THREAD: Today our @macropolochina team dropped a new report forecasting Chinese politics, economics, technology & energy 2020-2025.

I took on the task of predicting what will go down in Chinese tech over the next 5 years.

Here’s what I came up with: macropolo.org/analysis/china…

I took on the task of predicting what will go down in Chinese tech over the next 5 years.

Here’s what I came up with: macropolo.org/analysis/china…

First, a limitation: I didn’t try to cover every tech sector+issue. (Quantum, surveillance, fintech, social credit, etc.) Imagine predicting everything in US tech 2015-2020...

So if I didn’t cover your area, you should write that piece. Send it to me, I’ll read it! (thread 2/x)

So if I didn’t cover your area, you should write that piece. Send it to me, I’ll read it! (thread 2/x)

I focused on one major trend that I think will deeply shape Chinese tech in 2025, and one potential obstacle.

Trend: A shift from the consumer internet to the industrial internet via New Infrastructure.

Obstacle: Limited Chinese access to advanced semiconductors.

(thread 3/x)

Trend: A shift from the consumer internet to the industrial internet via New Infrastructure.

Obstacle: Limited Chinese access to advanced semiconductors.

(thread 3/x)

On shift from consumer internet to industrial internet.

2010-2020: Chinese tech cos focus on user-facing apps like WeChat, Alipay, TikTok.

2020-2025: Will focus on applying emerging tech (AI, IoT) to upgrading traditional sectors like ag, manufacturing & energy. (thread 4/x)

2010-2020: Chinese tech cos focus on user-facing apps like WeChat, Alipay, TikTok.

2020-2025: Will focus on applying emerging tech (AI, IoT) to upgrading traditional sectors like ag, manufacturing & energy. (thread 4/x)

Reasons for shift to industrial applications of emerging tech:

1. Fits CCP vision for tech’s role (advance econ+political goals)

2. Private Chinese co’s see markets abroad (🇨🇳🇺🇸🇪🇺) closing off➡️search for growth at home

3. The tech is mostly there, esp comp vision

(thread 5/x)

1. Fits CCP vision for tech’s role (advance econ+political goals)

2. Private Chinese co’s see markets abroad (🇨🇳🇺🇸🇪🇺) closing off➡️search for growth at home

3. The tech is mostly there, esp comp vision

(thread 5/x)

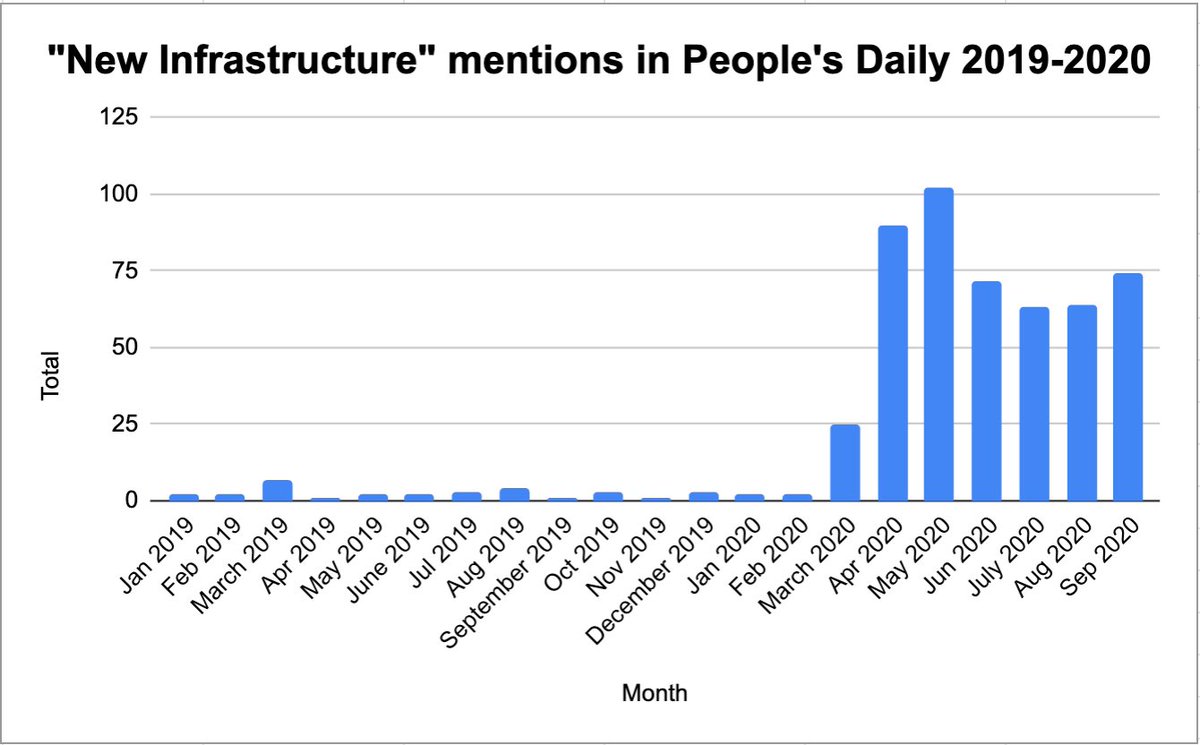

Driving this transition is gov push to build New Infrastructure aka 新基建.

There were murmurs about this dating back to 2018, but it took center stage in Chinese tech policymaking this year (see chart). I expect it to figure big in the upcoming 5 Year Plan.

(thread 6/x)

There were murmurs about this dating back to 2018, but it took center stage in Chinese tech policymaking this year (see chart). I expect it to figure big in the upcoming 5 Year Plan.

(thread 6/x)

New Infrastructure gets tangled in lots of CCP jargon, but the idea is simple: Build the physical+digital infrastructure for the massive, industrial-scale flow+processing of data.

Chinese gov has outlined 3 categories of New Infra, and I diagrammed them below. (thread 7/x)

Chinese gov has outlined 3 categories of New Infra, and I diagrammed them below. (thread 7/x)

More impt than infrastructure itself are applications China wants to build atop it: smart grids, smart farms, surveillance+.

Goal: turbocharge productivity in traditional engines of 🇨🇳 economy: ag, manufacturing, cities.

See new book by @xrw: nytimes.com/2020/10/15/boo…

thread 8/x

Goal: turbocharge productivity in traditional engines of 🇨🇳 economy: ag, manufacturing, cities.

See new book by @xrw: nytimes.com/2020/10/15/boo…

thread 8/x

But even in China, fancy plans ≠ concrete progress.

For a model of how Chinese gov tech plans work, see this 2018 piece I wrote on China’s massive AI plan: macropolo.org/analysis/how-c…

For New Infrastructure, I see 2 obstacles: cash and chips. (thread 9/x)

For a model of how Chinese gov tech plans work, see this 2018 piece I wrote on China’s massive AI plan: macropolo.org/analysis/how-c…

For New Infrastructure, I see 2 obstacles: cash and chips. (thread 9/x)

New Infrastructure been touted as 🇨🇳's post-Covid stimulus, but CCP doesn’t want another massive post-08 spending binge. (Can already see “Ghost Data Centers!” headlines)

I predict China will pilot New Infra in 3 regions: Jing-Jin-Ji, Shanghai+, Pearl River Delta (thread 10/x)

I predict China will pilot New Infra in 3 regions: Jing-Jin-Ji, Shanghai+, Pearl River Delta (thread 10/x)

I outlined the thinking behind this prediction of 3 key (explicit or implicit) pilot zones below.

macropolo.org/analysis/china…

(thread 11/x)

macropolo.org/analysis/china…

(thread 11/x)

In section 2, I predict biggest winners from shift to industrial internet will be new batch of Chinese startups +Alibaba Cloud.

Won’t dig into full argument here. Will know I got this right if @techbuzzchina starts doing episodes on AI agriculture/energy startups… (thread 12/x)

Won’t dig into full argument here. Will know I got this right if @techbuzzchina starts doing episodes on AI agriculture/energy startups… (thread 12/x)

Now for the thorny stuff:

What impact will US export controls on chips and Semiconductor Manufacturing Equipment have on China’s tech ambitions?

This is one of the most impt policy decisions for the next 🇺🇸 administration, and answering it sent me down a bunch of rabbit holes…

What impact will US export controls on chips and Semiconductor Manufacturing Equipment have on China’s tech ambitions?

This is one of the most impt policy decisions for the next 🇺🇸 administration, and answering it sent me down a bunch of rabbit holes…

Before my own analysis, shout-outs+reading on AI chips.

I learned lots from @CSETGeorgetown’s Saif Khan, @bartvanhezewijk, @FuDaoge, @macropolochina colleagues, @pstAsiatech + OTR convos w/ engineers. Links:

macropolo.org/digital-projec…

cset.georgetown.edu/research/ai-ch…

linkedin.com/pulse/chinas-p…

I learned lots from @CSETGeorgetown’s Saif Khan, @bartvanhezewijk, @FuDaoge, @macropolochina colleagues, @pstAsiatech + OTR convos w/ engineers. Links:

macropolo.org/digital-projec…

cset.georgetown.edu/research/ai-ch…

linkedin.com/pulse/chinas-p…

Key distinction:

1. Restrictions on exports of advanced chips (what US has done to Huawei + facial recognition startups)

2. Restrictions on Semiconductor Manufacturing Equipment (SME) China needs to indigenize chip production

(1) makes most headlines but (2) more impt in long run

1. Restrictions on exports of advanced chips (what US has done to Huawei + facial recognition startups)

2. Restrictions on Semiconductor Manufacturing Equipment (SME) China needs to indigenize chip production

(1) makes most headlines but (2) more impt in long run

For chip exports, I predict US will keep+slightly increase restrictions on for Huawei + key bad actors, but won’t go nuclear and cut off Chinese co’s like Ali/Tencent from advanced chips.

⬆️revenue for US chip R&D ⬇️ Incentive for global tech co’s to strip out US tech. (15/x)

⬆️revenue for US chip R&D ⬇️ Incentive for global tech co’s to strip out US tech. (15/x)

Biggest impact of US chip controls will be hobbling Huawei+slowing rollout of standalone 5G.

I see Huawei using dwindling chip reserves to build SA 5G in 3 pilot regions, then licensing 5G patents to other cos that continue buildout.

[Caveat: I could be totally wrong.]

(16/x)

I see Huawei using dwindling chip reserves to build SA 5G in 3 pilot regions, then licensing 5G patents to other cos that continue buildout.

[Caveat: I could be totally wrong.]

(16/x)

Reposting link to my full report here for those who jumped in mid-thread: macropolo.org/analysis/china…

And the full Forecast 2025 report w/ insights from my top-notch @macropolochina colleagues: macropolo.org/analysis/forec…

And the full Forecast 2025 report w/ insights from my top-notch @macropolochina colleagues: macropolo.org/analysis/forec…

Now for one of most impt forks in the road ahead: Restricting Semiconductor Manufacturing Equipment (SME) exports.

Two key questions:

1. What kinds of SME (+what node) will the US restrict SME exports to China?

2. Will it act unilaterally, or work closely w/ allies?

(19/x)

Two key questions:

1. What kinds of SME (+what node) will the US restrict SME exports to China?

2. Will it act unilaterally, or work closely w/ allies?

(19/x)

For SME restrictions, key questions - How much to restrict? Solo or w/ allies? - are deeply entwined, because key SME is made in 🇳🇱, 🇯🇵, 🇰🇷, etc.

Striking example: role of the Netherlands in key issue of advanced photolithography equipment: brookings.edu/techstream/the…

(20/x)

Striking example: role of the Netherlands in key issue of advanced photolithography equipment: brookings.edu/techstream/the…

(20/x)

KEY POINT: working w/ allies will empower the US to better enforce export restrictions, but it will also constrain US.

Working w/ allies means you must take their interests into account, and most US allies aren't on board w/ vision of tech competition as a 🇺🇸🇨🇳 deathmatch. 21/x

Working w/ allies means you must take their interests into account, and most US allies aren't on board w/ vision of tech competition as a 🇺🇸🇨🇳 deathmatch. 21/x

I forecast the US+allies implementing selective - but highly effective - SME export restrictions on China that hobble it’s catch-up.

Short term 2020-2023 won’t be devastating for Chinese tech cos, but mid-long term (2023-2030) it will be major stumbling block for China.

(22/x)

Short term 2020-2023 won’t be devastating for Chinese tech cos, but mid-long term (2023-2030) it will be major stumbling block for China.

(22/x)

Ok -- that’s a lot of analysis (re: me banging head against wall for months) for one twitter thread. And that’s just my Base Case scenario (60% chance)!

To read my secondary scenario + forecasts from my fabulous colleagues, get the whole report: macropolo.org/analysis/forec…

/THREAD

To read my secondary scenario + forecasts from my fabulous colleagues, get the whole report: macropolo.org/analysis/forec…

/THREAD

• • •

Missing some Tweet in this thread? You can try to

force a refresh