What are hybrid mutual funds?

Whether you should invest in this scheme or not?

A thread 🧵👇

Whether you should invest in this scheme or not?

A thread 🧵👇

1/ Hybrid Fund is a combination of different asset allocation like equities, debt, gold, real estate, etc. The biggest advantage for investors is that the investor gets a better allocation of funds.

2/ Also, the investor is also investing in debt which gives security and some funds also invest in commodities like Gold which gives protection when the overall market situation is bad for equity and debt asset class (like in Covid situation).

3/ The biggest risk for investors depends upon the percentage of asset allocation in various asset classes. Like if any fund invests more in equity class, the risk is as compared to other asset groups.

4/ Who should buy the hybrid fund ? Hybrid funds are considered to be riskier than debt funds but safer than equity funds. They tend to offer better returns than debt funds and are preferred by many low-risk investors.

5/ Further, new investors who are unsure about stepping into the equity markets tend to turn towards hybrid funds. This is because the debt component offers stability while they test the equity class too.

6/ Taxation - It depends upon the percentage of asset allocation. Like any fund, invest more than 65% in equity class, the taxation will be at 10% if the investor holds for more than 1 year and if the period is less than 1 year, 15% tax will be charged and considered as STCG.

7/ In debt class, the taxation will be as if an investor holds the funds for less than 3 years, then it’s considered as short term capital gain (STCG) and tax rate will be applicable as their current tax-slab. If hold for more than 3 years, a tax rate of 20% will be charged.

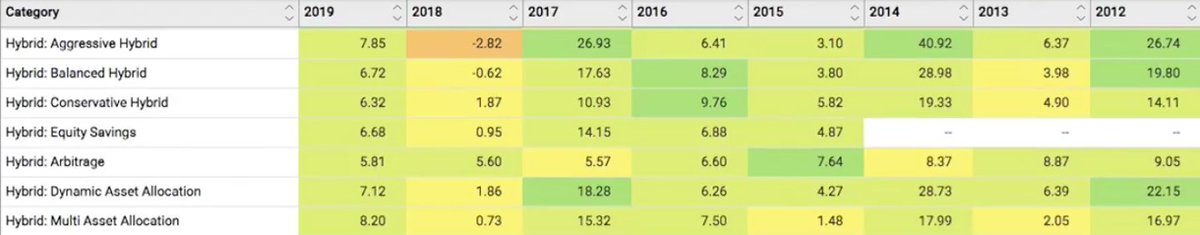

8/ Types of Hybrid Mutual funds - There are various fund available in this category, following are the types of it :

9/ Multi Asset Allocation Funds - These schemes need to have investments in at least 3 asset classes with a minimum of least 10% each. These schemes provide more diversification and prevent our capital. The taxation will be like debt class.

10/ Balance Hybrid Funds - These schemes Invest in a minimum of 40% and a maximum of 60% in equity and rest in different asset classes like debt, gold, etc. These types of schemes help us to earn some excess return by taking an excess risk in the equity.

11/ AND also helps to maintain a stream of cash flow which provides protection towards the invested capital. As balanced funds never have more than 65% of their assets in equity, they are considered debt funds for the purpose of taxation.

12/ Aggressive Hybrid Funds - These Schemes are mandated to invest a minimum of 65% and a maximum of 80% in the equity asset class and rest into debt. These schemes help to achieve and maximize the return due to larger allocation in the equity and less allocation towards Debt.

13/ As the scheme invests more than 65% in equity class, the taxation will be considered as equity.

Unpopular Fact - A fund house is allowed to offer only one Balanced Hybrid Fund to investors and it cannot offer both a Balanced Hybrid Fund and an Aggressive Hybrid Fund.

Unpopular Fact - A fund house is allowed to offer only one Balanced Hybrid Fund to investors and it cannot offer both a Balanced Hybrid Fund and an Aggressive Hybrid Fund.

14/ Dynamic Asset Allocation OR Balanced Advantage Funds - These schemes are truly dynamic and can shift between 100% debt to 100% equity asset class. The allocation is decided by the fund manager by forecasting the medium-term duration or expectations from the market.

15/ As assets are dynamically allocated between debt and equity based on market conditions and there is no fixed asset base, there is no particular frequency of asset rebalancing. The taxation can be both equity and debt but mostly based upon the asset allocation.

16/ Conservative Funds- These schemes invest 10-25% of their total asset is allocated in equity and remaining 75-90% is to be invested in the debt asset classes. The aim of the scheme is to provide a regular cash flow and safeguard of the capital. The taxation will be as debt.

17/ Arbitrage Fund- Arbitrage strategy is buying in the cash market & simultaneously selling in the futures market to generate return through the price differential b/w both markets. This is done through derivative instruments which are categorized as equity-oriented instruments.

18/ Since, there is a simultaneous buy and sell, there is no directional call on the stock and hence does not carry the volatility of the equity asset class and generates a stable debt-like return.

19/ These schemes invest 65-100% in equity assets and remaining 0-35% is invested in debt securities and money market instruments. The taxation will be taken as equity class.

20/ Equity Savings Fund - These funds try to balance risk in returns by investing in equity, derivatives and debt classes. Derivatives reduce directional equity exposure, thereby reducing the volatility and generating a stable.

21/ These schemes invest 65-100% in equity assets and remaining 0-35% is invested in debt securities and money market instruments. The taxation will be considered as equity class.

23/ According to us, one should buy the fund by looking their risk appetite and goals.

BY :- @pujanshah_15

BY :- @pujanshah_15

• • •

Missing some Tweet in this thread? You can try to

force a refresh