Today, we are launching a new effort, SC Emerging Managers, for people who want to become investors.

We want smart learners especially from diverse, nontraditional backgrounds.

We will give you money, training and a community around you to become successful.

Learn more...

We want smart learners especially from diverse, nontraditional backgrounds.

We will give you money, training and a community around you to become successful.

Learn more...

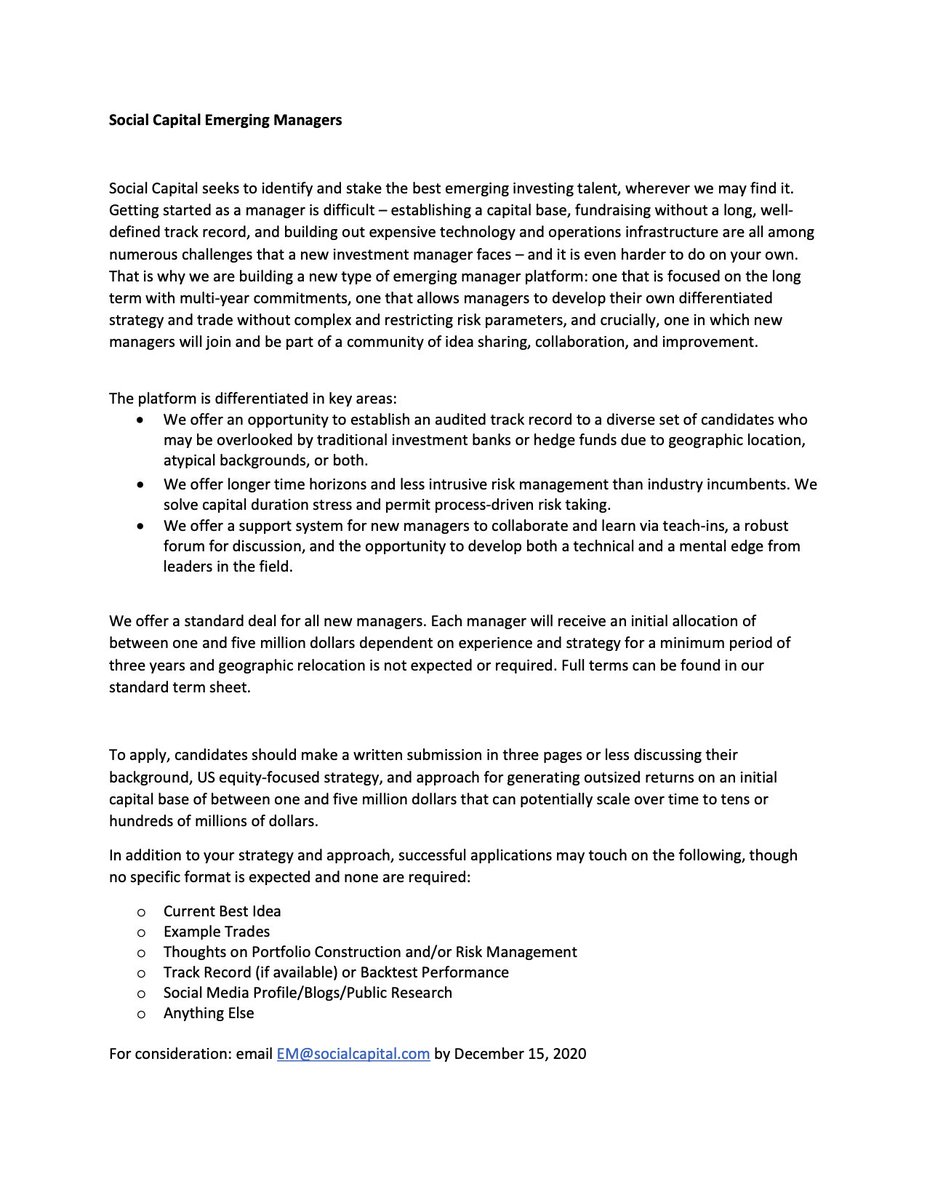

One of the hardest problems for new investors is getting started – how to establish a capital base without a track record, how to build out all the expensive infrastructure that’s required at scale, and how to pay the rent when you aren’t initially drawing fees.

Beyond the practical challenges, it’s even more difficult doing this on your own. Having a sounding board for new ideas, support in down markets, and mastering the mental side of investing are all crucial – and dramatically more difficult by yourself.

Social Capital is relentlessly bullish on talented people willing to back themselves, which is why we are building a new kind of platform to identify and stake the best emerging investors, wherever they are.

We are seeking new investors, of all backgrounds, who believe they can develop differentiated strategies to generate outsized returns on an initial capital base of millions of dollars, which can scale much larger over time to tens and hundreds of millions.

We will initially focus on US Public Equities but over time will expand our Emerging Managers program to include:

1. Worldwide Public Equities

2. Crypto

3. Venture Capital / Private Equity

4. Trading Cards

5. Art

6. Lending/Debt

7. Other (Shoes, Wine, Real Estate)

1. Worldwide Public Equities

2. Crypto

3. Venture Capital / Private Equity

4. Trading Cards

5. Art

6. Lending/Debt

7. Other (Shoes, Wine, Real Estate)

If selected you will come work with me and my partners, as part of Social Capital for a minimum of three years, and join a community of other investors to collaborate, share knowledge and expertise, help one another, and grow together.

If this is you, discuss your background, strategy, and approach to generating outsized returns trading US equities (fundamental, momentum, quant etc) in three pages or less by December 15th to em@socialcapital.com

A successful application could touch on best ideas, example trades or theses, backtests of ideas, thoughts on portfolio construction and risk management, or analysis you’ve done publicly or on social media, though no specific template is necessary or required. Pitch us.

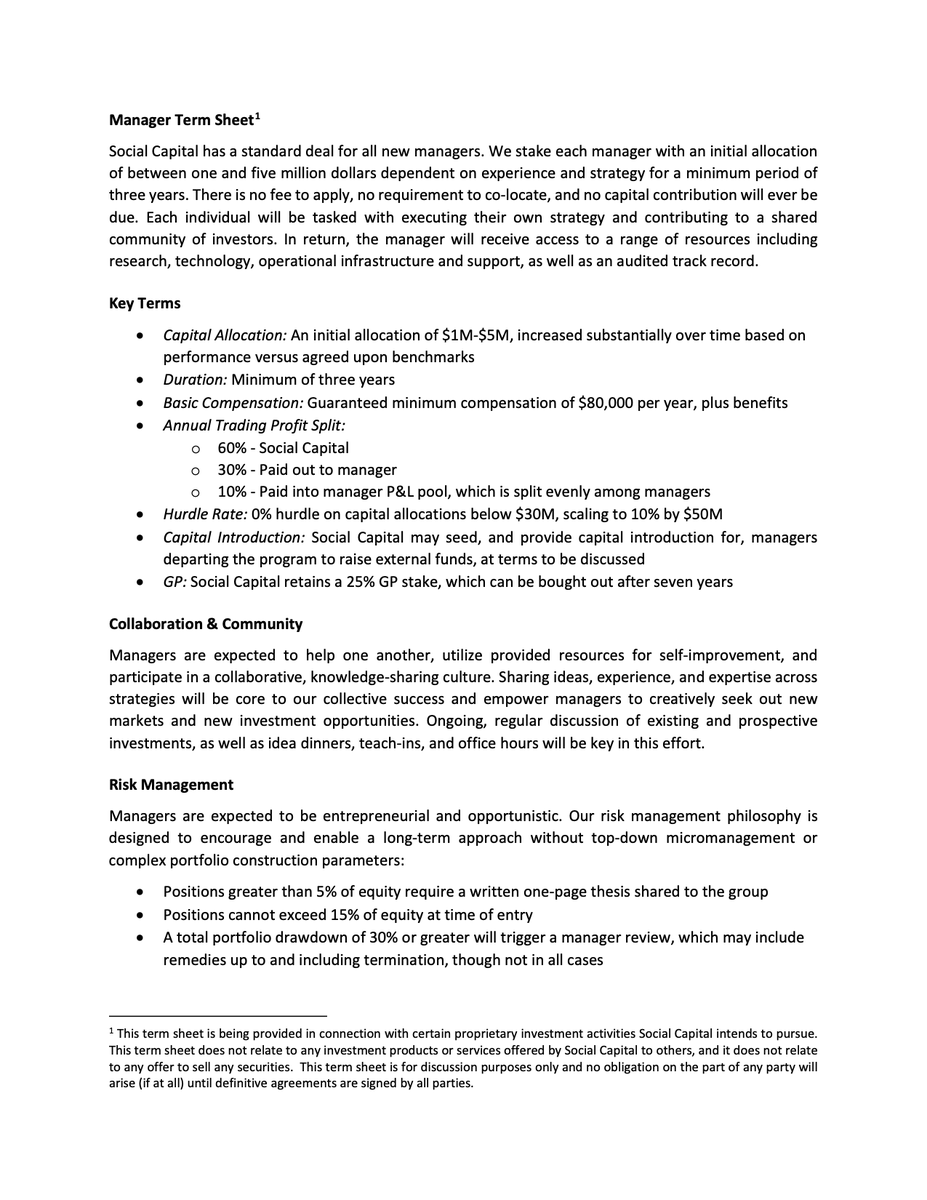

Our standard deal for managers and the formal announcement letter are attached. We will pick ten managers to be among the first cohort and begin trading in Q1 2021. Good luck!

• • •

Missing some Tweet in this thread? You can try to

force a refresh