Three days after our story on @realDonaldTrump, @DeutscheBank and Chicago runs, I get a FOIA response with 2,000+ pages of documents. A fun Friday afternoon and evening awaits....

No surprise here, but interesting to see up-close how for every condo unit that @realDonaldTrump sold, money went straight to @DeutscheBank to repay Trump's defaulted loan.

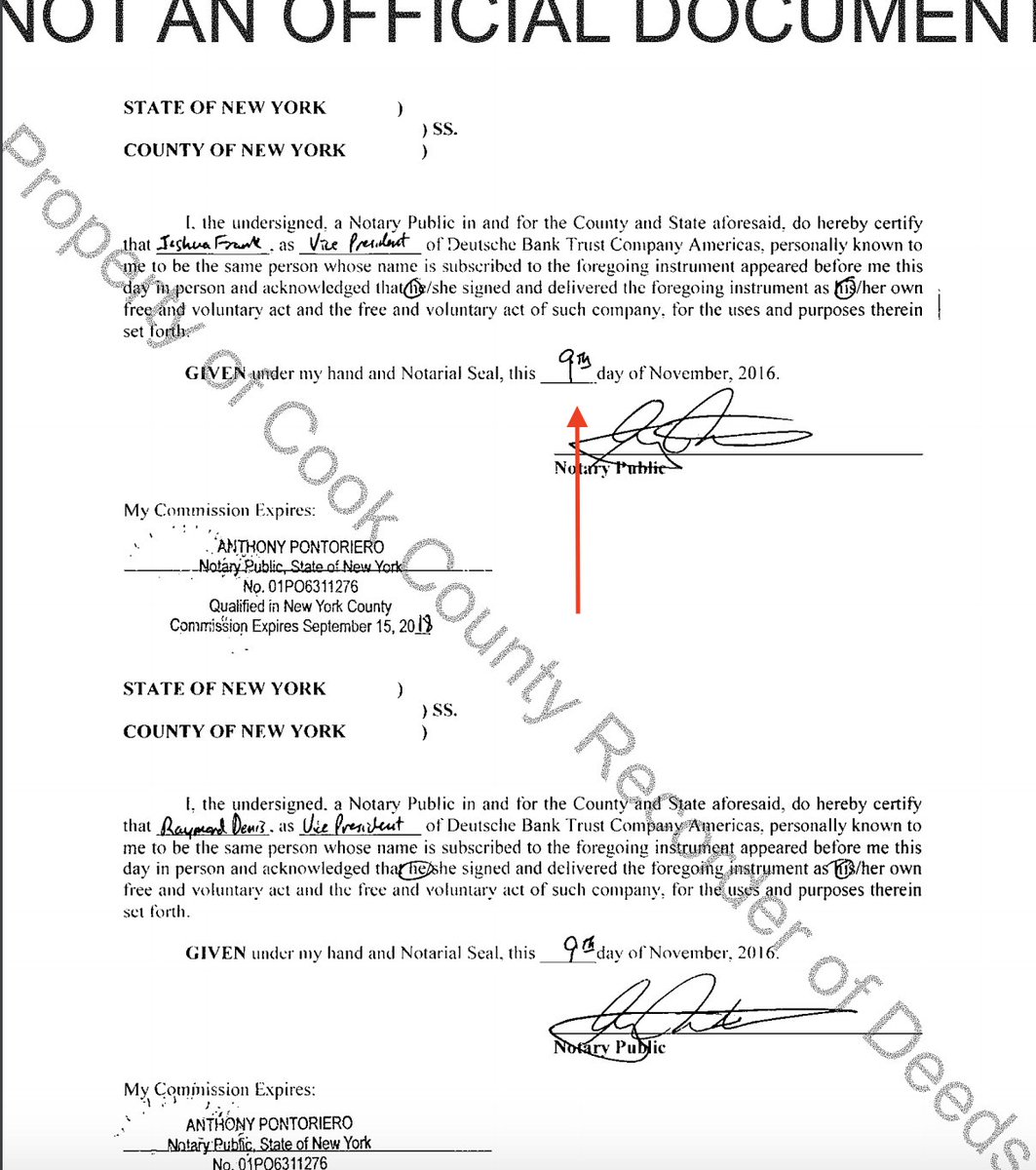

Here's one example of an all-cash purchase in April 2012.

Here's one example of an all-cash purchase in April 2012.

Here's a $2 million+ purchase by an LLC – Millenium New Ventures LLC, with "Millennium" misspelled – registered to what looks like a mailbox in a UPS Store. google.com/search?q=40+e+…

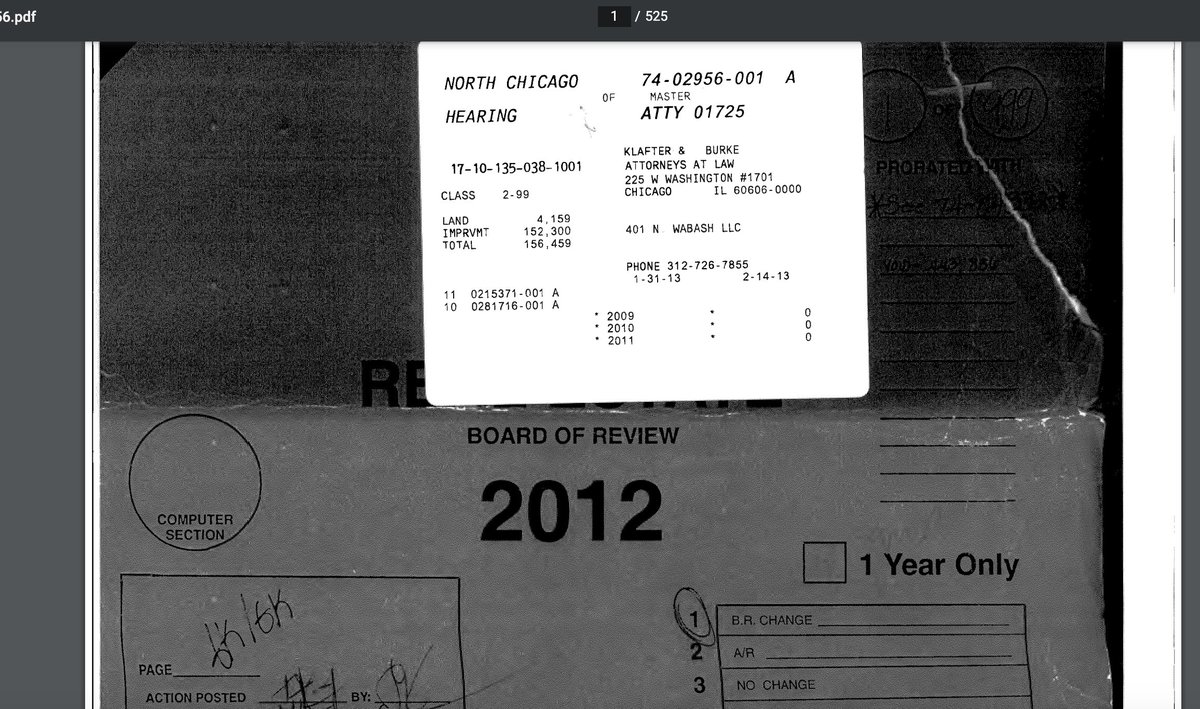

These documents are part of a long-running dispute over the property taxes owed on Trump Chicago. (This has been covered extensively in local media.) Classic @realDonaldTrump legal strategy of filing neverending motions and appeals in the hopes of grinding down opponents.

There's not a whole lot of interesting stuff in these documents, most of which I've at least skimmed.

Too bad, but that's the way it often goes with FOIA.

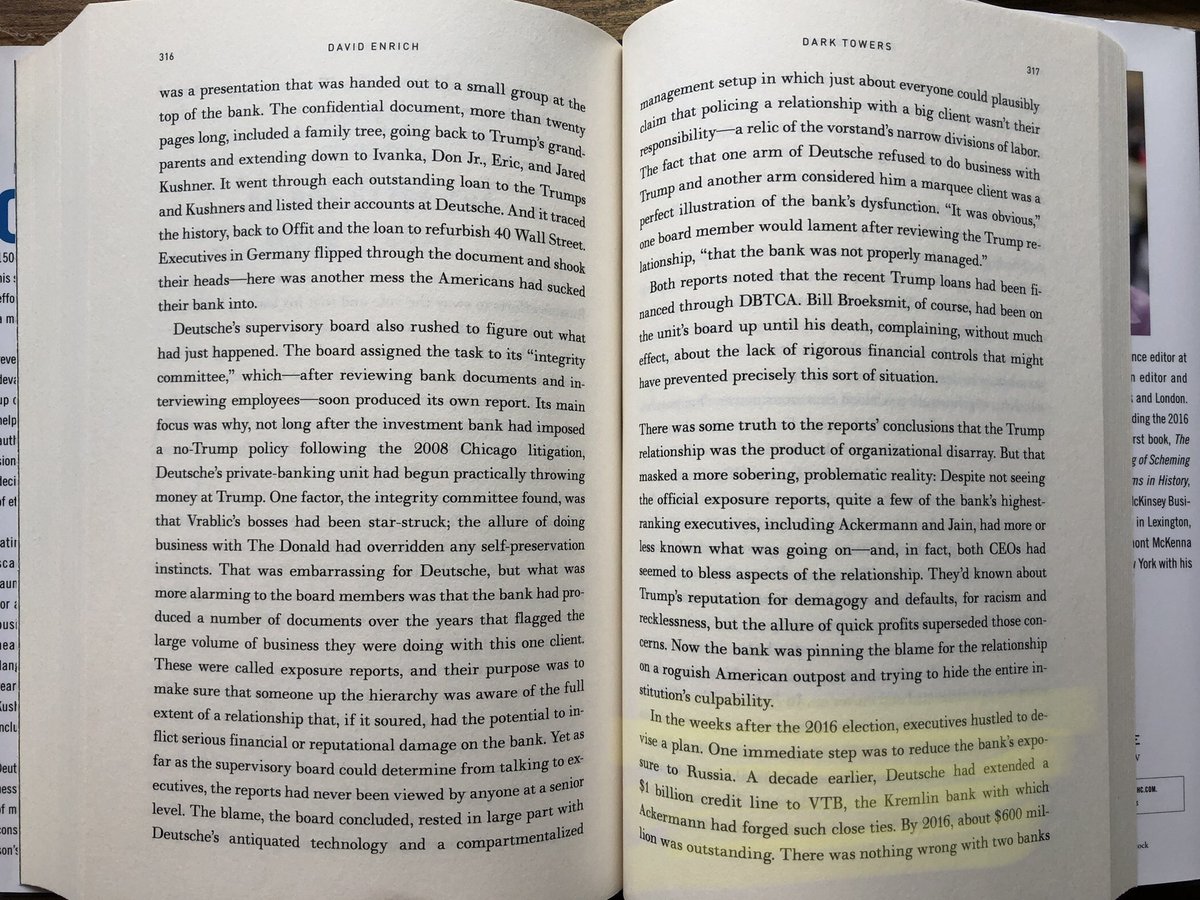

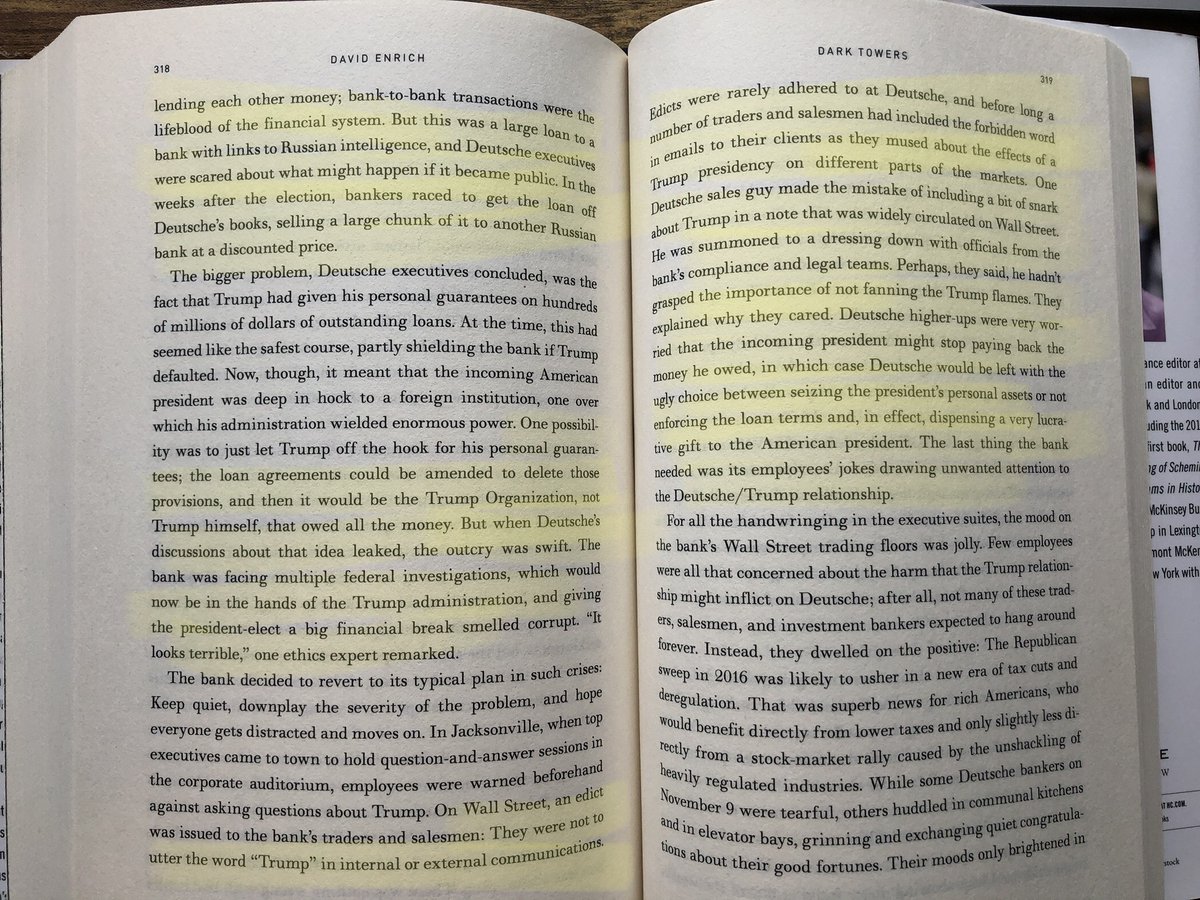

But there is something, which I just re-found in an old NY court document, which folks might be interested in....

Too bad, but that's the way it often goes with FOIA.

But there is something, which I just re-found in an old NY court document, which folks might be interested in....

Want to see a list of the original purchasers of units in Trump Chicago?

I haven't scrubbed these names – there are a lot of them (9 pages just like this one below).

Go to page 127 of the pdf at this link. iapps.courts.state.ny.us/nyscef/ViewDoc…

I haven't scrubbed these names – there are a lot of them (9 pages just like this one below).

Go to page 127 of the pdf at this link. iapps.courts.state.ny.us/nyscef/ViewDoc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh