This week I talk about Ant's future from their product range. Ant is pushing into SaaS with their blockchain, database and collaboration offerings. 1/

For Chinese consumers, trust in the products they buy remains the biggest concern. Scars from the numerous food scandals, including the infamous infant milk powder scandal in 2008 have left Chinese consumers with low trust for domestic goods. 2/

How does Ant solve this? Blockchains.

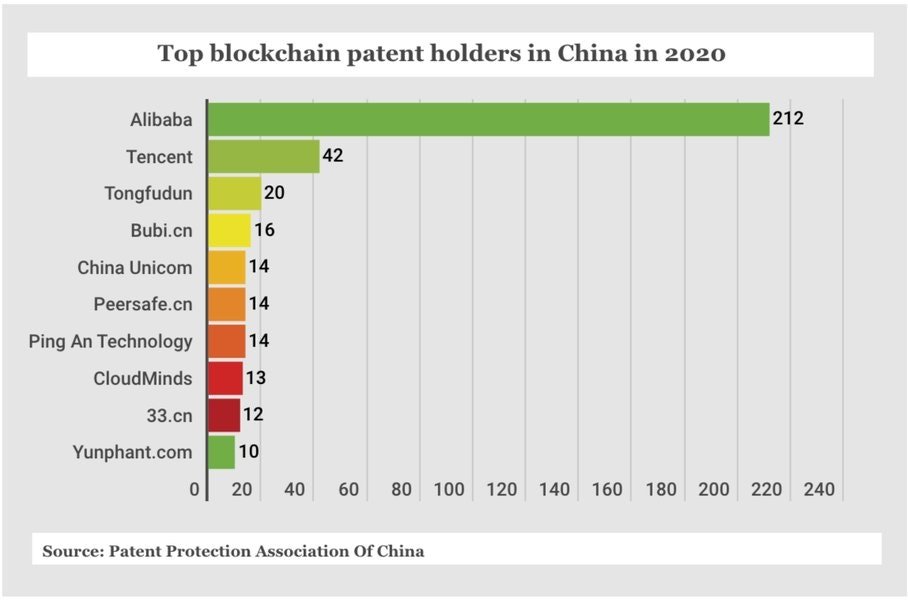

Ant has been working on blockchain technology since 2015 (Jack Ma made it very public that he was bullish on blockchain technology) and currently holds the most patents for blockchain in China. 3/

Ant has been working on blockchain technology since 2015 (Jack Ma made it very public that he was bullish on blockchain technology) and currently holds the most patents for blockchain in China. 3/

Since 2018, they have launched cross-border remittance services, Blockchain-as-a-Service (BaaS) open platform, AntChain (which is a more off-shelf BaaS offering), a blockchain-backed smart contract platform called Trusple and many others. 4/

Ant is positioning the solution as a general-purpose immutable system of records and asset management service for retailers, manufacturers, governments and researchers. 5/

Case study example: Glass crystal seller on Alibaba whose customers are predominantly abroad. Before blockchain, payments were paid out in parts upon receipt of wares. 6/

With Trusple, the software generates a smart contract once a buyer and a seller upload a trading order on the platform. As the retailer executes the order, the smart contract is automatically updated with crucial information, such as order placements, logistics, and tax refund. 7

The seller no longer has to confirm invoices, remittances or banks details. Everything is handled automatically on the blockchain. 8/

It seems like Ant has worked out these kinks, the most significant hurdle being the ability to process high volumes of transactions securely. AntChain reportedly allows 25k Transactions Per Second (TPS), ahead of the industry average of 1k TPS and way ahead of Bitcoin’s 5 TPS. 9/

I also give my bull and bear cases in this week's edition. Check it out!

lillianli.substack.com/p/ant-group-pa…

lillianli.substack.com/p/ant-group-pa…

• • •

Missing some Tweet in this thread? You can try to

force a refresh