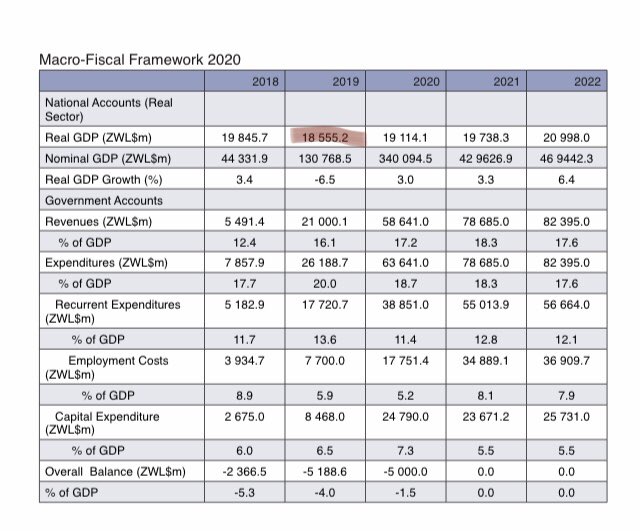

National Development strategy document reveals quite a lot. I will raise technical questions so the minister can answer. The Minister is a math whiz kid, yet a whole document is laden with arithmetic problems. Forget the 1000’s of words. Focus here

1. Treasury cannot change numbers randomly . The 2019 GDP according to Treasury was $18.5bn while the NDS has 2020 at $13.1bn using the official exchange rate. That’s a 30% decline in GDP. And not 4%.

2. The NDS assumes a population of 11.3m in 2020. This is less than the last census, & way less than the current 15/16m.

Most curious is the 58.8% jump in GNI per capita to 1842.2 from 1159.8 yet real GDP is supposed to rise by just 7%. Does it mean the population will half?

Most curious is the 58.8% jump in GNI per capita to 1842.2 from 1159.8 yet real GDP is supposed to rise by just 7%. Does it mean the population will half?

3. An average compounded growth of 5% p.a on real GDP of 13bn in 5 years or 10years for that matter with current population means per capita will be less than $1k. The 2025 numbers are not feasible under treasury own numbers.

4. The NDS avoids going into details with what Public Finance calls Gross Fixed Capital Formation (GFCF). This is the amount of capital required to achieve any proposed growth. Without capital injection growth won’t happen.

5. The NDS is not entirely sure of the external debt to GDP ratio.

Ps the $8.1bn does not include $5bn debt held with RBZ & $3.5bn farmer compensation and other parastatals.

Very clear debt trap.

Ps the $8.1bn does not include $5bn debt held with RBZ & $3.5bn farmer compensation and other parastatals.

Very clear debt trap.

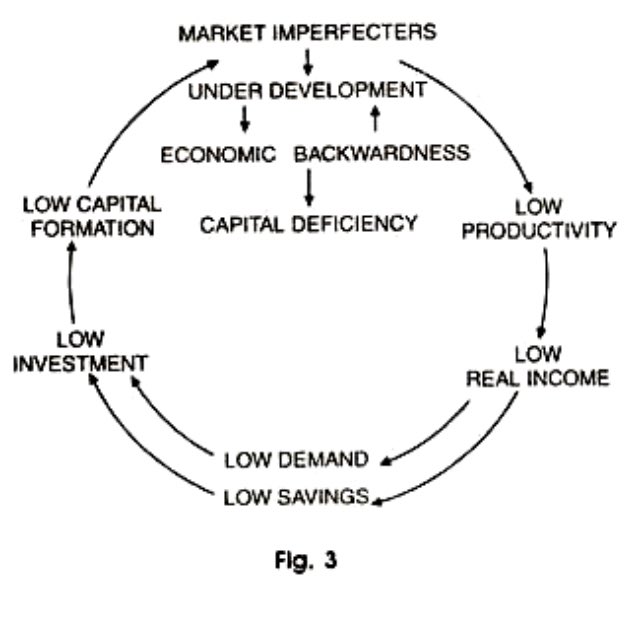

6. Zimbabwe can be classified as being in a vicious cycle of poverty. It has all the signs

(1) Low incomes

(2) Low productivity

(3)Low Savings

(4) Low Demand

(5) Low capital formation

Any strategy document must address these

(1) Low incomes

(2) Low productivity

(3)Low Savings

(4) Low Demand

(5) Low capital formation

Any strategy document must address these

7.A farmer who stopped producing can’t argue next year will be a better year since he will be coming from a low base.

It is probable he is on a low base for lack of capital. Until he solves the capital problem the low base will get lower

It is probable he is on a low base for lack of capital. Until he solves the capital problem the low base will get lower

• • •

Missing some Tweet in this thread? You can try to

force a refresh