10 chart patterns every trader needs to know If find useful pls RT to reach more @ArjunB9591 @SANAMBHATIA99 @sanstocktrader @yogeshnanda1 @TradingMonk_UJ @PAlearner @jigspatel1988 @BankniftyA @blisstrades @NileshTrader @Puretechnicals9

Chart patterns are an integral aspect of technical analysis, but they require some getting used to before they can be used effectively.

A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past

A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past

Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for

Best chart patterns

Head and shoulders

Double top

Double bottom

Rounding bottom

Cup and handle

Head and shoulders

Double top

Double bottom

Rounding bottom

Cup and handle

There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market.

Some patterns are more suited to a volatile market, while others are less so. Some patterns are best used in a bullish market, and others are best used when a market is bearish

That being said, it is important to know the ‘best’ chart pattern for your particular market, as using the wrong one or not knowing which one to use may cause you to miss out on an opportunity to profit.

Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Support refers to the level at which an asset’s price stops falling and bounces back up. Resistance is where the price usually stops rising and

Dip back down.The reason levels of support and resistance appear is because of the balance between buyers and sellers – or demand and supply. When there are more buyers than sellers in a market (or more demand than supply), the price tends to rise.

When there are more sellers than buyers (more supply than demand), the price usually falls.

As an example, an asset’s price might be rising because demand is outstripping supply. However, the price will eventually reach the maximum that buyers are willing to pay, and demand will decrease at that price level. At this point, buyers might decide to close their positions.

This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand as more and more buyers close their positions. Once an asset’s price falls enough, buyers might buy back into the market because the price is now more acceptable

– creating a level of support where supply and demand begin to equal out.

If the increased buying continues, it will drive the price back up towards a level of resistance as demand begins to increase relative to supply. Once a price breaks through a level of resistance, it may become a level of support.

Types of chart patterns

Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns.

Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns.

The most important thing to remember when using chart patterns as part of your technical analysis, is that they are not a guarantee that a market will move in that predicted direction – they are merely an indication of what might happen to an asset’s price

••Head and shoulders••

Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal.

Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal.

••Wedges••

Wedges form as an asset’s price movements tighten between two sloping trend lines. There are two types of wedge: rising and falling.

A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance.

Wedges form as an asset’s price movements tighten between two sloping trend lines. There are two types of wedge: rising and falling.

A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance.

In this case the line of support is steeper than the resistance line. This pattern generally signals that an asset’s price will eventually decline more permanently – which is demonstrated when it breaks through the support level.

A falling wedge occurs between two downwardly sloping levels. In this case the line of resistance is steeper than the support. A falling wedge is usually indicative that an asset’s price will rise and break through the level of resistance, as shown in the example below.

••Pennant or flags••

Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. Generally, there will be a significant increase during the early stages of the trend, before it enters into a series of smaller

Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. Generally, there will be a significant increase during the early stages of the trend, before it enters into a series of smaller

upward and downward movements.

Pennant pattern

Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. The above chart is an example of a bullish continuation.

Pennant pattern

Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. The above chart is an example of a bullish continuation.

In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals.While a pennant may seem similar to a wedge pattern or a triangle pattern – explained in the next sections – it is important to note that wedges are narrower than pen

••Ascending triangle••

The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Ascending triangles can be drawn onto charts by placing a horizontal line along the swing highs – the resistance – and then drawing an ascending

The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Ascending triangles can be drawn onto charts by placing a horizontal line along the swing highs – the resistance – and then drawing an ascending

trend line along the swing lows – the support.

Ascending triangle pattern

Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. The trend line signifies the overall uptrend of the pattern, while the horizontal line

Ascending triangle pattern

Ascending triangles often have two or more identical peak highs which allow for the horizontal line to be drawn. The trend line signifies the overall uptrend of the pattern, while the horizontal line

••Descending triangle••

In contrast, a descending triangle signifies a bearish continuation of a downtrend. Typically, a trader will enter a short position during a descending triangle – possibly with CFDs – in an attempt to profit from a falling market.

In contrast, a descending triangle signifies a bearish continuation of a downtrend. Typically, a trader will enter a short position during a descending triangle – possibly with CFDs – in an attempt to profit from a falling market.

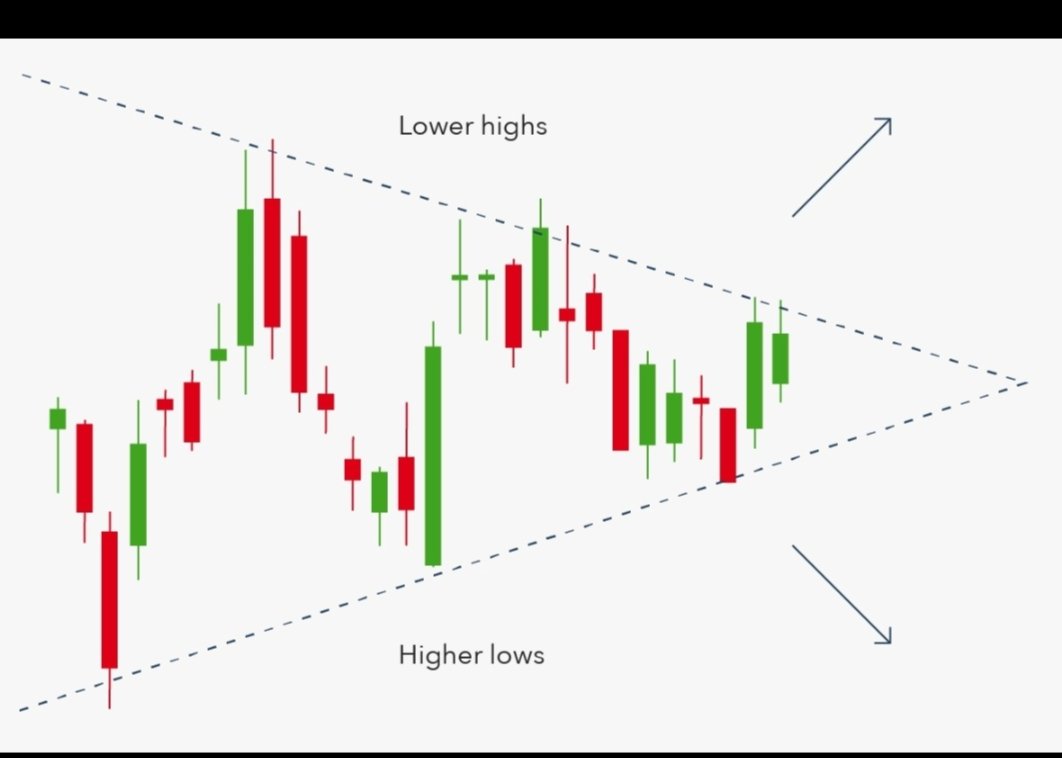

•Symmetrical triangle••

The symmetrical triangle pattern can be either bullish or bearish, depending on the market. In either case, it is normally a continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern

The symmetrical triangle pattern can be either bullish or bearish, depending on the market. In either case, it is normally a continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern

Has formed Symmetrical triangles form when the price converges with a series of lower peaks and higher troughs. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals.

• • •

Missing some Tweet in this thread? You can try to

force a refresh