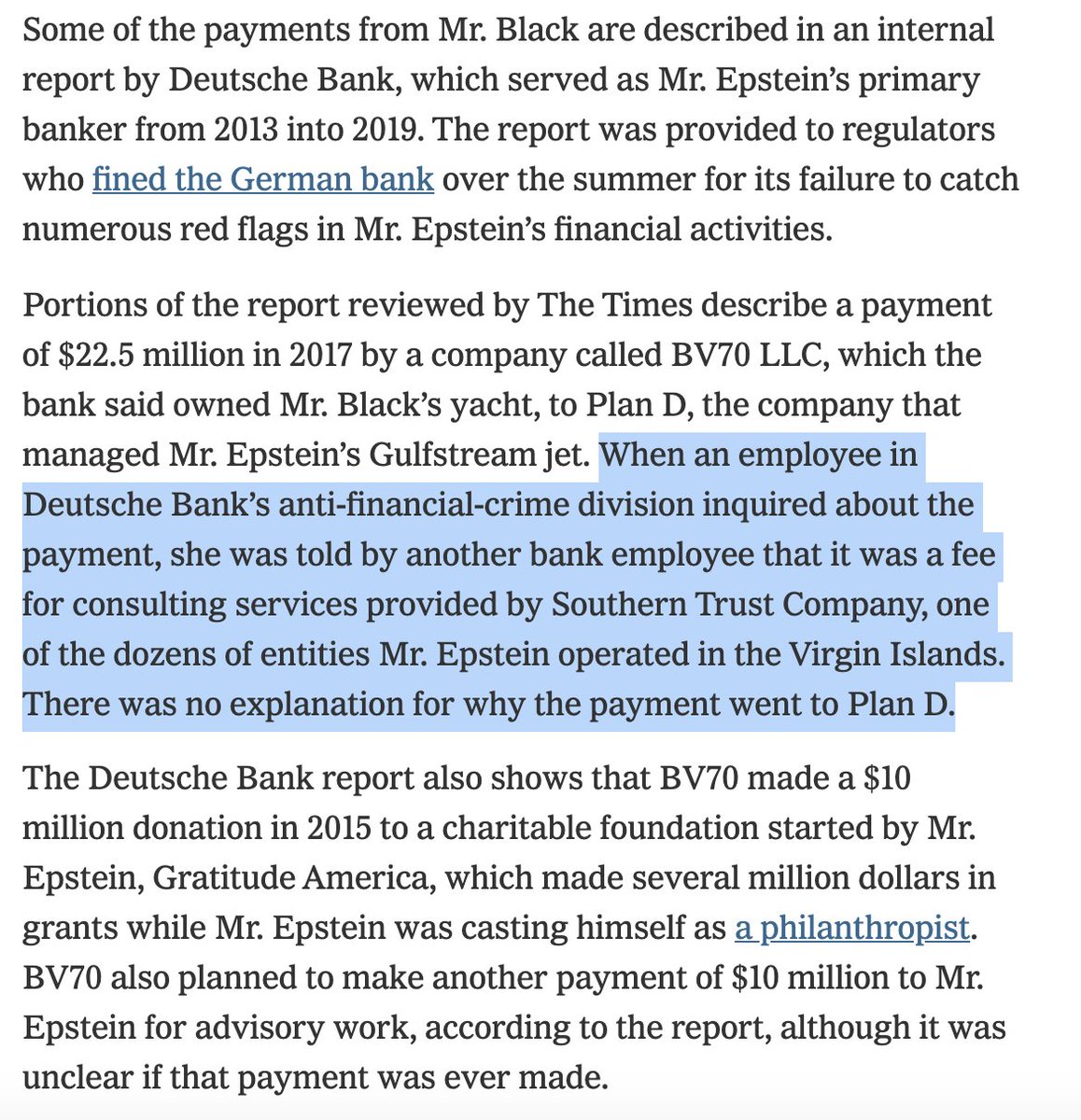

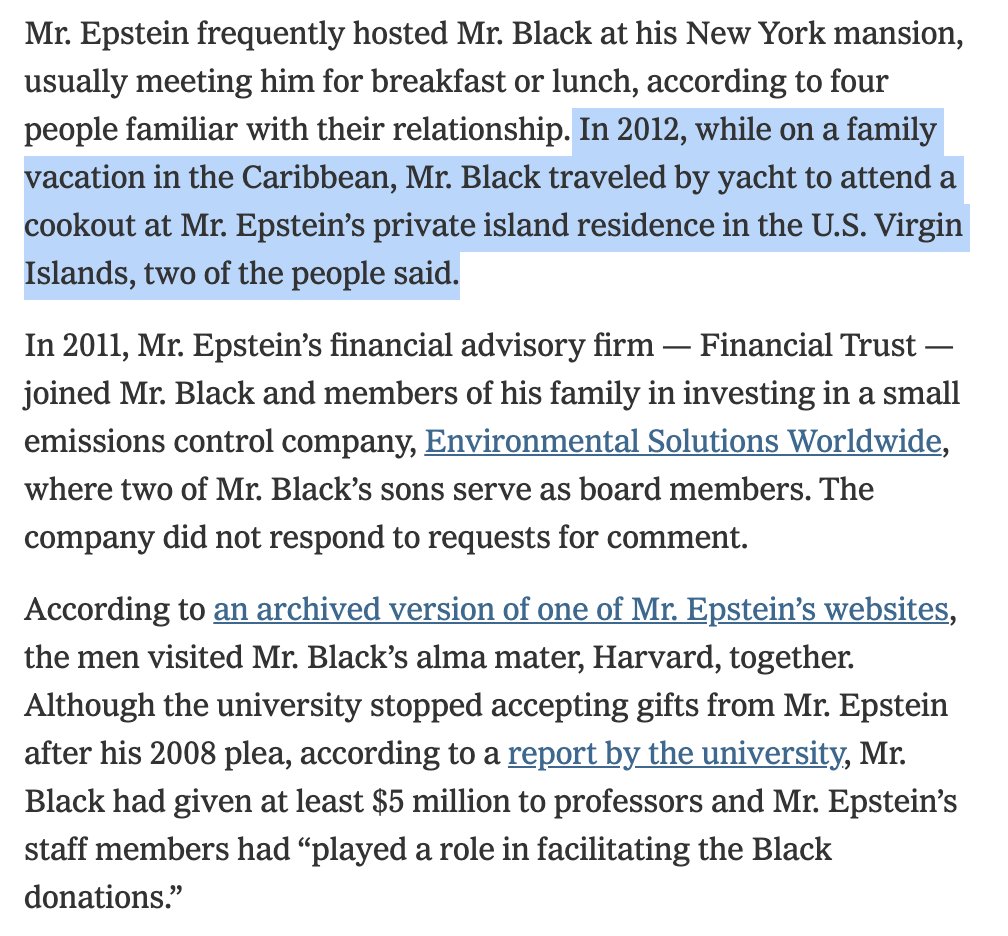

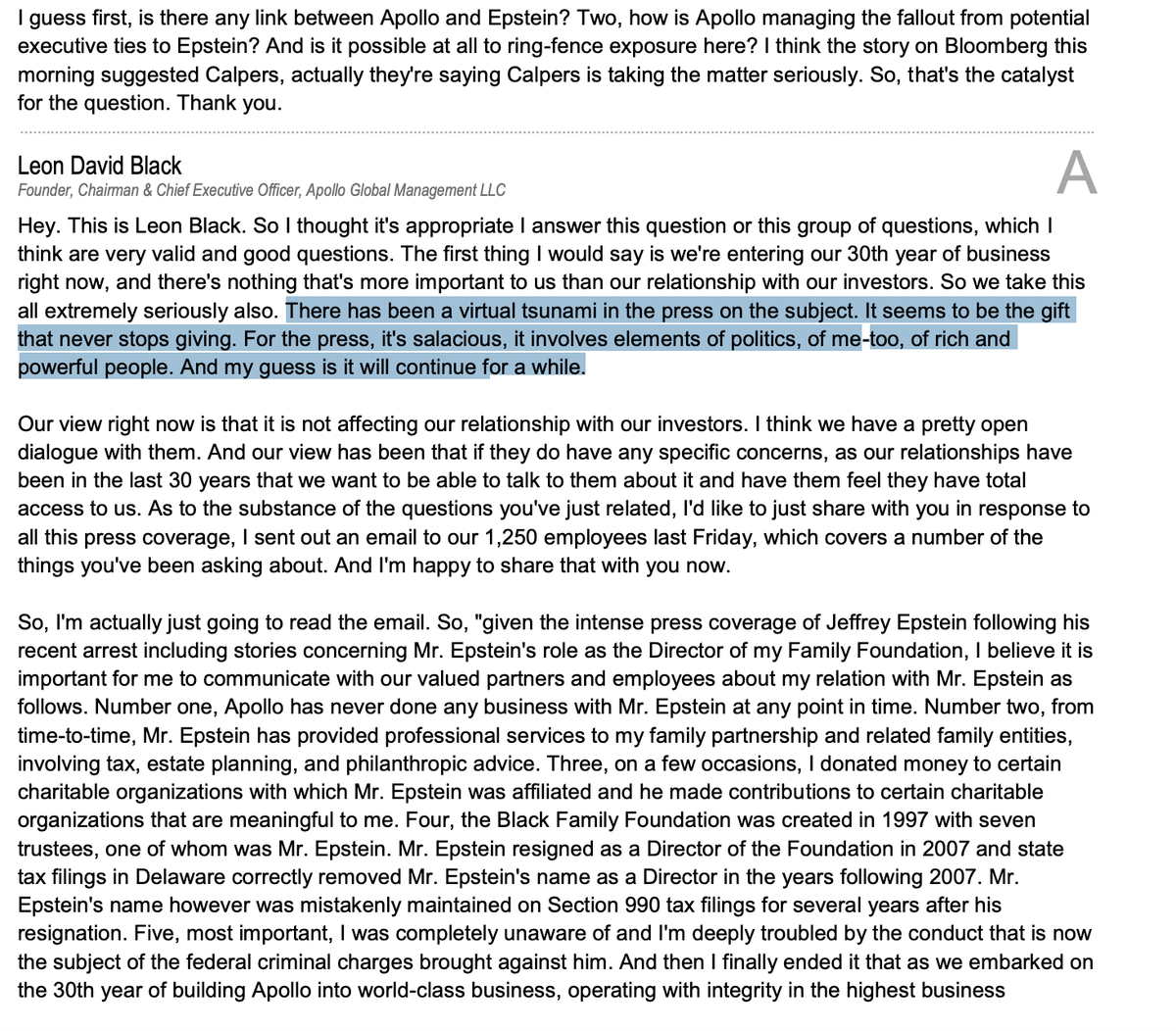

The board of directors of Leon Black's Apollo is launching an investigation of Black's ties to Epstein in wake of last week's @nytimes story. wsj.com/articles/apoll…

This article describes the Apollo investigation as coming at Black's request. He hopes "to put to rest renewed speculation into the nature of his ties to Mr. Epstein."

[One way to put speculation to rest would be to explain why he paid Epstein >$50M for tax/estate services.]

[One way to put speculation to rest would be to explain why he paid Epstein >$50M for tax/estate services.]

Spokeswoman for @apolloglobal confirms to @MattGoldstein26 that the board hired an outside law firm to investigate Black's ties to Epstein following our story last week. nytimes.com/2020/10/12/bus…

ICYMI last night, the private equity firm Apollo has launched an internal investigation into billionaire Leon Black’s long, $50M+ relationship with Jeffrey Epstein, following @nytimes reporting last week. nytimes.com/2020/10/20/bus…

• • •

Missing some Tweet in this thread? You can try to

force a refresh