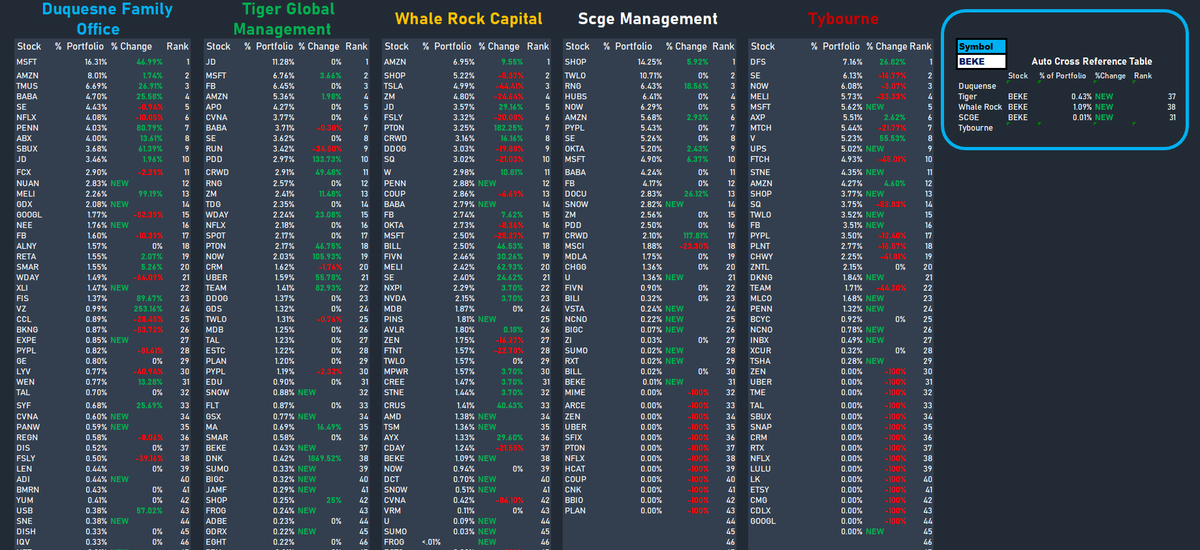

🎄Christmas is here again w/ another round of 13f's filed. I will update this thread over the course of the next few days with my findings of what some of the top hedge funds have been buying.🎄

👇👇👇

👇👇👇

1/ 1st on this thread... is a no brainer stock $AMZN

Nearly a top 10 holding among my top 5 hedge funds and all of which added to their position last quarter.

Nearly a top 10 holding among my top 5 hedge funds and all of which added to their position last quarter.

2/ Next is probably my favorite long term hold for the next 5-10 years... $SE

Also nearly a top 10 holding for all these funds. It's the most obvious stock to own I can think of

Also nearly a top 10 holding for all these funds. It's the most obvious stock to own I can think of

3/ $MSFT... One I don't own, and maybe I should. Tybourne not only capitulated to finally owning this stock along with his other buddies... he made it a top 5 position.

Microsoft also remains GOAT Druckenmiller's top position by a significant margin.

Microsoft also remains GOAT Druckenmiller's top position by a significant margin.

4/ Next is $SHOP.... I posted about this one last week. Seeing 4/5 w/ ownership and a new position also initiated by Tybourne gives me more conviction this is heading higher..

6/ Lets continue this thread with some more exciting new names... It's clear that $PENN is not some one off speculative bet... New positions initiated and Druck increased his position by 80%

7/ $DKNG catching love from Tybourne as well. One thing is clear, you want to be onboard the gambling trend. Don't overthink it.

13/ Now here's a really new exciting name I've never heard of before yesterday... $NCNO. High growth SaaS Recent IPO, that's 100% worth your attention

14/ $BEKE is another one I've never heard of, and it definitely deserves our attention. Massive sales, Recent IPO, Online Chinese Real Estate Platform.

15/ To sum up and to make this easier to digest, here's lists I came up w/ based on the hedge fund data:

"Top Stocks"

$AMZN

$SE

$MSFT

$SHOP

$CRWD

$PENN

$FB

$BABA

$NOW

$MELI

$JD

$CVNA

$PDD

$TWLO

$FIVN

$DOCU

$STNE

"Top Stocks"

$AMZN

$SE

$MSFT

$SHOP

$CRWD

$PENN

$FB

$BABA

$NOW

$MELI

$JD

$CVNA

$PDD

$TWLO

$FIVN

$DOCU

$STNE

16/ "Top new adds"... the names in this list interest me more than anything else

$SUMO

$PENN

$DKNG

$SNOW

$BIGC

$U

$BEKE**

$NCNO**

$FROG

$NUAN**

$SUMO

$PENN

$DKNG

$SNOW

$BIGC

$U

$BEKE**

$NCNO**

$FROG

$NUAN**

17/ "Notable"... These are mixed between bullish and bearish transactions. But nonetheless worth considering at a minimum.

$PTON

$ZI

$BILL

$OKTA

$ZM

$FTCH

$V

$PTON

$ZI

$BILL

$OKTA

$ZM

$FTCH

$V

18/ Hope you enjoyed! For me personally, I'm taking a hard look at $BEKE $SNOW $FROG $NCNO as far as new positions go. I own many of the above names already, thanks to this type of analysis

• • •

Missing some Tweet in this thread? You can try to

force a refresh