1) Last week was obviously a huge rotation towards reopening & travel names on the Pfizer news.

Reopening and travel baskets were up +12%ish vs. Megacap Tech, Software and Stay at Home baskets down -2 to -6%. Insane moves in the Momentum factor.

Moderna news likely next week.

Reopening and travel baskets were up +12%ish vs. Megacap Tech, Software and Stay at Home baskets down -2 to -6%. Insane moves in the Momentum factor.

Moderna news likely next week.

2) Curious to see how the market trades on the Moderna readout and likely Regeneron approval given Covid third wave, increasing lockdowns and credit card data rolling over hard.

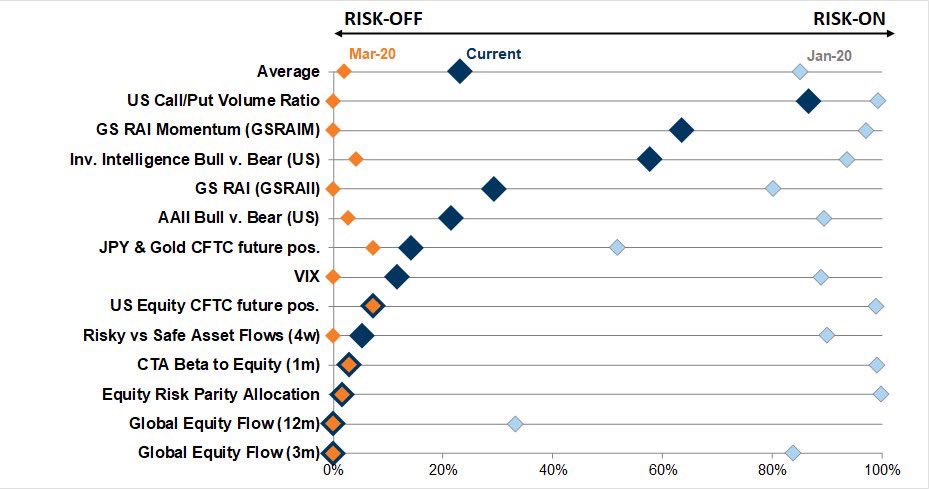

Setup and positioning are quite different now vs. going into the Pfizer news.

Setup and positioning are quite different now vs. going into the Pfizer news.

3) Tech and WFH names were strong the day of the election and were especially strong the Wednesday immediately after Biden won.

4) These dynamics began to shift on the Thursday after the election (11/5), but the market was still offsides for Pfizer’s vaccine news.

As indicated by some highly skeptical quote tweets of the below tweet. 😀

As indicated by some highly skeptical quote tweets of the below tweet. 😀

https://twitter.com/GavinSBaker/status/1324392046665359360

5) As an aside: While I try to appreciate all of my detractors here on FinTwit equally, I do have some particular favorites.

Happy to have some *very* reliable quote/sub tweeting detractors who are genuinely funny. More GIFs and JPEGs pls.

Happy to have some *very* reliable quote/sub tweeting detractors who are genuinely funny. More GIFs and JPEGs pls.

6) Back on topic, people are *slightly* more on sides for an inevitable reopening after last week, but still a lot of skepticism over the Pfizer vaccine around temperature, production, logistics.

7) All these concerns are misplaced.

There is going to be tidal wave of positive news on various vaccines that are easier to distribute over the next few weeks and months.

There is going to be tidal wave of positive news on various vaccines that are easier to distribute over the next few weeks and months.

8) Therapeutic approvals even more important in near term. Lilly data is impressive and Regeneron will likely be better.

The statistics below show that when given at the time of Covid diagnosis, the Lilly combo cuts risk of hospitalization amongst all patients from 5.9% to 0.9%.

The statistics below show that when given at the time of Covid diagnosis, the Lilly combo cuts risk of hospitalization amongst all patients from 5.9% to 0.9%.

9) Improvement is more dramatic in high risk (age or BMI) patients.

Eliminating the fear of death via therapeutics like this should be transformational for consumer behavior.

Eliminating the fear of death via therapeutics like this should be transformational for consumer behavior.

10) And I suspect most companies have been in risk production of vaccines and therapeutics for months now so supply of all of them likely surprises to the upside.

11) So lots to be optimistic about on vaccines and therapeutics, but they are 4-8 weeks out best case.

In the interim we have an exponential curve to new Covid cases *before* Thanksgiving likely makes it worse and the economy is rolling over per credit card data.

In the interim we have an exponential curve to new Covid cases *before* Thanksgiving likely makes it worse and the economy is rolling over per credit card data.

12) Net, net the reaction to the Moderna news whenever it comes will be telling.

Reopening and travel names are more expensive than pre-Pfizer and positioning is *slightly* more on sides for positive news.

Anyways, curious to see how the market trades on Moderna.

Feels tricky.

Reopening and travel names are more expensive than pre-Pfizer and positioning is *slightly* more on sides for positive news.

Anyways, curious to see how the market trades on Moderna.

Feels tricky.

• • •

Missing some Tweet in this thread? You can try to

force a refresh