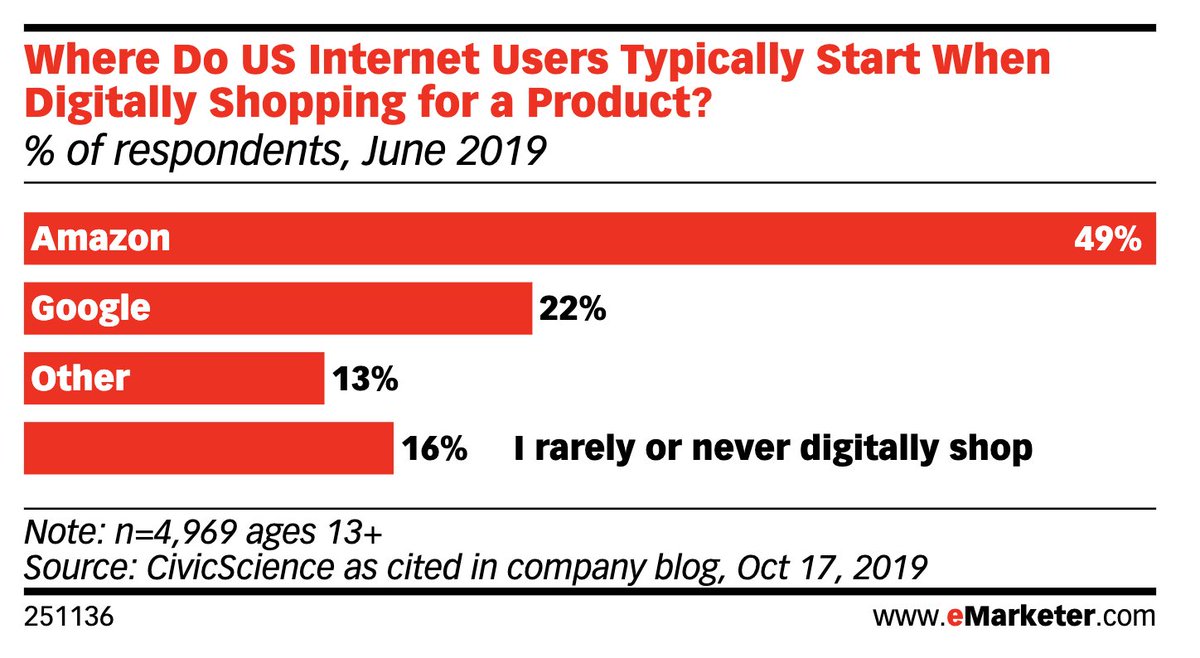

Here's the biggest problem for the DOJ:

To show that Google has a monopoly, they need to show that search ads are different from other kinds of ads.

So they emphasize that search matters because users have very high purchase intent.

But 49% of online shoppers start on Amazon!

To show that Google has a monopoly, they need to show that search ads are different from other kinds of ads.

So they emphasize that search matters because users have very high purchase intent.

But 49% of online shoppers start on Amazon!

Here's a really important point I haven't seen elsewhere yet:

DOJ says Google has 90% market share in search.

Also says Google controls distribution channels for 80% of the search market.

But that means, on net, users are choosing to switch to Google when it's not the default!

DOJ says Google has 90% market share in search.

Also says Google controls distribution channels for 80% of the search market.

But that means, on net, users are choosing to switch to Google when it's not the default!

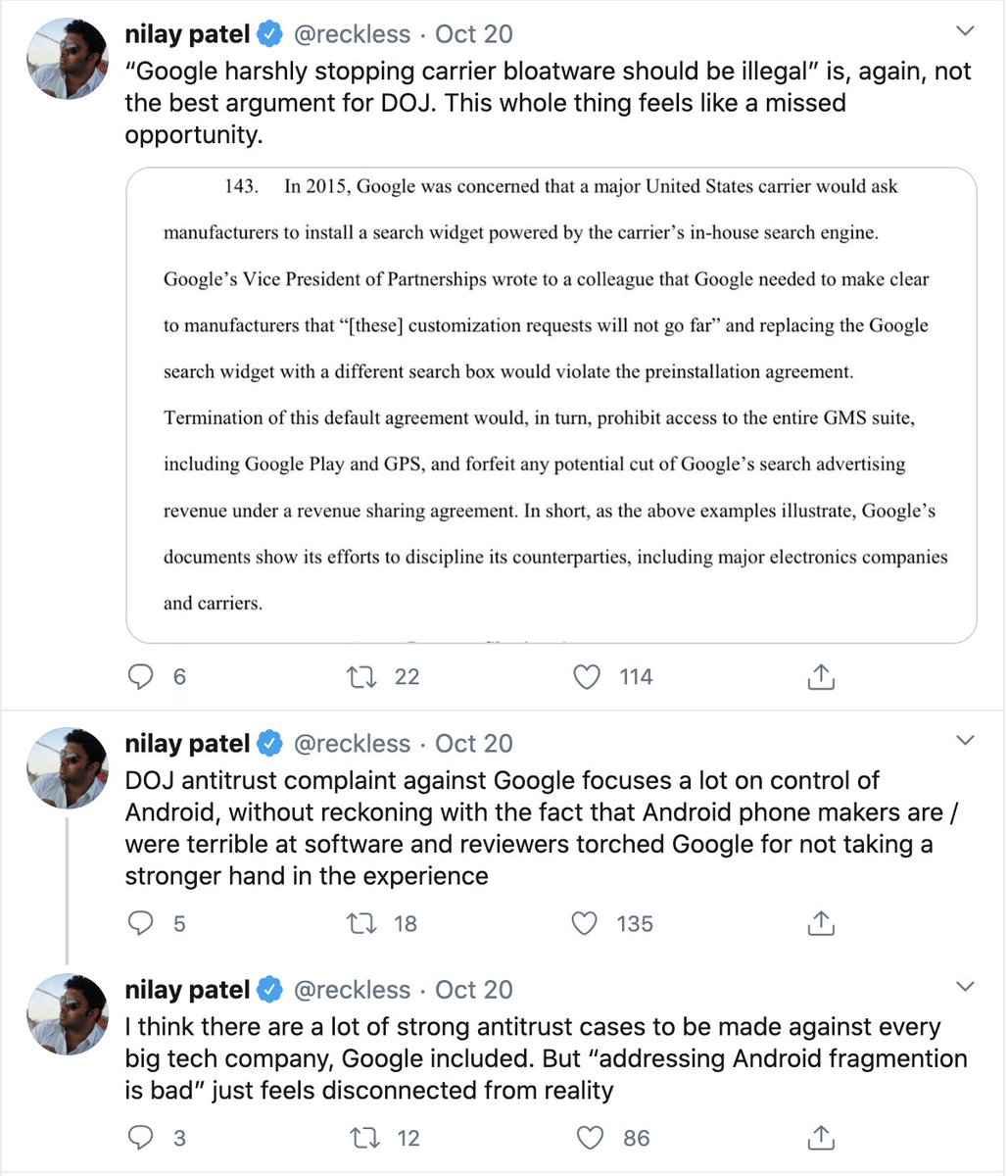

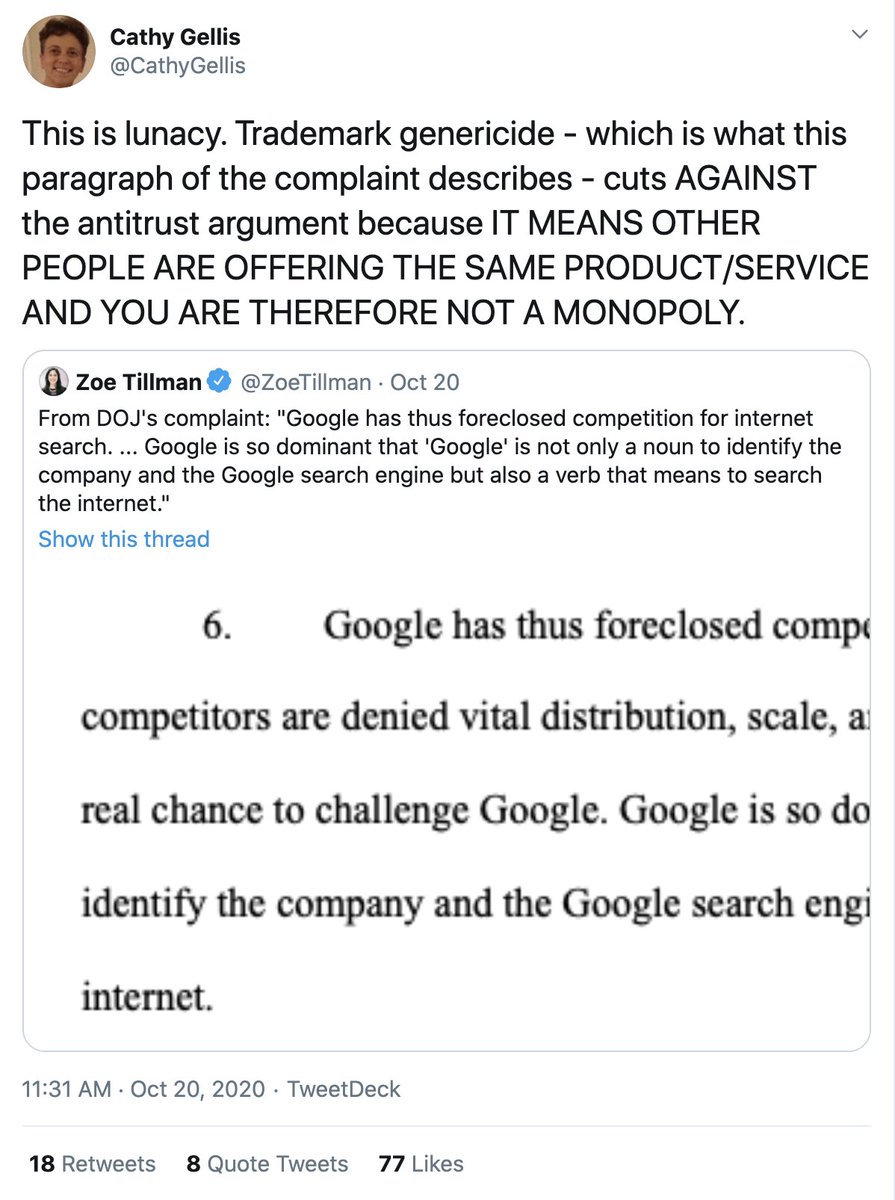

A few final points others have made:

- @reckless points out that Android devices are most often criticized for being *too fragmented*

- @CathyGellis reminds us that trademark genericide is indicative of competition, not monopoly

- @mcuban argues that it's all about AI

- @reckless points out that Android devices are most often criticized for being *too fragmented*

- @CathyGellis reminds us that trademark genericide is indicative of competition, not monopoly

- @mcuban argues that it's all about AI

• • •

Missing some Tweet in this thread? You can try to

force a refresh