My E-Commerce🛒& Advertising📺Journey. Thesis (initial & latest), Scorecard & Lessons from those holdings.

Sharing with few friends @saxena_puru @richard_chu97 @BrianFeroldi @7Innovator @Gautam__Baid @TMFJMo @dhaval_kotecha @JonahLupton @adventuresinfi

Scorecard📊⬇️

Sharing with few friends @saxena_puru @richard_chu97 @BrianFeroldi @7Innovator @Gautam__Baid @TMFJMo @dhaval_kotecha @JonahLupton @adventuresinfi

Scorecard📊⬇️

The point of the thread is not to show off, but to share my experiences & general lessons with whoever is interested & applies to. Divided into the below sections.

Philosophy

Trends

Research

Thesis

Valuation

Financials

Buying

Holding, Maintenance

Selling

Philosophy

Trends

Research

Thesis

Valuation

Financials

Buying

Holding, Maintenance

Selling

✔️My Philosophy

- Invest your Capital with the best Businesses & Mgmt Teams.

- Hold for longterm as long as the biz quality/strength are improving & intrinsic value is growing.

- Learn from mistakes & improve the process.

- Expect & take advantage of Volatility along the way.

- Invest your Capital with the best Businesses & Mgmt Teams.

- Hold for longterm as long as the biz quality/strength are improving & intrinsic value is growing.

- Learn from mistakes & improve the process.

- Expect & take advantage of Volatility along the way.

✔️Trends

Companies and their Financial statements & Stocks don't exist in vacuum. The future of most Co's (in most industries) hugely depends on their correlation to major/sustainable trends (Technological/Consumer/Regulatory...) trends around them.

Companies and their Financial statements & Stocks don't exist in vacuum. The future of most Co's (in most industries) hugely depends on their correlation to major/sustainable trends (Technological/Consumer/Regulatory...) trends around them.

If they are at the forefront of those trends or at least aligned to them in providing ongoing value to Customers, they will have a better future. If not, the ongoing innovation and disruption will slowly eat away at their value.

✔️Research

Figuring out the major trends (or mini-trends) in the Sectors you're interested in & your circle of competence.

Identifying and understanding why certain Co's are winning in those trends and how sustainable that is and visualizing the runway ahead.

Figuring out the major trends (or mini-trends) in the Sectors you're interested in & your circle of competence.

Identifying and understanding why certain Co's are winning in those trends and how sustainable that is and visualizing the runway ahead.

This initial research can be done directly based on Co's published reports (if you're experienced) or depending on plenty of good online research available (some free, some paid).

Many folks sharing great stuff here on FinTwit and Medium/Substack also. 👏

Many folks sharing great stuff here on FinTwit and Medium/Substack also. 👏

Contextualizing the Financial Statements & Valuation for Quality, Growth, Life cycle of the Co, Management quality, Financial strength etc. and then determining if the Company is worth investing in and worth paying up for.

✔️Thesis

Once you have a good understanding of the Company & all other related factors, it helps to boil it down to 2-3 simple points on why it makes for a good long-term investment.

Once you have a good understanding of the Company & all other related factors, it helps to boil it down to 2-3 simple points on why it makes for a good long-term investment.

Ex : $TTD :

Digital Ads -> Programmatic Ads.

Desktop/Mobile/Audio/CTV... huge space that can be effectively served by TTD (offering better transparency than the walled gardens of GOOG/FB).

Visionary Management and executing well, Excellent Financials...

Digital Ads -> Programmatic Ads.

Desktop/Mobile/Audio/CTV... huge space that can be effectively served by TTD (offering better transparency than the walled gardens of GOOG/FB).

Visionary Management and executing well, Excellent Financials...

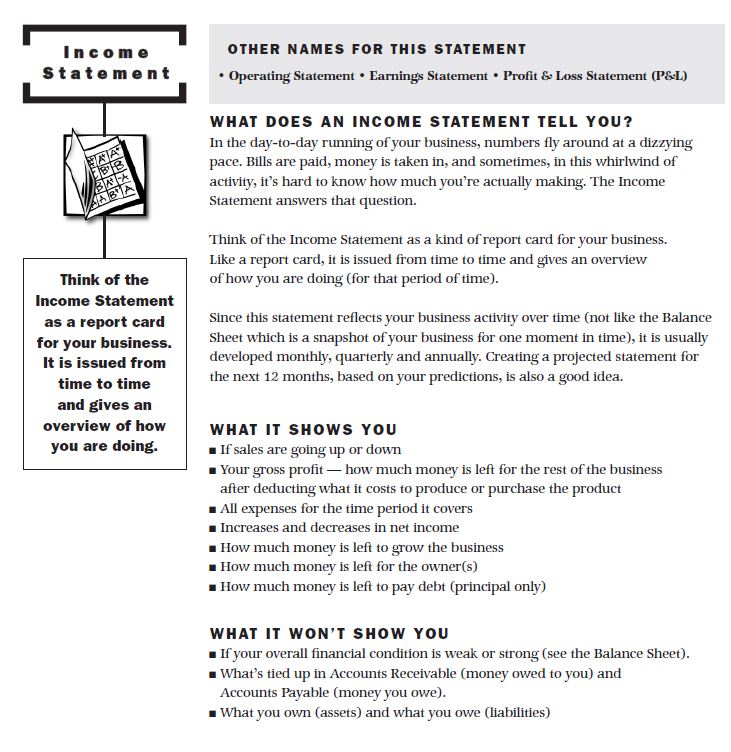

✔️Financials

Reading Financial statements in the easy part. Interpreting them to figure out if the long-term story of the business is tracking along and improving is the harder part. Learn how to do this.

Reading Financial statements in the easy part. Interpreting them to figure out if the long-term story of the business is tracking along and improving is the harder part. Learn how to do this.

It's also important to know the few important/specific Business drivers that are not necessarily reported in Financial statements (User/Engagement growth, Retention, ARPU, Take Rates...), check on how they are trending and the reasons.

✔️Valuation

Of course it's important but it's also a hugely subjective based on the Investor's strategy, risk tolerance, time horizon and research/conviction levels.

Of course it's important but it's also a hugely subjective based on the Investor's strategy, risk tolerance, time horizon and research/conviction levels.

One person might not invest if there are no positive Earnings/cash flows....

Someone else might just use EV/S (on currently unprofitable Co's) and decide based on historical & Competitor ranges.

Some one else might use MktCap to (reasonable) TAM.

Someone else might just use EV/S (on currently unprofitable Co's) and decide based on historical & Competitor ranges.

Some one else might use MktCap to (reasonable) TAM.

A person with high level of understanding, conviction and long term thesis might be willing to pay up, while someone w/o those is not willing to touch until it falls a lot.

Your choice.

Your choice.

✔️Buying

When to buy is a also hugely personal decision, depending on capital availability, stock price movements and Portfolio objectives.

I usually like to buy 1/3rd after my initial research (unless the stock had a crazy run up recently).

When to buy is a also hugely personal decision, depending on capital availability, stock price movements and Portfolio objectives.

I usually like to buy 1/3rd after my initial research (unless the stock had a crazy run up recently).

Add it along the way as the Business executes or when Macro volatility provides nice opportunities.

I sometimes utterly fail at this (like buying MELI only once in 2014), but that's because there were always some other great Co's high on my Watchlist at very attractive prices.

I sometimes utterly fail at this (like buying MELI only once in 2014), but that's because there were always some other great Co's high on my Watchlist at very attractive prices.

I acknowledge that (for experienced investors) adding to your winners & concentrating (up to a limit) in ur highest conviction positions (when they've a lot more potential ahead) will produce superior longterm results. It's something I'm seriously putting an effort at improving.

✔️Holding, Maintenance

Provided that you're invested in good Business and they're executing as expected, the hardest part then is in holding for the ultra long-term.

Provided that you're invested in good Business and they're executing as expected, the hardest part then is in holding for the ultra long-term.

Everyday, there are countless distractions tempting you to sell - Macro sentiment, Competition fears, huge run-ups or meltdowns during Earnings season, Short attacks, Insider selling reports, Analyst Price targets, random articles or TV reports....

For every Business, you can find lot of excuses to sell BUT all you need are the few valid/strong reasons to hold for the long term, and using the latest & important facts to re-test your thesis/conviction and then holding long/strong if they align with the facts.

✔️Selling

Selling is also a very personal choice.

Did you make a mistake in analyzing the Company?

Did your thesis fail after investing?

Portfolio weight adjustments?

Valuation giving you excessive concerns?

Not selling at all as long as biz is growing?

Your choice.

Selling is also a very personal choice.

Did you make a mistake in analyzing the Company?

Did your thesis fail after investing?

Portfolio weight adjustments?

Valuation giving you excessive concerns?

Not selling at all as long as biz is growing?

Your choice.

Disc:

E-Commerce:

Holdings💼 $AMZN $BABA $MELI $SHOP $ETSY $W

Watchlist👀 $SE $CHWY $FTCH

Advertising :

Holdings💼 $GOOG $FB $TCEHY $TTD $ROKU $PINS

Watchlist👀 $SNAP

All the above is for informational purposes only, not advice. I'm not responsible for your actions/results.😀

E-Commerce:

Holdings💼 $AMZN $BABA $MELI $SHOP $ETSY $W

Watchlist👀 $SE $CHWY $FTCH

Advertising :

Holdings💼 $GOOG $FB $TCEHY $TTD $ROKU $PINS

Watchlist👀 $SNAP

All the above is for informational purposes only, not advice. I'm not responsible for your actions/results.😀

• • •

Missing some Tweet in this thread? You can try to

force a refresh