Many of the talking heads were screaming about Bitcoin being a horrible safe haven during the recent economic crisis.

They have been proven wrong.

Time for a thread 👇🏽👇🏽👇🏽

They have been proven wrong.

Time for a thread 👇🏽👇🏽👇🏽

1) The pandemic led to uncertainty & chaos across markets in March & April.

During shocks like this, we historically have seen liquidity crises play out — everyone starts selling any asset with a liquid market.

I wrote about it as it was happening.

pomp.substack.com/p/the-liquidit…

During shocks like this, we historically have seen liquidity crises play out — everyone starts selling any asset with a liquid market.

I wrote about it as it was happening.

pomp.substack.com/p/the-liquidit…

2) We are now 7 months since the start of the economic shock.

Bitcoin is up 83% year-to-date and up more than 300% since the March lows.

It has outperformed all other asset classes by a material amount.

Bitcoin is up 83% year-to-date and up more than 300% since the March lows.

It has outperformed all other asset classes by a material amount.

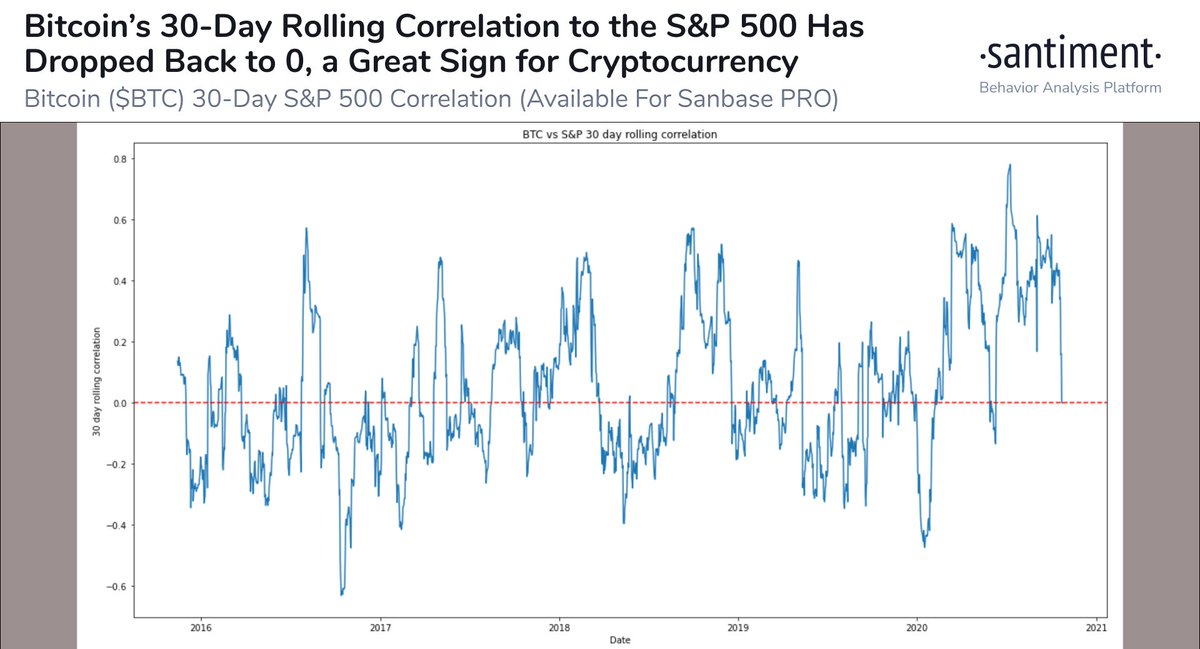

3) The best part is that every talking head was yelling about how Bitcoin's correlation to other assets in March/April proved it wasn't a safe haven asset.

During liquidity crises, all asset correlations trend towards 1. This was temporary thing & happened to gold, stocks, etc.

During liquidity crises, all asset correlations trend towards 1. This was temporary thing & happened to gold, stocks, etc.

4) Today Bitcoin's correlation to the stock market is at 0.

It could not be more uncorrelated than it is right now. (h/t @santimentfeed)

It could not be more uncorrelated than it is right now. (h/t @santimentfeed)

5) So how did Bitcoin do during an economic downturn?

It outperformed stocks, bonds, gold, oil, and pretty much everything else.

It also has a low to no correlation over any material amount of time.

Bitcoin is the ultimate safe haven & the market is proving it.

It outperformed stocks, bonds, gold, oil, and pretty much everything else.

It also has a low to no correlation over any material amount of time.

Bitcoin is the ultimate safe haven & the market is proving it.

6/6 Be very careful who you listen to.

Always ask yourself — does this person have skin in the game around what they are saying? Will they lose something and experience pain if they are wrong?

If the answer is no, then ignore them. If the answer is yes, pay close attention.

Always ask yourself — does this person have skin in the game around what they are saying? Will they lose something and experience pain if they are wrong?

If the answer is no, then ignore them. If the answer is yes, pay close attention.

• • •

Missing some Tweet in this thread? You can try to

force a refresh