H1 results will b a revelation 4 lazy P&L st analysts making YoY compare bt discounting cash flow/EPS

& H2 is seasonally better

Market will do some math for sure- #TanlaPlatforms isn’t 13PE stock (FY21 est) with much high revenues/margins than #RouteMobile which now is at 40PE

& H2 is seasonally better

Market will do some math for sure- #TanlaPlatforms isn’t 13PE stock (FY21 est) with much high revenues/margins than #RouteMobile which now is at 40PE

https://twitter.com/wealth_creator9/status/1321677294977515520

And the proof is here:

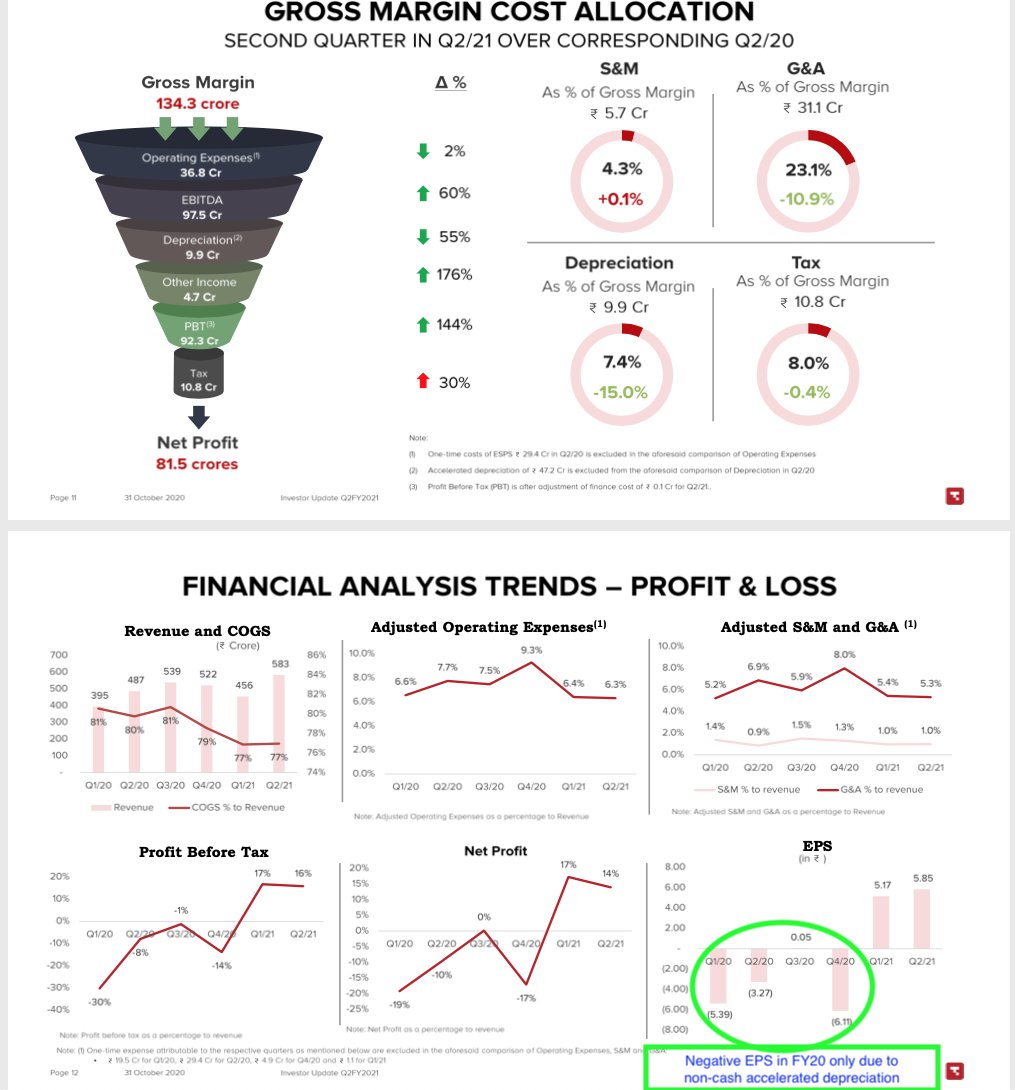

#TanlaPlatforms #Tanla announced stellar results for #Q2FY21 :

Result: bseindia.com/xml-data/corpf…

Presentation: bseindia.com/xml-data/corpf…

PressRelease: bseindia.com/xml-data/corpf…

#TanlaPlatforms #Tanla announced stellar results for #Q2FY21 :

Result: bseindia.com/xml-data/corpf…

Presentation: bseindia.com/xml-data/corpf…

PressRelease: bseindia.com/xml-data/corpf…

#TanlaPlatforms #Tanla - rerating is coming in a big way here.

https://twitter.com/AmitMis93532571/status/1322558168098992128?s=20

Thanks much DC - amazing analysis.

#TanlaPlatforms #Tanla is the leader in the industry & deserves much better valuations (current PE 13) as compared to the smaller peer that is #RouteMobile which is trading at 43 PE.

#Q2FY21 #H1FY21

#TanlaPlatforms #Tanla is the leader in the industry & deserves much better valuations (current PE 13) as compared to the smaller peer that is #RouteMobile which is trading at 43 PE.

#Q2FY21 #H1FY21

https://twitter.com/Deepak56276678/status/1322753576700010496

Breaking😊

MSCI has added #TanlaPlatforms to its INDIA SMALL CAP INDEX in review of 10Nov (effective on 30Nov)

MSCI weblink: app2.msci.com/eqb/gimi/small…

Massive endorsement coming from Global Index like MSCI #Tanla is officially an investment scrip 🚀🚀

#CPaaS #A2P #Telecom

MSCI has added #TanlaPlatforms to its INDIA SMALL CAP INDEX in review of 10Nov (effective on 30Nov)

MSCI weblink: app2.msci.com/eqb/gimi/small…

Massive endorsement coming from Global Index like MSCI #Tanla is officially an investment scrip 🚀🚀

#CPaaS #A2P #Telecom

#Tanla #TanlaPlatforms

Massive bulkdeal of 1.5 Cr shares(> 10% of total shares)

Blackstone(GSO Capital)seems to have exited partly & kept remaining 70lacs shares (may sell also later)

Given deal size & hot sector, big solid hands has bought in it seems

Strategic development

Massive bulkdeal of 1.5 Cr shares(> 10% of total shares)

Blackstone(GSO Capital)seems to have exited partly & kept remaining 70lacs shares (may sell also later)

Given deal size & hot sector, big solid hands has bought in it seems

Strategic development

#Tanla #TanlaPlatforms is getting the much deserving screen space finally

Thanks @_anujsinghal @CNBCTV18Live

Thanks @_anujsinghal @CNBCTV18Live

*Good surprise* in today's share transactions is that besides the big institution(s) (names 2b confirmed), promoters have also acquired 17.1 lakhs shares at 392.2 Rs/share.

This is a massive boost for all shareholders.

#Tanla #TanlaPlatforms

This is a massive boost for all shareholders.

#Tanla #TanlaPlatforms

https://twitter.com/AmitMis93532571/status/1328575726472343555?s=20

block deals details r out-includes very reputable names & promoter

Capital Group(American Funds Insurance Series Intl Fund) 86 lac

Amansa 40.84 lac

MobileTechsol(Promoter) 17.1 lac

Dalal-Broacha 3.5 lac

Sapni Reddy 2.56 lac

#Tanla #TanlaPlatforms

Capital Group(American Funds Insurance Series Intl Fund) 86 lac

Amansa 40.84 lac

MobileTechsol(Promoter) 17.1 lac

Dalal-Broacha 3.5 lac

Sapni Reddy 2.56 lac

#Tanla #TanlaPlatforms

https://twitter.com/AmitMis93532571/status/1328575726472343555?s=20

#Tanla #TanlaPlatforms

Among these, Capital group is a massive name with over 2 trillion USD AUM, under which American Fund Insurance Series is managing 150+ billion USD in assets.

Among these, Capital group is a massive name with over 2 trillion USD AUM, under which American Fund Insurance Series is managing 150+ billion USD in assets.

https://twitter.com/VincentVaz8/status/1328694809779789825?s=20

Here is ET gushing praises on #Tanla after entry of big names (Capital group, Amansa, Dalal-Broacha) incl promoters by buying in 1.5 Cr shares from Blackstone

After selling, Blackstone still holds 70 lakhs shares (> 5% of total shares)

#TanlaPlatforms

m.economictimes.com/markets/stocks…?

After selling, Blackstone still holds 70 lakhs shares (> 5% of total shares)

#TanlaPlatforms

m.economictimes.com/markets/stocks…?

Rahul Khanna (Partner/Portfolio Manager at Habrok Capital Mgmt) who is a director in #TanlaPlatforms since July 2020 has further increased his holdings in #Tanla -bought 20,000 shares at ~441 Rs/share - his total holdings now are 70,000 shares.

This is getting better n better.

This is getting better n better.

Sidhant Sachdeva, Senior Vice President, also increased his stake yesterday by 5K shares bought at 439 Rs/share - his total holding post recent acquisition is 13,51,076 shares (~1% of total equity).

#Tanla #TanlaPlatforms

#Tanla #TanlaPlatforms

Another bulk deal in #TanlaPlatforms for 16.7 lacs in pre-open at high point of today 555.9 Rs/share

Due to the arrangement it seems that shares changed hands from Blackstone (GSO Capital-Banyan) to some other fund house.

Details awaited...

#Tanla

Due to the arrangement it seems that shares changed hands from Blackstone (GSO Capital-Banyan) to some other fund house.

Details awaited...

#Tanla

#TanlaPlatforms #Tanla

Details of today’s bulk deals are out - again top foreign institutions entered the stock @ 524.3Rs/share

Massachusetts Institute of Technology 🚀

Vantage Equity Funds🚀

Cherry on the top, Tanla’s MarketCap touched 1 BUSD (7,563 Cr) - amazing turnaround.

Details of today’s bulk deals are out - again top foreign institutions entered the stock @ 524.3Rs/share

Massachusetts Institute of Technology 🚀

Vantage Equity Funds🚀

Cherry on the top, Tanla’s MarketCap touched 1 BUSD (7,563 Cr) - amazing turnaround.

Another 5% Upper Circuit in #TanlaPlatforms - incredible run by #Tanla and what is more incredible it is still undervalued given the future growth prospects and presence in sunrise sector of #CloudCommunication #CPaaS

• • •

Missing some Tweet in this thread? You can try to

force a refresh