Thought of developing a bit more on comparisons being made between Route and Tanla

Both are in an undeniably hot sector and therefore attracting lot of attention

One needs to b careful while making any loose comparisons of Tanla & Route

(1/n)

#TanlaPlatform #Tanla #RouteMobile

Both are in an undeniably hot sector and therefore attracting lot of attention

One needs to b careful while making any loose comparisons of Tanla & Route

(1/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/AmitMis93532571/status/1323400335738560515

When one dispassionately looks at both scrips, it can be easily seen that they are miles apart on financials,business operations, promoters, clients, regulatory front

Will list some of the reasons here below for everyone's consideration.

(2/n)

#TanlaPlatform #Tanla #RouteMobile

Will list some of the reasons here below for everyone's consideration.

(2/n)

#TanlaPlatform #Tanla #RouteMobile

While reading this, please take your eyes off the share prices and price action because that doesn't represent value - price largely just represent sentiments.

(1) Route is a recently listed company post IPO in September 2020...(contd..)

(3/n)

#TanlaPlatform #Tanla #RouteMobile

(1) Route is a recently listed company post IPO in September 2020...(contd..)

(3/n)

#TanlaPlatform #Tanla #RouteMobile

(...contd)..with less than 2 months of trading under greater regulatory scrutiny - lot of stuff is not known about the company.

(2) Route's earlier application in January 2018 for IPO was rejected by SEBI-see embedded tweet for 2018 DHRP

(4/n)

#TanlaPlatform #Tanla #RouteMobile

(2) Route's earlier application in January 2018 for IPO was rejected by SEBI-see embedded tweet for 2018 DHRP

(4/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/Invkkkk/status/1322816522260111361

(3) Various promoters stories for siphoning off benefits from subsidiary companies - there is a whole thread on it - see embedded tweet and weblink here below:

gsninvest.com/amp/route-mobi…

(5/n)

#TanlaPlatform #Tanla #RouteMobile

gsninvest.com/amp/route-mobi…

(5/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/GsnInvest/status/1303953311230382081

(4) Route is a bulk sms / low-cost (i.e. less margins) company which derives concentrated revenues from top 10 clients (59% as per Slide9 of presentation-link below) with low presence in the enterprise segment.

bseindia.com/xml-data/corpf…

(6/n)

#TanlaPlatform #Tanla #RouteMobile

bseindia.com/xml-data/corpf…

(6/n)

#TanlaPlatform #Tanla #RouteMobile

(5) Given its low margin business, market is very generous giving high valuations - it is currently trading at PE of ~44 & EV/EBITDA of ~34 on FY21 est

See embedded tweet from Deepak for brilliant comparison on #H1FY21 #Q1FY21 numbers

(7/n)

#TanlaPlatform #Tanla #RouteMobile

See embedded tweet from Deepak for brilliant comparison on #H1FY21 #Q1FY21 numbers

(7/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/Deepak56276678/status/1322753576700010496

But lets be real Route is *NOT* a high tech company to command such premium valuation for long time/with low margins

Affle for ex is a high tech products cpy & has high margins (~40%) to show for & therefore able to keep high valuations

(8/n)

#TanlaPlatform #Tanla #RouteMobile

Affle for ex is a high tech products cpy & has high margins (~40%) to show for & therefore able to keep high valuations

(8/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/Deepak56276678/status/1322753576700010496

At some point market will align itself to fundamentals & give what Route really deserves and personally it is not more than 20 PE stock

And one can only hope that there are no bigger impropriety issues alluded in GSN thread here or more

(9/n)

#TanlaPlatform #Tanla #RouteMobile

And one can only hope that there are no bigger impropriety issues alluded in GSN thread here or more

(9/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/GsnInvest/status/1303953311230382081

In striking comparison to Route (which is low level peer for Tanla as clear from pic appended below), Tanla is still trading at PE of 13.xx and EV/EBITDA of 12.xx with much better financials (Half yearly #H1FY21 basis)

(10/n)

#TanlaPlatforms #Tanla #RouteMobile

(10/n)

#TanlaPlatforms #Tanla #RouteMobile

https://twitter.com/Deepak56276678/status/1322753576700010496

Tanla with its

-superior financials,

-being a product/platform high tech company

-serving mainly enterprises

-zero debt & no legacy issue

can easily command 2x valuations it is currently trading at as soon as FY21 results are announced.

(11/n)

#TanlaPlatform #Tanla #RouteMobile

-superior financials,

-being a product/platform high tech company

-serving mainly enterprises

-zero debt & no legacy issue

can easily command 2x valuations it is currently trading at as soon as FY21 results are announced.

(11/n)

#TanlaPlatform #Tanla #RouteMobile

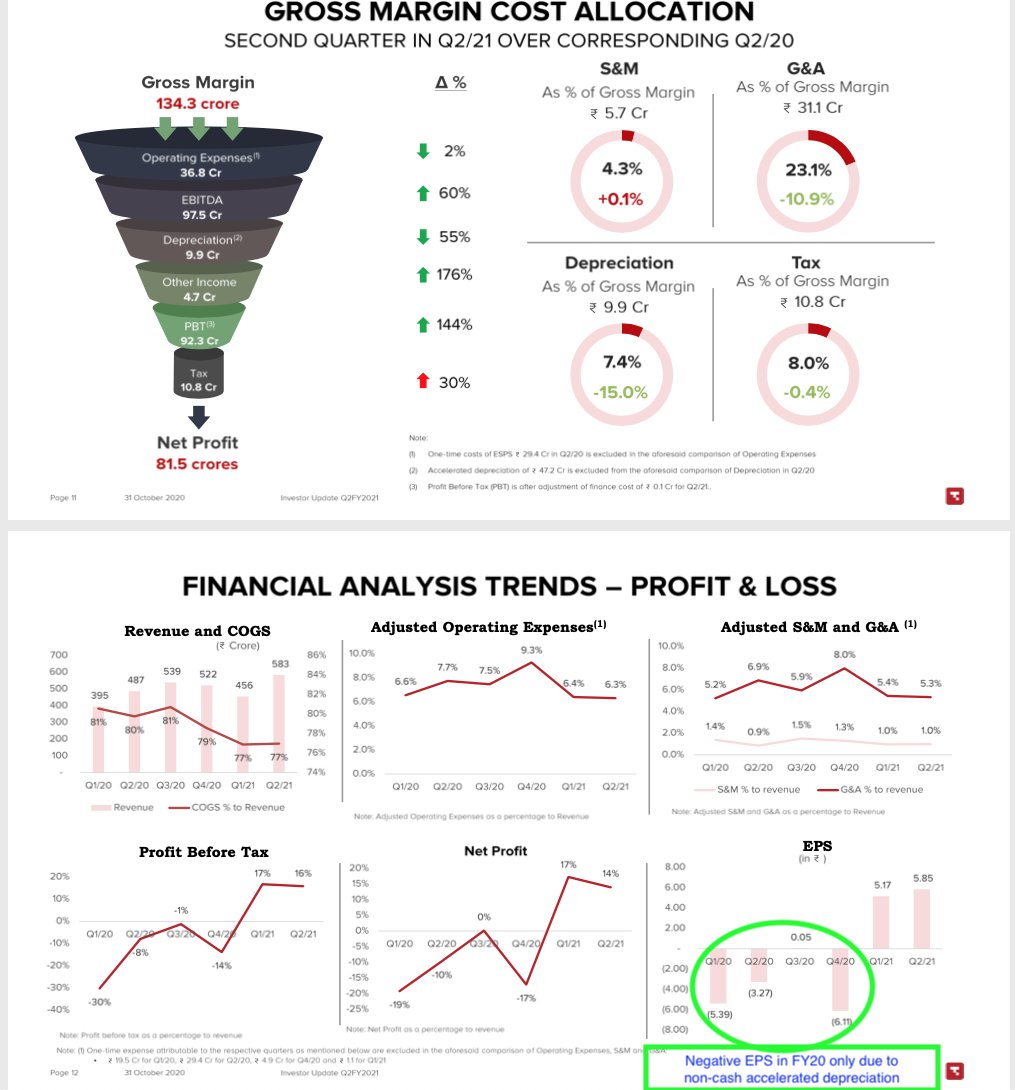

Please remember if someone points negative PAT in FY20, Tanla had to charge one off non cash items (acc depreciation & impair goodwill) as per telecom regulation which resulted in -ve PAT

Cash statement/Balance sheet shud be the focus

(12/n)

#TanlaPlatform #Tanla #RouteMobile

Cash statement/Balance sheet shud be the focus

(12/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/AmitMis93532571/status/1323162033005551616

Those who are interested to read further on all recent developments at Tanla since July 2020, should read this embedded thread - very good for chronological record with some technical guidance on top.

(13/n)

#TanlaPlatforms #Tanla #RouteMobile

(13/n)

#TanlaPlatforms #Tanla #RouteMobile

https://twitter.com/SForStiletto/status/1283431054414475265

Link for Tanla’s Q2FY21 results and presentation is here:

(14/n)

#TanlaPlatform #Tanla #RouteMobile

(14/n)

#TanlaPlatform #Tanla #RouteMobile

https://twitter.com/AmitMis93532571/status/1322565979033935874

Hope the above is helpful.

Disclosure: Am an investor in Tanla and therefore my views may be biased, please do your own due diligence before taking any position or take professional help.

(15/n)

#TanlaPlatform #Tanla #RouteMobile

Disclosure: Am an investor in Tanla and therefore my views may be biased, please do your own due diligence before taking any position or take professional help.

(15/n)

#TanlaPlatform #Tanla #RouteMobile

Guess #Tanla will continue to see valuation re-rating as we progress to #Q3FY21 #Q4FY21 results,both will b much better thn Q1/Q2

personally, #TanlaPlatform being leader in #CPaaS sector & better in every matrix,will cross #RouteMobile valuations in 2021

personally, #TanlaPlatform being leader in #CPaaS sector & better in every matrix,will cross #RouteMobile valuations in 2021

https://twitter.com/AmitMis93532571/status/1328643457083064322?s=20

Plugging below tweet (based upon beautiful comparative analysis frm @SForStiletto ) here also as it is more relevant to above thread on comparisons btwn #TanlaPlatforms / #RouteMobile

https://twitter.com/AmitMis93532571/status/1335015887170981890

Summary

#TanlaPlatforms ,a product/platform company serving majorly enterprises, rerating may continue given its PE range 26-33(based on FY21EPS est ranges)

against

#RouteMobile a low margin bulk sms business which trades at 50+PE

As usual, plz do ur own due diligence

#Tanla

#TanlaPlatforms ,a product/platform company serving majorly enterprises, rerating may continue given its PE range 26-33(based on FY21EPS est ranges)

against

#RouteMobile a low margin bulk sms business which trades at 50+PE

As usual, plz do ur own due diligence

#Tanla

https://twitter.com/AmitMis93532571/status/1322566155396026369

good observation @SForStiletto 👍🏼

btw, if we keep #Karix & #Gamooga in view which were acquired recently by #TanlaPlatforms , then in some ways we can say that #Tanla now is equivalent to #AffleIndia plus #RouteMobile

btw, if we keep #Karix & #Gamooga in view which were acquired recently by #TanlaPlatforms , then in some ways we can say that #Tanla now is equivalent to #AffleIndia plus #RouteMobile

https://twitter.com/SForStiletto/status/1335571315080589312

@EdelweissFin starts coverage of #RouteMobile TP1280

CMP valued at

PE & EV/EBITDA w/FY:

33 & 22 w/FY23 est⚡️

48 & 36 w/FY21 est⚡️

#CPaaS #CloudCommunication sector is major theme 4this decade,& market will continue 2rerate *sector leader* #TanlaPlatforms

#Blockchain #Platforms

CMP valued at

PE & EV/EBITDA w/FY:

33 & 22 w/FY23 est⚡️

48 & 36 w/FY21 est⚡️

#CPaaS #CloudCommunication sector is major theme 4this decade,& market will continue 2rerate *sector leader* #TanlaPlatforms

#Blockchain #Platforms

https://twitter.com/AmitMis93532571/status/1335897986593816576

Updates from Deepak on comparative analysis for #TanlaPlatforms vs #RouteMobile

While RM is much lesser player in comparison to standalone #Karix & far from #Tanla,this table is prepared to demonstrate that Tanla is due for massive rerating given massive earning growth potential

While RM is much lesser player in comparison to standalone #Karix & far from #Tanla,this table is prepared to demonstrate that Tanla is due for massive rerating given massive earning growth potential

https://twitter.com/AmitMis93532571/status/1323541316936949760

Thanks 4info Vincent

#RouteMobile mgmt is selling as it is clearly overpriced

PE~90

EV/EBITDA~60

totally unsustainable given low margin bulk business it has-details👆🏼in thread

#TanlaPlatforms,superior in all matrices & undervalued,is a no brainer-details in pinned thread #Tanla

#RouteMobile mgmt is selling as it is clearly overpriced

PE~90

EV/EBITDA~60

totally unsustainable given low margin bulk business it has-details👆🏼in thread

#TanlaPlatforms,superior in all matrices & undervalued,is a no brainer-details in pinned thread #Tanla

https://twitter.com/VincentVaz8/status/1362027328813953027

Thanks team @SudzzBTS @nimishshp @BeatTheStreet10 for the video - very informative and helpful 👍🏼

#TanlaPlatforms vs #RouteMobile

@SForStiletto @Deepak56276678

#TanlaPlatforms vs #RouteMobile

@SForStiletto @Deepak56276678

https://twitter.com/sudzzbts/status/1370046854012891137

• • •

Missing some Tweet in this thread? You can try to

force a refresh