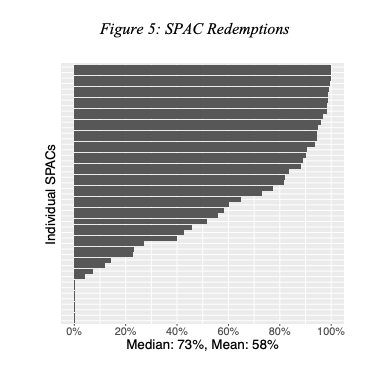

The median proceeds of a SPAC IPO are roughly $220 million, but at the median, 73% of those proceeds are returned to shareholders in redemptions

2/

2/

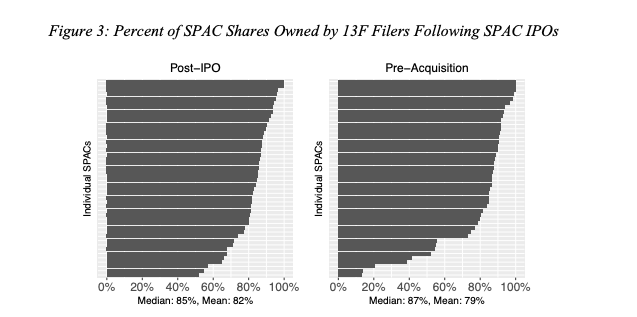

SPAC IPOs are dominated by a group of hedge funds known colloquially as the “SPAC Mafia”

3/

3/

the description of SPACs as “poor man’s private equity” is off the mark. Some retail investors may own shares prior to a merger announcement and then hold shares in the post-merger company, but the figures contradict a description of SPACs as instruments of financial democracy

4/

4/

SPAC Mafia members, defined as we have, account for roughly 70% of total post-IPO shareholdings. The top five SPAC Mafia funds held 15% of total 2019-20 post-IPO shares

5/

5/

the mean and median redemption rates among our 2019-20 Merger Cohort are 58% and 73%, respectively. A quarter of those SPACs saw redemptions over 95%

6/

6/

To replace cash lost to redemptions, 77% of SPACs raised additional money at the time of their mergers from a combination of sources. Of the SPACs that raised additional money, 83% raised money from third-party investors, 61% raised money from the sponsor

7/

7/

SPAC arbitrageurs as liquidity providers:

The primary role that investors in a SPAC’s IPO play is to get the SPAC up and running, and ready to bring a private company public in a later merger for which new equity is

raised. IPO shareholders are well compensated for this role

8/

The primary role that investors in a SPAC’s IPO play is to get the SPAC up and running, and ready to bring a private company public in a later merger for which new equity is

raised. IPO shareholders are well compensated for this role

8/

On the attractiveness of SPAC arbitrage as an investment strategy:

Among the 2019-20 Merger Cohort, the mean annualized return for IPO investors that redeemed their shares was 11.6% – for a risk-free investment

9/

Among the 2019-20 Merger Cohort, the mean annualized return for IPO investors that redeemed their shares was 11.6% – for a risk-free investment

9/

Alpha that SPAC arbs earn come from others:

This is the flip side of the 11.6% return that the pre-merger shareholders earn. The high return to redeeming investors does not come from any magic in the SPAC structure; it comes at the expenses of non-redeeming investors.

10/

This is the flip side of the 11.6% return that the pre-merger shareholders earn. The high return to redeeming investors does not come from any magic in the SPAC structure; it comes at the expenses of non-redeeming investors.

10/

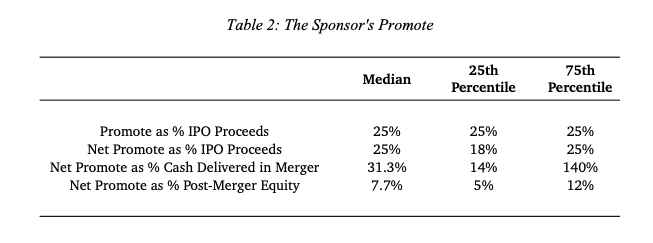

The median net promote as a fraction of a SPAC’s pre-merger equity is 31.3%. The 75th percentile for the sponsor’s net promote is above 100%--meaning the sponsor’s essentially free shares outnumber post-redemption public shares plus shares purchased in PIPEs

11/

11/

Redemptions lead to elevated underwriting fees:

The median underwriting fee as a percentage of cash delivered to the target company is 7.2%, with 25th and 75th quantiles of 4% and 34% respectively.

12/

The median underwriting fee as a percentage of cash delivered to the target company is 7.2%, with 25th and 75th quantiles of 4% and 34% respectively.

12/

SPAC warrants are a large portion of arbitrage returns

redeeming shareholders earned annualized returns of 11.6%. That return is primarily attributable to the warrants they retain

13/

redeeming shareholders earned annualized returns of 11.6%. That return is primarily attributable to the warrants they retain

13/

Not all post-SPAC equities are losers:

Of course, as is true of the promote and the underwriting fee, it is possible that the combination of the SPAC, the target and the sponsor’s ongoing engagement will produce enough value to compensate for the SPAC’s dilution costs

14/

Of course, as is true of the promote and the underwriting fee, it is possible that the combination of the SPAC, the target and the sponsor’s ongoing engagement will produce enough value to compensate for the SPAC’s dilution costs

14/

SPACs with high-quality sponsors could produce greater post-merger returns for their shareholders in two ways. First, their SPACs may not be as dilutive as SPACs sponsored by others... Second, high-quality sponsors may be able to add value to a post-merger company

15/

15/

• • •

Missing some Tweet in this thread? You can try to

force a refresh