Thread on $ICLTF (TSXV: ICL, OTCBB: ICLTF), Itasca Capital soon to be renamed GreenFirst

drive.google.com/file/d/1XDC07O…

Thread could get long so I've linked to a PDF in case thats easier. I'll probably add to this thread over time.

Disclosure: I own a bunch

1/n

drive.google.com/file/d/1XDC07O…

Thread could get long so I've linked to a PDF in case thats easier. I'll probably add to this thread over time.

Disclosure: I own a bunch

1/n

TL:DR

ICL was a pile of cash run by @kcerminara . They bought a lumber mill in Canada out of bankruptcy. Price paid looks really attractive. Two secular changes making CA lumber mills look like decent assets. Two very legit outsiders wrote a $5m check to get involved...

2/n

ICL was a pile of cash run by @kcerminara . They bought a lumber mill in Canada out of bankruptcy. Price paid looks really attractive. Two secular changes making CA lumber mills look like decent assets. Two very legit outsiders wrote a $5m check to get involved...

2/n

... at the current price of the stock you're paying about $20 million for it, roughly the amount of the secured debt pre BK and 40c asset value. Current lumber prices = big $$$ once running. Estimated 0.17x revenue and 0.66x to 1.0x pre tax profit (depending on US duties)

3/n

3/n

Background

I came across ICL reading through Kyle C's public holdings. He is the chairman of ICL and controlled 49.99% of this prior to this mill purchase. ICL was a pile of cash which Kyle had invested in a (seemingly) complicated venture called 1347 Investors LLC...

4/n

I came across ICL reading through Kyle C's public holdings. He is the chairman of ICL and controlled 49.99% of this prior to this mill purchase. ICL was a pile of cash which Kyle had invested in a (seemingly) complicated venture called 1347 Investors LLC...

4/n

...which should not be confused with 1347 Property Insurance $PIH. Last fall the investment he made matured and ICL received $10m (USD) in cash and ~62,000 shares of Limbach $LMB.

Until 8 weeks ago that was all there was. No liabilities really. No operations.

5/n

Until 8 weeks ago that was all there was. No liabilities really. No operations.

5/n

Net he had about 45c / share (USD) in net cash and the public market was 30c-35c so I started buying figuring he'd either find something to do or liquidated. Luckily something good found him.

6/n

6/n

On 9/17 ICL announced two simultaneous transactions and hinted at a 3rd:

1) Bought Kenora Mill for $11.5m

2) New Primary investment of $5m from two guys who would join the BoD

3) Possible new $25m investment (not discussed in detail)

7/n

1) Bought Kenora Mill for $11.5m

2) New Primary investment of $5m from two guys who would join the BoD

3) Possible new $25m investment (not discussed in detail)

7/n

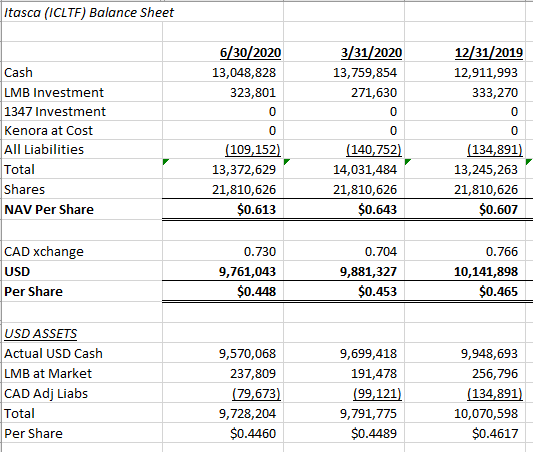

Here is a look at prior ICL:

Simple. Sorry in advance I was trained to put most recent financials on the left. It annoys some people. Nothing I can do.

8/n

Simple. Sorry in advance I was trained to put most recent financials on the left. It annoys some people. Nothing I can do.

8/n

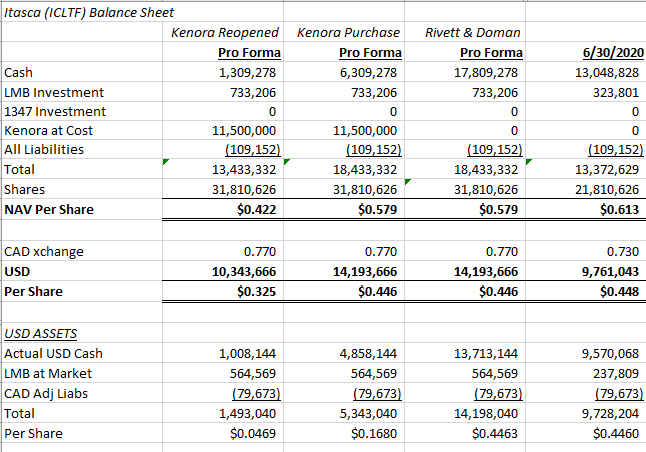

The cash and LMB investments were all in USD. Then the announcement of the purchase and investment. The investment is structured in 2 parts

1) $1m of units, each of which has 1 share of common at 50c and 1 warrant (60c strike)

2) $4m of 2 yr converts, yld 4%

9/n

1) $1m of units, each of which has 1 share of common at 50c and 1 warrant (60c strike)

2) $4m of 2 yr converts, yld 4%

9/n

The converts will convert to units in 2 years (same terms as the other) if they get a $25m investment. Unclear to me if they convert without the investment (or just straight debt).

I assume they do convert in my cap table, and do not count the $320k in interest...

10/n

I assume they do convert in my cap table, and do not count the $320k in interest...

10/n

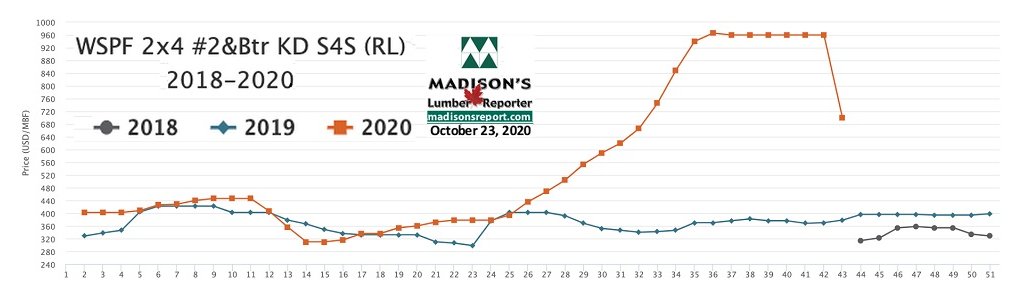

...because i'm lazy. Also, I assume it will cost $5m to get the plant up and running (I do not think its a coincidence that was the amount raised). Hope to find out soon if thats right. Here is the updated cap table (3 steps):

11/n

11/n

Pretty simple stuff. Cash updated for the new CAD rate (77c vs 74c) and the new LMB price. Added $5m from Doman / Rivett and and took out $11.5m for the purchase and another $5m for startup costs.

12/n

12/n

Kenora Saw Mill

The mill is located in a town 2 hours east of Winnipeg (7 hours north of Minneapolis) called Kenora, right on the water at Lake of the Woods.

The mill was acquired in 1994 by Prendiville Industries and operated for 14 years at full capacity.

13/n

The mill is located in a town 2 hours east of Winnipeg (7 hours north of Minneapolis) called Kenora, right on the water at Lake of the Woods.

The mill was acquired in 1994 by Prendiville Industries and operated for 14 years at full capacity.

13/n

In the crash of '08 the mill was shut only to reopen in 2015 with $22m of fresh equipment.

Shortly after that, bad luck came in three waves

First, in 2017 Trump doubled the duties on CA softwood lumber (from 10-20%). Ouch.

14/n

Shortly after that, bad luck came in three waves

First, in 2017 Trump doubled the duties on CA softwood lumber (from 10-20%). Ouch.

14/n

The mill survived hoping for better prices, which came in 2018.

Then, the second wave. Just as prices were firming the mill experienced a fire and lost its kilns / had to pull production. $4m later they had new kilns but missed the opp to sell lumber at high prices

15/n

Then, the second wave. Just as prices were firming the mill experienced a fire and lost its kilns / had to pull production. $4m later they had new kilns but missed the opp to sell lumber at high prices

15/n

In 2019 lumber prices fell and losses mounted (down $5.6m in 2018 in a year where they should have been solidly profitable and another $7m+ in 2019 on higher duties and lower prices). By Sept they shut the mill and by Dec they filed BK

16/n

16/n

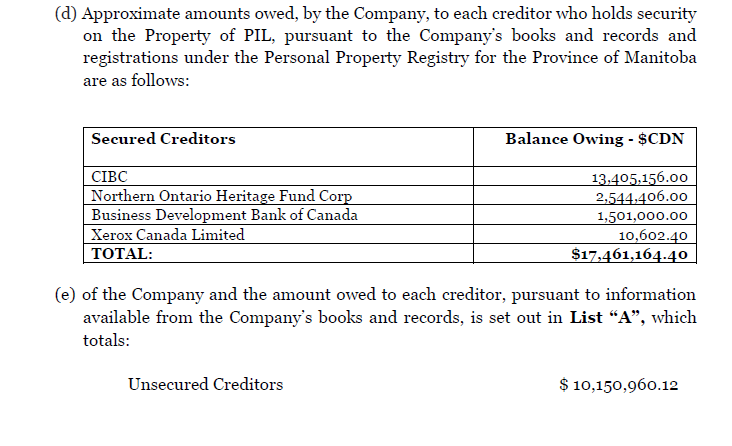

At they time they believed they could sell the mill by the Spring (of 2020) and get lenders their money back ($17m secured, $28m total).

Then, the third wave, Covid hits. Nothing happens. Bad luck.

As of this summer they listed $17.5m in secured debt and $28m total

17/n

Then, the third wave, Covid hits. Nothing happens. Bad luck.

As of this summer they listed $17.5m in secured debt and $28m total

17/n

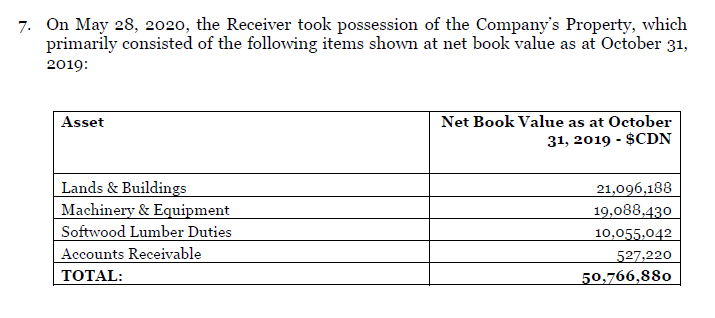

Here is a simple table showing various values listed through this process and what the implied per share price is on the common including the new investment:

19/n

19/n

Current price on the TSX was 66c which implied 51c USD (though the OTC is showing 46c). Basically the market is giving them credit for what they have in the mill and nothing more.

20/n

20/n

How did this come together?

I assume it was brought to them by Paul Rivett and Rick Doman, the two guys who wrote checks and jumped on the BoD. Don't know for sure but it seems to fit. So who are they?

Rivett retired from Fairfax Financial $FRFHF this February...

21/n

I assume it was brought to them by Paul Rivett and Rick Doman, the two guys who wrote checks and jumped on the BoD. Don't know for sure but it seems to fit. So who are they?

Rivett retired from Fairfax Financial $FRFHF this February...

21/n

... where he worked for 17 years most recently as President. Prem Watsa describes him as "instrumental in our success", not a horrible endorsement. I think he was on the BoD of Resolute Forest Products for a while.

Doman ran Doman Industries until 2004 when it...

22/n

Doman ran Doman Industries until 2004 when it...

22/n

...sold to Western Forest Products. He's now the CEO of EACOM Timber (TSXV: ETR) which just bought Domtar's Forest Products biz in March for $110m+.

Its fair to say they know the Canadian lumber business. And its fair to say they like this deal given the $5m investment.

23/n

Its fair to say they know the Canadian lumber business. And its fair to say they like this deal given the $5m investment.

23/n

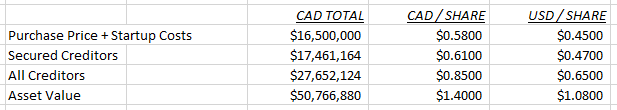

Why should you be excited?

There are reasons to be optimistic. Demand for lumber has improved during Covid for various reasons which has caused prices to rise. Here is a look at prices over the last few years:

24/n

There are reasons to be optimistic. Demand for lumber has improved during Covid for various reasons which has caused prices to rise. Here is a look at prices over the last few years:

24/n

Pricing for lumber is driven by housing demand in the US. I personally like the re-suburbinization thesis. Maybe its because I'm out in my garage building shelves all day. If demand for SF continues to rise, and remodeling continues, demand for lumber will rise.

25/n

25/n

Thats a good thing for prices clearly. There is also an environment angle to lumber - evergreen obviously but also lighter so less fossil fuel burned to ship. ESG!

In addition, back in Feb Trump lowered duties by as much as half (set to be confirmed this month)

26/n

In addition, back in Feb Trump lowered duties by as much as half (set to be confirmed this month)

26/n

Additionally analysts think that Biden will be better for CAD resource exports including lumber (link below). TBD. Hard to imagine trade negotiations being much worse.

Higher prices plus lower duties are positive.

biv.com/article/2020/1…

Higher prices plus lower duties are positive.

biv.com/article/2020/1…

Wait, so what are the numbers?

I have the EV at about $19.6m CAD today:

Thats a little bit more than the secured debt and around 40c on the estimated asset value from 2019.

28/n

I have the EV at about $19.6m CAD today:

Thats a little bit more than the secured debt and around 40c on the estimated asset value from 2019.

28/n

Another way to think about it: you're paying $20m for 150m of production. Thats about $131 per thousand bf. CME is listing lumber futures at $585 (USD) which is $760 CAD. You're getting production at 0.17x revenue.

We don't know the cost of production yet...

29/n

We don't know the cost of production yet...

29/n

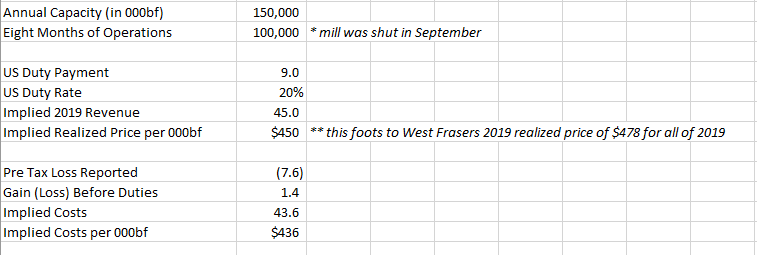

...but we can guess at what it was in 2019 based on public disclosures.

Mill was open for 8 months, they lost $7.6m and paid $9m in duties at 20%. Implies $450 realized price per 000bf. Generated $1.4m of pre tax profit pre duties, implying costs of $436 per 000bf.

30/n

Mill was open for 8 months, they lost $7.6m and paid $9m in duties at 20%. Implies $450 realized price per 000bf. Generated $1.4m of pre tax profit pre duties, implying costs of $436 per 000bf.

30/n

Lets use a round number and say it costs $450 to produce a thousand board foot. At the current price of $760 they make about $300 per a 000bf you paid $131 for (0.33x pre tax profit).

At full capacity thats $45m of pre tax profit. You're paying less than $20m for it.

31/n

At full capacity thats $45m of pre tax profit. You're paying less than $20m for it.

31/n

Obvious question is "what will duties be"? I have no idea, but:

The "Trump 20" takes $150 per 000bf = $22m pre tax

The "Prior 10" takes it down by $75 = $34m

The "Biden Bump" is unknown. Maybe he'll pay us to ship lumber to the US. One can dream.

32/n

The "Trump 20" takes $150 per 000bf = $22m pre tax

The "Prior 10" takes it down by $75 = $34m

The "Biden Bump" is unknown. Maybe he'll pay us to ship lumber to the US. One can dream.

32/n

In any case you're paying $20m for that. At current lumber prices if they get the mill up and running this asset is a steal. If duties drop they will print money.

33/n

33/n

More work to do here

Early days clearly. Prices are a huge factor obvious as are duties. I can't predict either. Also some CAD exposure to note.

Timing is unclear as is the cost to start up and the cost of production.

We know its a good price, but we're waiting for detail

Early days clearly. Prices are a huge factor obvious as are duties. I can't predict either. Also some CAD exposure to note.

Timing is unclear as is the cost to start up and the cost of production.

We know its a good price, but we're waiting for detail

I'll keep updating this thread as things the develop. The deal is done now so I expect we'll hear more from management in the coming days / weeks.

Questions / thoughts? Just LMK

35/n

Questions / thoughts? Just LMK

35/n

Link to the deck they just filed on their website. Main thing, this confirms the startup costs at $4.5m (I figured $5m) and gives some comparative valuation information as well as bios for Rivett and Doman

gffp.ca/wp-content/upl…

gffp.ca/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh