1/ the next big trade seems almost too obvious that it’s going to be a boring company / value revival. I’ve been debating with friends (@GreenhavenRoad @AboveAvgOdds @LaughingH20Cap @Dan_Roller @macrotwain) over the past couple of days, and most are skeptical, so here’s my case.

2a/ when I say value, I’m using @mjmauboussin's term, paying less than what a co. is worth, which I think >90% of investors still do. The trick is, is it worth less than a fair value in ‘20, ‘22, or ‘25-26 value, as many are justifying today?

https://twitter.com/mjmauboussin/status/1329019808323686400?s=20

2b / So I’m talking about things undervalued on current results- the “bird in hand” value and NOT price/book.

3/ Growth rates coming from the physical economy are going to be impressively better than big tech for the foreseeable future while the valuation mismatch is extreme. Even using today's estimates, which I think under-estimate the cyclical recovery with a vaccine.

4/ but I have to admit after the US election driving bond yields lower and compounders higher, I almost completely threw in the towel on value, still cognizant of the 200-year relative underperformance. Troughs are emotional beasts, and let’s just say I’m glad we’re out of that..

5/ until this year, I failed to realize how correlated compounders were to low bond yields, but it makes sense: terminal value > present value when rates converge to zero. Here’s election night snapshot.

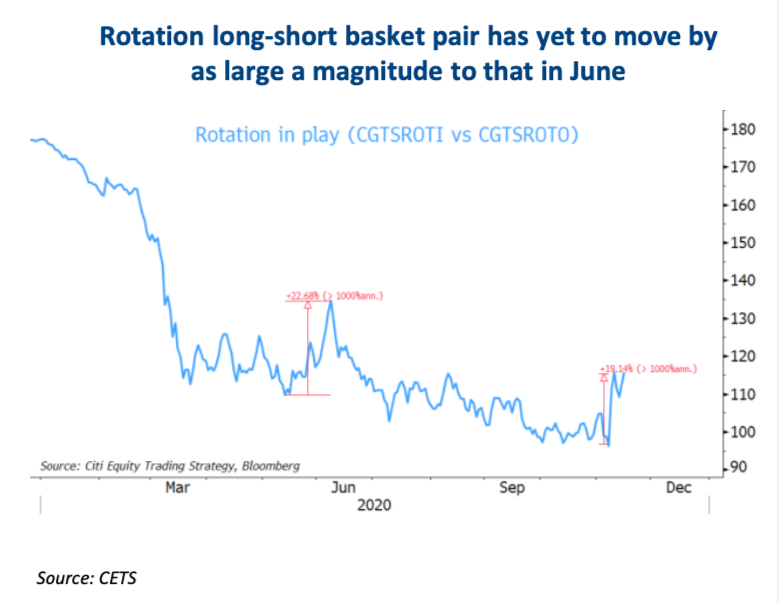

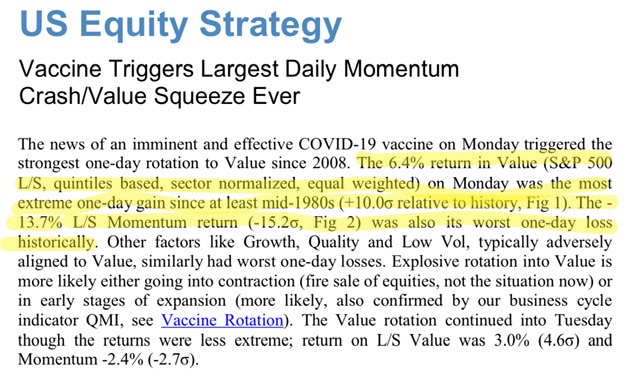

6/ Then the vaccine news triggered the largest value rebound in 3 decades. But when you recover from a 2-century relative underperformance, a great day is really just the start, especially with the retracements happening…

7/ In the K-shaped recovery, so many traditional businesses have suffered in valuation, without fundamentals in some cases. We’ve been amazed by “compounder” companies that were fundamentally crushed that hit new highs ($BKNG or $EL). While resilient “value” names still de-rated.

8/ the mother of all inventory re-stocking cycles has started - with inventory of autos and houses at near unprecedented lows.

10/ small caps have nearly the same flows mismatch to reality. Innumerable conversations attest to very good results being completely abandoned by the market because they are “off trend.”

11/ So many “value” co's have legs as we head into '21 w/ the guides of the cyclicals looking heroic while the Nasdaq will be less remarkable. It should continue in ’22 as the trough in some co's (esp travel) has a very long recovery road ahead. This is our base case for $TRIP.

12/ the inconvenient truth behind all of this, though, is that if the Fed goes to YCC, we'll resume the trade of "Terminal Value > Present Value." I have a lot of very smart friends long compounders that still don't realize that most of their trade is just short interest rates...

13/ we’ve been living in a low inflation world for so long, no one believes it’ll ever come back. But there’s a LOT of evidence with all the major capacity reductions, prices of key variables are VERY strong. Transports, housing, autos (new & used), even restaurants & grocery.

14/ so there is still hope for bird in hand after all. I'm not necessarily thinking growth / duration assets will crash, in fact the periods of worst momentum under-performance (14 of the biggest 15) come when previous winners trail the gigantic resurgence of the "losers."

15/ so with all that said, the question I have for you is- do you think bird-in-hand-value will outperform:

16/ “a bird in the bush is worth 5 in the hand.” -2020 stock market 💋

17/ and a warning- when you go hunting for “bird in hand value”, make sure that pretty bird is still alive.

• • •

Missing some Tweet in this thread? You can try to

force a refresh