Today was a massive mover in GEX readings across the board. Let's explore some in a thread:

1/ $SPY $QQQ $IWM $DIA

All indexes erased some of the most bullish dealer positioning of the year (as of yesterday) completely off the board and all are now negative or neutral! 🤯

1/ $SPY $QQQ $IWM $DIA

All indexes erased some of the most bullish dealer positioning of the year (as of yesterday) completely off the board and all are now negative or neutral! 🤯

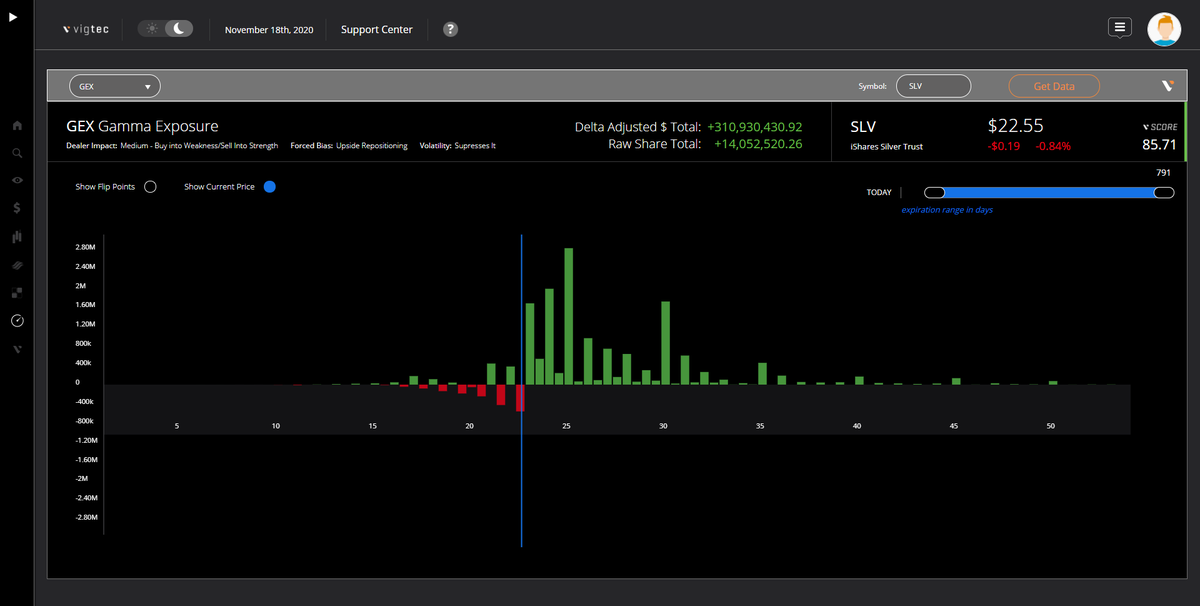

2/ $GDX $SLV $GLD

$GDX is in real trouble - GEX is very negative and selling into weakness will persist

$SLV is holding onto the positive reading by a thread here

$GLD is also holding onto the positive reading by a thread here

$GDX is in real trouble - GEX is very negative and selling into weakness will persist

$SLV is holding onto the positive reading by a thread here

$GLD is also holding onto the positive reading by a thread here

3/ $TLT

20 year bonds are on the rally - pretty close to busting up and over to a positive GEX and definitely neutral now

@hereforthefin

20 year bonds are on the rally - pretty close to busting up and over to a positive GEX and definitely neutral now

@hereforthefin

4/ $UUP

$USD bullish ETF is looking like $25.50 will turn it into a positive GEX situation and $26.50 is the major resistance (tallest bar)

$USD bullish ETF is looking like $25.50 will turn it into a positive GEX situation and $26.50 is the major resistance (tallest bar)

5/ $XLF $BKLN $LQD

$XLF - banks still holding positive but want to hold $26.50 and must hold $25.50 @hereforthefin @CryptikCo

$BKLN - Sr. Loans already negative @FadingRallies

$LQD - High yield looking very close to a flip point as well so worth watching.

$XLF - banks still holding positive but want to hold $26.50 and must hold $25.50 @hereforthefin @CryptikCo

$BKLN - Sr. Loans already negative @FadingRallies

$LQD - High yield looking very close to a flip point as well so worth watching.

Last but not least...

Advance Decline was all bearish pacman look today

Absolute Breadth showing volatility readings across the board.

Was this a correction or is there more to unfold in the coming day/weeks?

Stay tuned and grab our app!

@threadreaderapp unroll

Advance Decline was all bearish pacman look today

Absolute Breadth showing volatility readings across the board.

Was this a correction or is there more to unfold in the coming day/weeks?

Stay tuned and grab our app!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh