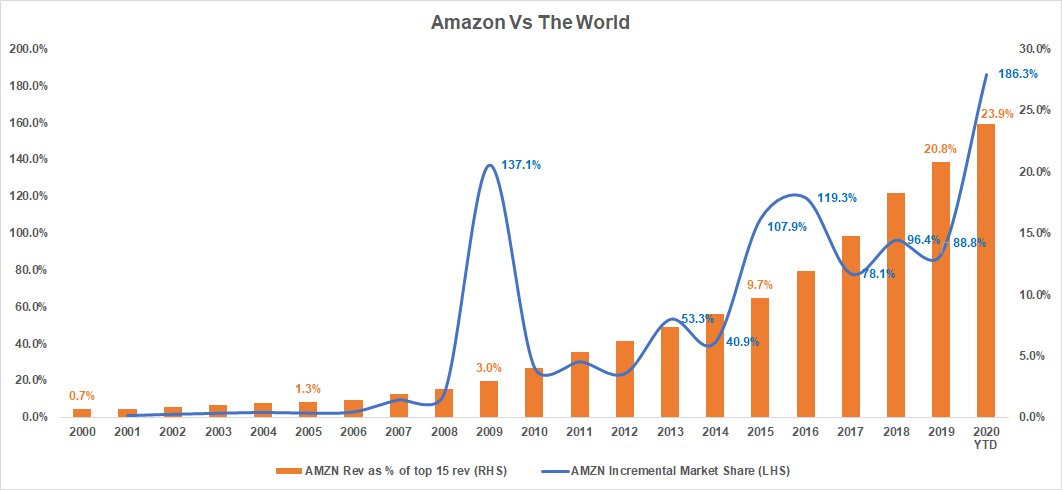

1/ Thread: $AMZN 3Q'20 Update

Another quarter of mind-boggling numbers, but since it’s AMZN, that’s expected.

Let’s dive in.

Another quarter of mind-boggling numbers, but since it’s AMZN, that’s expected.

Let’s dive in.

2/ Few things stand out.

Most people understandably rave about AWS, especially given its high margin. But I was always amazed by AMZN’s 3P numbers.

Although we cannot “see” it, it’s highly profitable too (not as much as AWS though).

Most people understandably rave about AWS, especially given its high margin. But I was always amazed by AMZN’s 3P numbers.

Although we cannot “see” it, it’s highly profitable too (not as much as AWS though).

3/ International segment was again profitable for two consecutive quarters.

Strong volume in Europe and Japan.

AMZN is still in pretty early days in international markets. Launched AMZN Sweden yesterday. Also, launched Prime in Turkey.

Strong volume in Europe and Japan.

AMZN is still in pretty early days in international markets. Launched AMZN Sweden yesterday. Also, launched Prime in Turkey.

4/ International Prime members streaming Prime Video +80% YoY.

Time spent on Prime Video by them doubled.

Prime renewal rates improved. Engagement improved. Prime members are buying more frequently from more categories.

Time spent on Prime Video by them doubled.

Prime renewal rates improved. Engagement improved. Prime members are buying more frequently from more categories.

5/ Investors concerns related to AWS margins amidst competition from $MSFT and $GOOG continue be assuaged by another +30% operating margin quarter.

6/ The other segment grew by +49%. ~80% of “other” segment is advertising.

Needless to say, it’s likely to be extremely profitable too.

From trade promotion opportunity in the marketplace to Twitch and OTT, that ad inventory continues to look mighty impressive.

Needless to say, it’s likely to be extremely profitable too.

From trade promotion opportunity in the marketplace to Twitch and OTT, that ad inventory continues to look mighty impressive.

7/ $AMZN created 400k jobs this year!!

Fulfillment and logistics network square footage to grow by 50% this year.

AMZN saved $1 Bn so far from lack of travel. A lot of the Covid related expenses are more than offset by consistently high demand in typically off-peak quarters.

Fulfillment and logistics network square footage to grow by 50% this year.

AMZN saved $1 Bn so far from lack of travel. A lot of the Covid related expenses are more than offset by consistently high demand in typically off-peak quarters.

8/ Operating Cash Flow +56% YoY.

FCF (the most restrictive definition) was +71% YoY

So yeah, another great quarter and life as usual for $AMZN.

FCF (the most restrictive definition) was +71% YoY

So yeah, another great quarter and life as usual for $AMZN.

End/ All my twitter threads are here: mbi-deepdives.com/twitter-thread…

$FB (tonight) and $GOOG (tomorrow morning) earnings update to be followed.

$FB (tonight) and $GOOG (tomorrow morning) earnings update to be followed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh