Robert Smith’s issues go well beyond tax fraud.

His private equity firm, Vista Equity Partners, has been accused of defrauding investors and mismarking assets, and he has close ties to a man raided by the FBI in 2019.

Let’s dive into what the media is missing.

<thread>

His private equity firm, Vista Equity Partners, has been accused of defrauding investors and mismarking assets, and he has close ties to a man raided by the FBI in 2019.

Let’s dive into what the media is missing.

<thread>

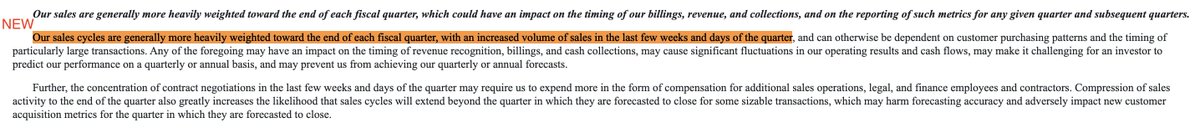

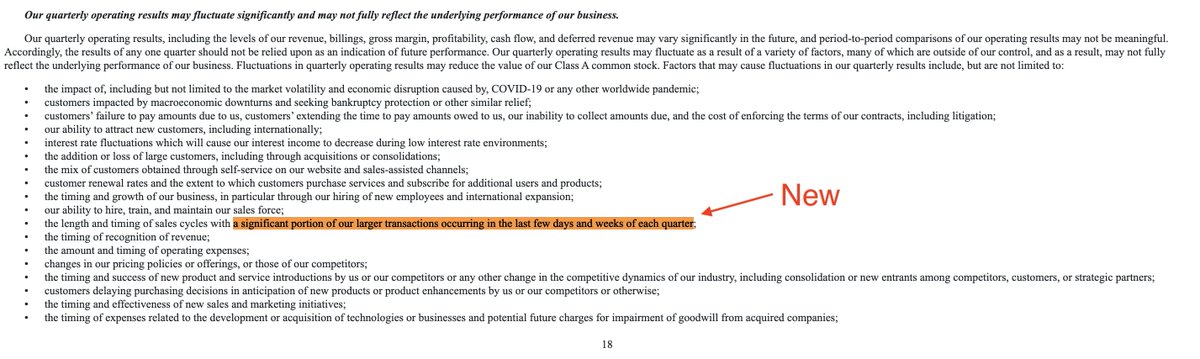

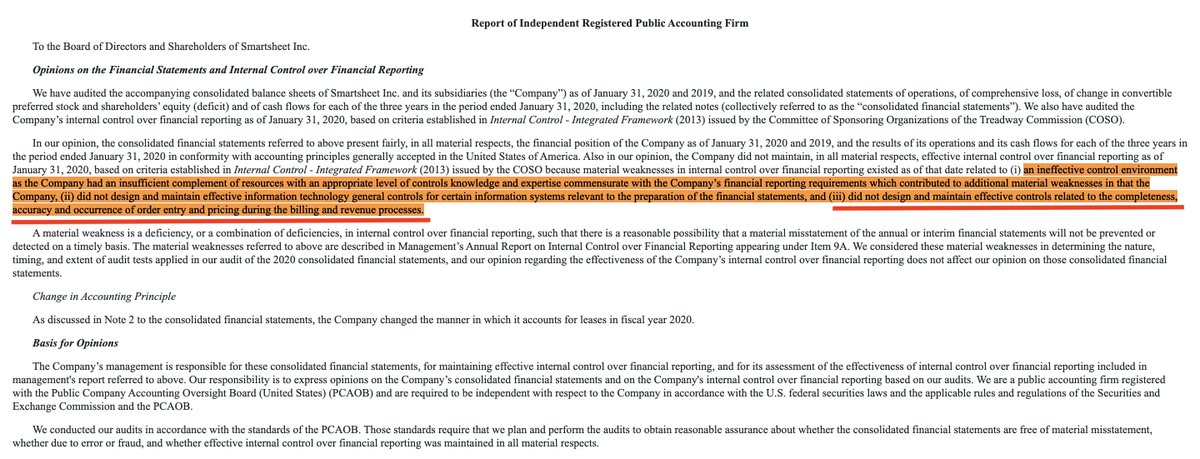

In lawsuits, Vista has been accused of egregiously mismarking assets.

For example, in 2014 Vista invested in DealerSocket at a $387 valuation.

In June 2019 Vista marked up the investment to $499 million and just *two months* later marked the investment down 95% to $28 million.

For example, in 2014 Vista invested in DealerSocket at a $387 valuation.

In June 2019 Vista marked up the investment to $499 million and just *two months* later marked the investment down 95% to $28 million.

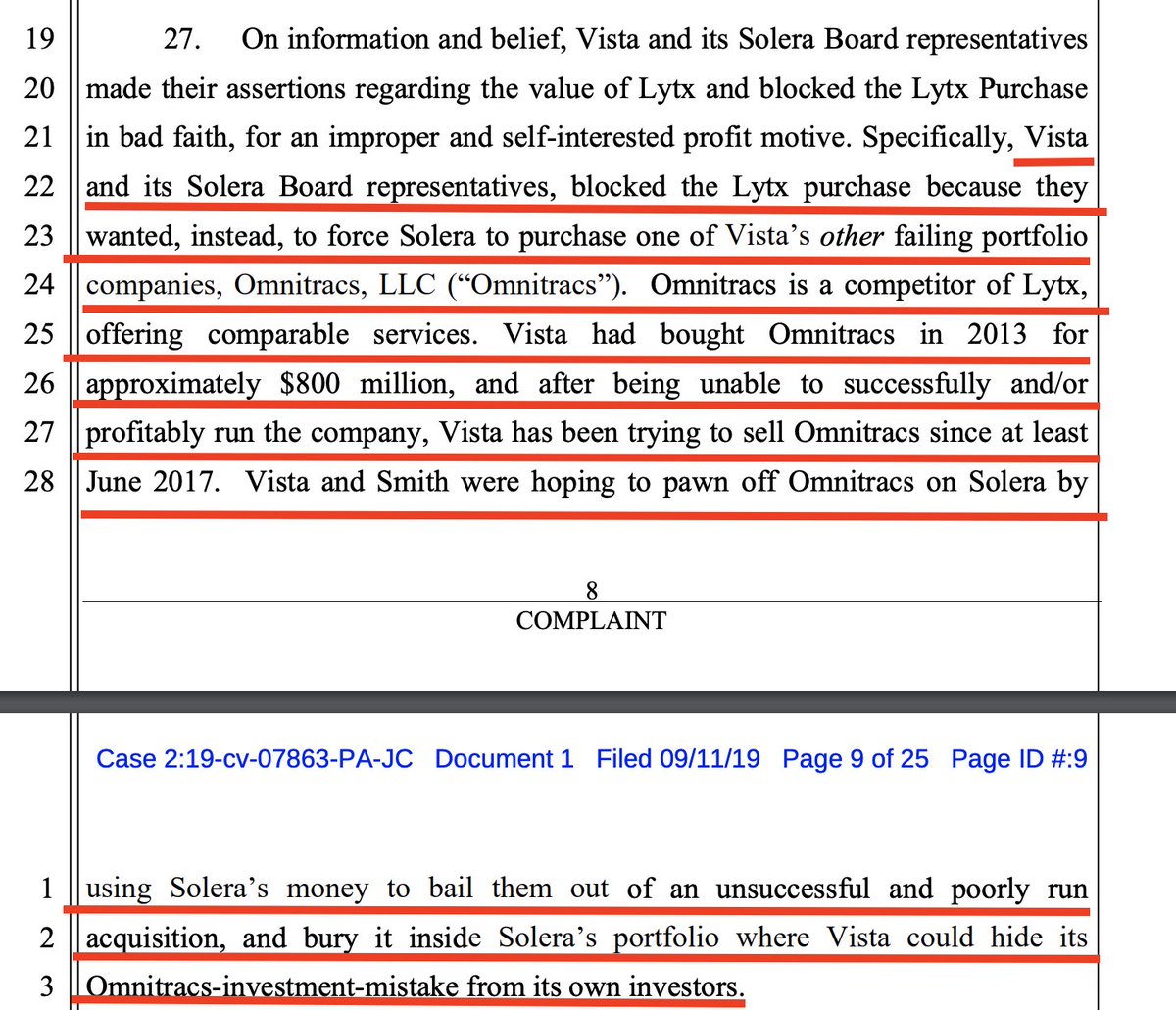

Vista has also been accused of trying to force healthy portfolio companies to buy failing ones.

A lawsuit by an independent director of Solera Holdings (52% owned by Vista) alleged Vista tried to force the acquisition of its struggling portfolio company called Omnitracs.

A lawsuit by an independent director of Solera Holdings (52% owned by Vista) alleged Vista tried to force the acquisition of its struggling portfolio company called Omnitracs.

When that failed Vista tried to force Solera, the healthy company, to buy DealerSocket.

After that acquisition fell apart Vista would go on to mark DealerSocket down 95%.

After that acquisition fell apart Vista would go on to mark DealerSocket down 95%.

One of the lawsuits against Vista alleged that Vista’s actions “appear designed to mislead current and future investors concerning Vista’s performance.”

In addition, the lawsuit alleged Robert Smith would retaliate against people who raised concerns about Vista’s practices.

In addition, the lawsuit alleged Robert Smith would retaliate against people who raised concerns about Vista’s practices.

The DoJ recently released a huge indictment against businessman Robert Brockman for tax evasion.

As part of the fraud, Vista took money from Brockman and shielded it from the IRS. Vista also invested money back into Brockman's company (creating a circular flow of cash).

As part of the fraud, Vista took money from Brockman and shielded it from the IRS. Vista also invested money back into Brockman's company (creating a circular flow of cash).

Robert Smith also has numerous ties to Nate Paul, a controversial Texas real estate developer who was raided by the FBI in 2019 and is currently facing bankruptcy.

In a 2017 Forbes profile, Smith praised Paul as a phenomenal investor and said “his returns have been spectacular.” The profile also mentioned that Smith “has invested tens of millions in five of Paul's deals.”

Below is a photo of them together.

Below is a photo of them together.

At least four Vista companies have rented office space from Nate Paul.

In 2014, two Vista companies, Omnitracs and Active Network, moved into 717 N. Harwood (Austin, Texas) just four months after Nate Paul bought the building.

In 2014, two Vista companies, Omnitracs and Active Network, moved into 717 N. Harwood (Austin, Texas) just four months after Nate Paul bought the building.

As part of the move Vista’s companies received $3.4 million from the Texas Enterprise Fund for relocating to Texas. In total, Vista has received over $17 million of taxpayer money from the program.

Texas taxpayers paid a billionaire to rent office space from his friend.

Texas taxpayers paid a billionaire to rent office space from his friend.

That building, 717 N. Harwood, was raided by the FBI in 2019.

In addition, Vista and Nate Paul both had office space in the Frost Bank Tower (401 Congress Avenue, Austin, TX).

That building was raided in 2019 too.

In addition, Vista and Nate Paul both had office space in the Frost Bank Tower (401 Congress Avenue, Austin, TX).

That building was raided in 2019 too.

Today the AP reported that the FBI is looking into the Texas Attorney General and his close ties to Nate Paul. Paul was a big donor and allegedly hired a woman who had an affair with the attorney general.

In sum, Vista has been accused of mismarking assets, Vista took illicit money from Robert Brockman and invested money into Brockman’s companies, and Robert Smith has close ties to a man affiliated with multiple FBI investigations.

None of this is slowing Robert Smith down. He spent $48 million on two Palm Beach mansions this month and is speaking at the NYT DealBook conference later today.

If you have any information you would like to share please DM or email me at edwin@585research.com

If you have any information you would like to share please DM or email me at edwin@585research.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh