A student debt forgiveness executive order is a good idea, because the senate is basically guaranteed to not do enough fiscal stimulus. The marginal dollar of relief money would be better spent elsewhere, but an executive order wouldn’t come at the expense other priorities

I dont think student debt forgiveness is progressive on the whole (though the poorer people it does help will be helped a lot), but it’s probably a much more effective form of trickle down than tax cuts. We should be pumping money into the economy however we can

https://twitter.com/xtrexer/status/1125564392324468737

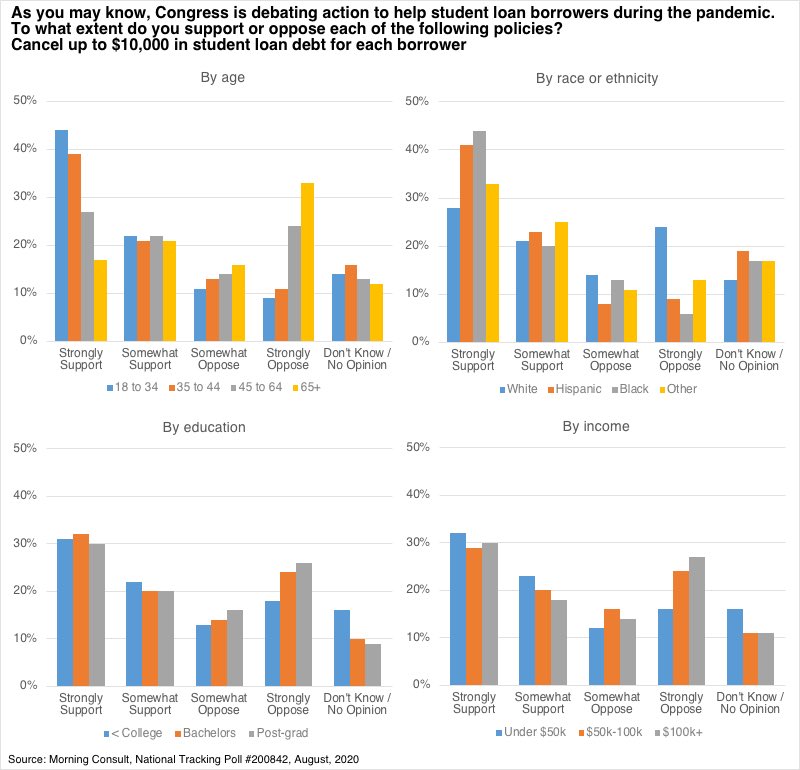

I do worry a bit about the potential for political backlash, giving rising educational polarization. Debt forgiveness is one area where I have no problem with means testing if it’s administratively feasible - could avoid viral stories about giving forgiveness to super rich people

It’s also worth noting that non-college grads are the most supportive of some debt forgiveness right now. That very well may change if conservative media hammers the issue, but at this point it seems fine

assets.morningconsult.com/wp-uploads/202…

assets.morningconsult.com/wp-uploads/202…

• • •

Missing some Tweet in this thread? You can try to

force a refresh