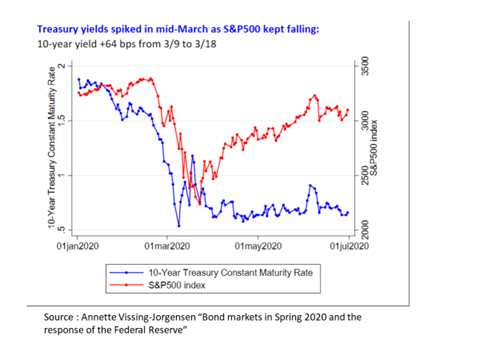

Many papers have emerged analysing the March episode of price collapse and illiquidity in US treasuries, an unprecedented event in the “deepest and most liquid “ financial market in the world. Many things hinge on this analysis 1/n

Two days ago, at the ECB Monetary Conference, ecb.europa.eu/pub/conference… , A.V-J presented a comprehensive paper. It identified the main sellers after the severity of the virus came into the open: investment/mutual funds, hedge funds and non-residents.2/

On a panel with D. Duffie and Vice-Chair Quarles at a webinar organised by the Systemic Risk Council on 14th Oct. , I particularly underlined the role of hedge fund´s sales as they unwound Treasuries basis trades that crucially involve funding with repos 3/..

That basis trade consists of buying Treasuries (buying the basis) when the actual repo rate is below a “neutral level”, and investing in shorting Treasury futures by borrowing in the repo market. The operation is leveraged and runs the risk of repo rate volatility.4/

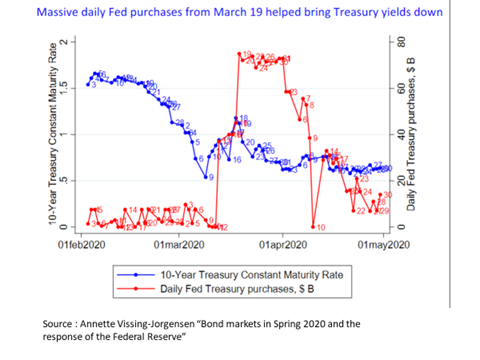

When the repo rate goes above that "neutral rate", as it happened in the March turbulence in repos, the trade consists of selling Treasuries spot (obtained via repo lending), and investing long in Treasury futures. Hedge funds losses were limited by massive FED interventions 5/

Repos transform price downturns into liquidity stress episodes, leading to distressed sales. The re-use of the same securities in repos, amplifies the phenomenon as reflected in an amount of repos 7 times the stock of US Treasuries (see Infante et al AER May 2020 p.482) 6/

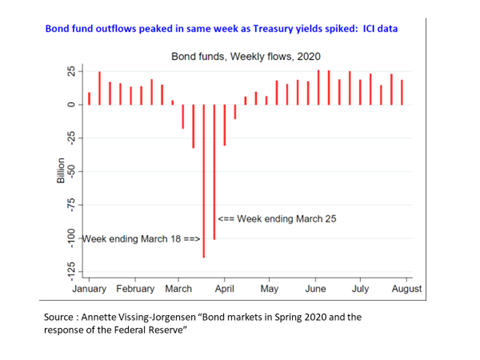

As mentioned, significant sellers were also Bond Funds pressured by massive redemption outflows fearing corporate defaults. The Funds had to sell the more liquid assets i.e. Treasuries. This exposes the maturity mismatch risks of these Funds with daily redeemable liabilities 7/

Market literature boasts that the system worked because there were no collapses of Funds or ETFs, forgetting that this was possible because of the huge FED (and CBs in other countries) interventions in all debt-assets markets, much more significant than in 2008-9 8/

D. Duffie pointed out that the Treasury price collapse also resulted from Dealer Institutions not having enough balance-sheet size to act as buyers and proposed that Treasuries should go to Central Clearing. Later, V-C Quarles said publicly that this justified QE continuation. 9/

The SRC webinar was on the relaunching of regulatory reform. I underlined the need to better regulate the Funds industry in terms of liquidity and leverage; regulation of repo re-use and initial haircuts and margins (for OTC derivatives); solving the issue of CCPs resolution 10/

The alternative to better regulation of non-bank intermediation and short-term financing is a permanent policy-put by central banks, each time hugely increasing moral hazard in an industry more and more used to the socialisation of losses.This should change. 11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh