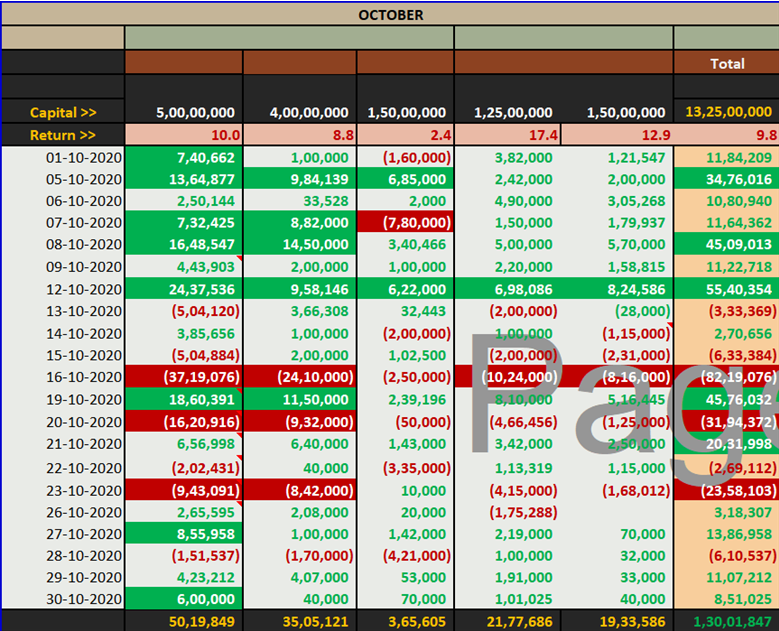

Good Morning Everyone. Just thought to share my last months pnl of my major accounts, with you all. Will do this on monthly basis, no point putting daily profit / loss. Have been maintaining these for last few months. Maintain a journal of the hits and misses :)

Will doo a thread on Numbers as I had promised sometime back. Numbers and stats fascinate me, am sure it will give you all some food for thought.

Objective is to provide a fresh perspective, up to you to believe it or not.

Most importantly Money can be made with buying and without leverage. You don't need bigger capital. Have made return of >90% on a 32L cap in last 4-5 months (not included above). That too infrequent

Most importantly Money can be made with buying and without leverage. You don't need bigger capital. Have made return of >90% on a 32L cap in last 4-5 months (not included above). That too infrequent

trading and option buying using 50-60% of capital (if you doubt be my guest will show the ledger). So just don't be herd, and do things that suit of trading personality. End of the day it is ur own trading capital and ur life. Trade carefully!!

So here it goes.

Last column represents the summation of all the individual pnl

All these numbers do give me a sense of what am I doing right or wrong. These have been generated with

-50-60% capital deployment (In high conviction trades would go up >90% (like on 16th :))

Last column represents the summation of all the individual pnl

All these numbers do give me a sense of what am I doing right or wrong. These have been generated with

-50-60% capital deployment (In high conviction trades would go up >90% (like on 16th :))

- Without any intraday leverage

- 90% directional trades.

- Don’t operate all the accounts all the time (do that only when conviction is the highiest)

-Carrying overnight positions always (with hedging)

-Don’t operate all the accounts all the time (do that

- 90% directional trades.

- Don’t operate all the accounts all the time (do that only when conviction is the highiest)

-Carrying overnight positions always (with hedging)

-Don’t operate all the accounts all the time (do that

only when conviction is the highest)

-+- 7-8 lac a day is normal, and I get worried only when it goes beyond that

Now few takeaways.

-Higher capital doesn't guarantee better return at all. It has taken years before I started working on this level of capital. Yes it does give

-+- 7-8 lac a day is normal, and I get worried only when it goes beyond that

Now few takeaways.

-Higher capital doesn't guarantee better return at all. It has taken years before I started working on this level of capital. Yes it does give

lot of buffer and allows you to make some minor blunders, you can

always make a comeback.

- Few days (16th / 20th / 23rd) took away around 1.4cr, basically these days market did just the opposite of my reading and system and I lost heavily (part of the game)

always make a comeback.

- Few days (16th / 20th / 23rd) took away around 1.4cr, basically these days market did just the opposite of my reading and system and I lost heavily (part of the game)

- Never try to defend my positions when views go wrong. No averaging and no revenge trading

- Always try to protect the capital then less of loss and then profit

- Size of trading bets go up only when there is a backup profit. Till 15th profit was more than 1.5cr

- Always try to protect the capital then less of loss and then profit

- Size of trading bets go up only when there is a backup profit. Till 15th profit was more than 1.5cr

then lost my way..

- Don’t envisage to make more than 5-6% return

- How many of big +ve days vs -ve days decides the fate of monthly return.

Apart from last month when had few bad days and less of good days, rest of all last 6 months have been positive to a great extent.

- Don’t envisage to make more than 5-6% return

- How many of big +ve days vs -ve days decides the fate of monthly return.

Apart from last month when had few bad days and less of good days, rest of all last 6 months have been positive to a great extent.

- Last but not the least, these are system based non Algo based trades. Hoping to upgrade myself fully Algo based trader in coming years (assuming they'll enhance the returns)

Hope it helps in someway. Dont be fooled that traders make money everyday and that too big ones.

Happy to answer any genuine queries for learning and sharing my experience. Will block idiots without any discussion. Not here to engage in negativity. So kindly excuse me. Cheers

Happy to answer any genuine queries for learning and sharing my experience. Will block idiots without any discussion. Not here to engage in negativity. So kindly excuse me. Cheers

• • •

Missing some Tweet in this thread? You can try to

force a refresh