Take the time to read this 1886 Economist piece. Trust me. (Seriously)

An all time favorite historical source I like to re-read.

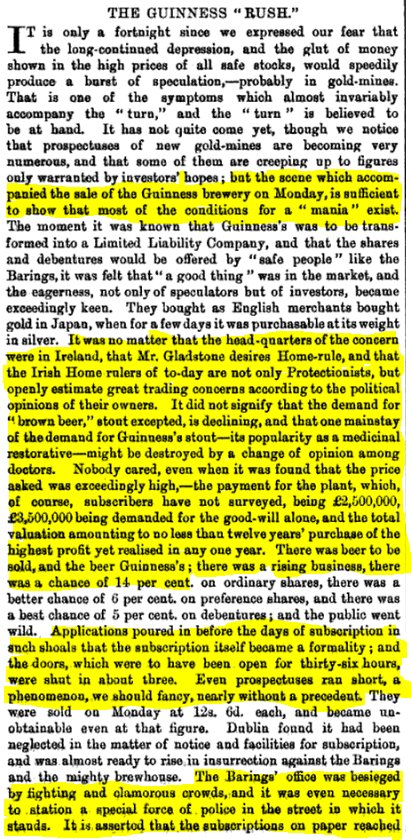

Excellent insight into human nature via a description of the Guinness IPO in 1886, and investor mania.

Gem.

An all time favorite historical source I like to re-read.

Excellent insight into human nature via a description of the Guinness IPO in 1886, and investor mania.

Gem.

This writing...

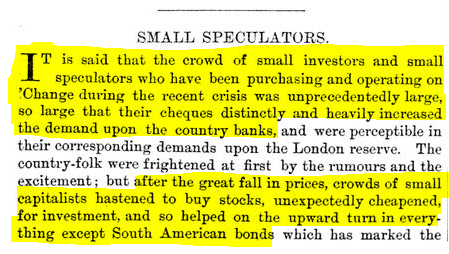

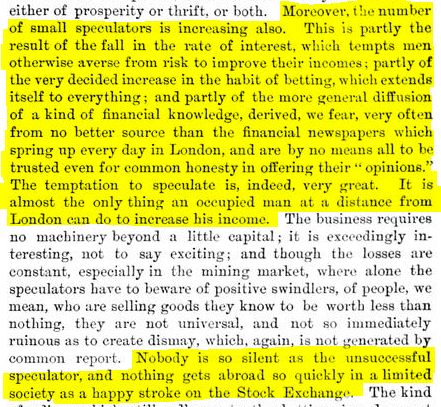

"It was doo delightful; it was betting on a certainty, or subscribing to a lottery in which all the tickets were prizes...

The world which desires money, quickly and easily made - and that world is the largest of all - was stirred to its foundations."

"It was doo delightful; it was betting on a certainty, or subscribing to a lottery in which all the tickets were prizes...

The world which desires money, quickly and easily made - and that world is the largest of all - was stirred to its foundations."

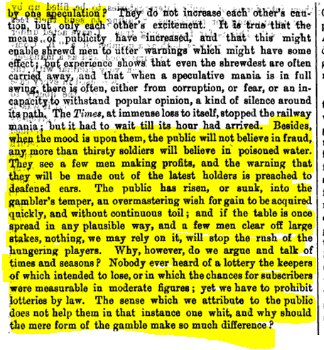

"Experience of one generation seldom teaches another... not one business-man in three in the City of London could write out an outline history of the last [mania].

Experience will not prevent speculative manias any more than it will prevent ambitious wars..."

Experience will not prevent speculative manias any more than it will prevent ambitious wars..."

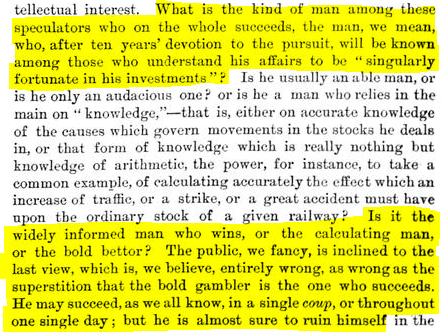

"When the mood is upon them, the public will not believe in fraud, any more than thirsty soldiers will believe in poisoned water.

They see a few men making profits, and the warning that they will be made out of the latest holders is preached to deafened ears."

Cc: @WallStCynic

They see a few men making profits, and the warning that they will be made out of the latest holders is preached to deafened ears."

Cc: @WallStCynic

Can't wait to share @ProfJohnTurner 's lecture on Guinness and the 19th Century Brewery Mania for my online financial history course.

Stay up to date on the course and when it launches by subscribing below:

mailchi.mp/investoramnesi…

Stay up to date on the course and when it launches by subscribing below:

mailchi.mp/investoramnesi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh