1/ Notes from @Rich_Barton and @altcap episode at @InvestLikeBest

This was a wide range of conversation touching on many different topics. Let's start.

This was a wide range of conversation touching on many different topics. Let's start.

4/ "...as an entrepreneur, you have to over-index to courage. You have to think about the world that you wish to exist, not the one that does exist. As investor, I'm constantly looking at distribution of probabilities, that those outcomes will in fact be achieved."

6/ Add the magic of Frank Slootman, and you probably don't want to scoff at that $SNOW valuation anymore.

If you want to know more about Slootman, go here:

If you want to know more about Slootman, go here:

https://twitter.com/borrowed_ideas/status/1306581240837963776

8/ We are perhaps underestimating how much Fed has been instrumental in driving up the valuation for these tech companies.

But instead of focusing on these potential risks, a better idea to remain invested in great companies.

"you trade against yourself almost all the time"

But instead of focusing on these potential risks, a better idea to remain invested in great companies.

"you trade against yourself almost all the time"

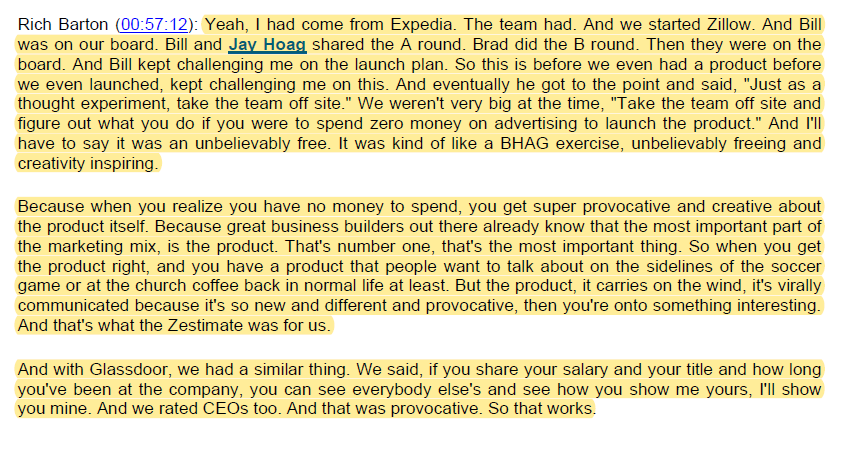

9/ Another good thought exercise which was suggested by @bgurley to Barton:

"figure out what you do if you were to spend zero money on advertising to launch the product"

"figure out what you do if you were to spend zero money on advertising to launch the product"

10/ "SEO was a dirty three letter word"

"Look if I build the greatest product, Google ought to find me"

"Look if I build the greatest product, Google ought to find me"

11/ Amazing to see how Altimeter thinks about their research process and talent. It's not rocket science, but kinda incredible how very few firms actually get it.

End/ Episode link: investorfieldguide.com/brad-gerstner-…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh