I just finished "The Cancer Code" by Jason Fung (@drjasonfung) easily the best book I've read this year.

Highly recommend.

Highly recommend.

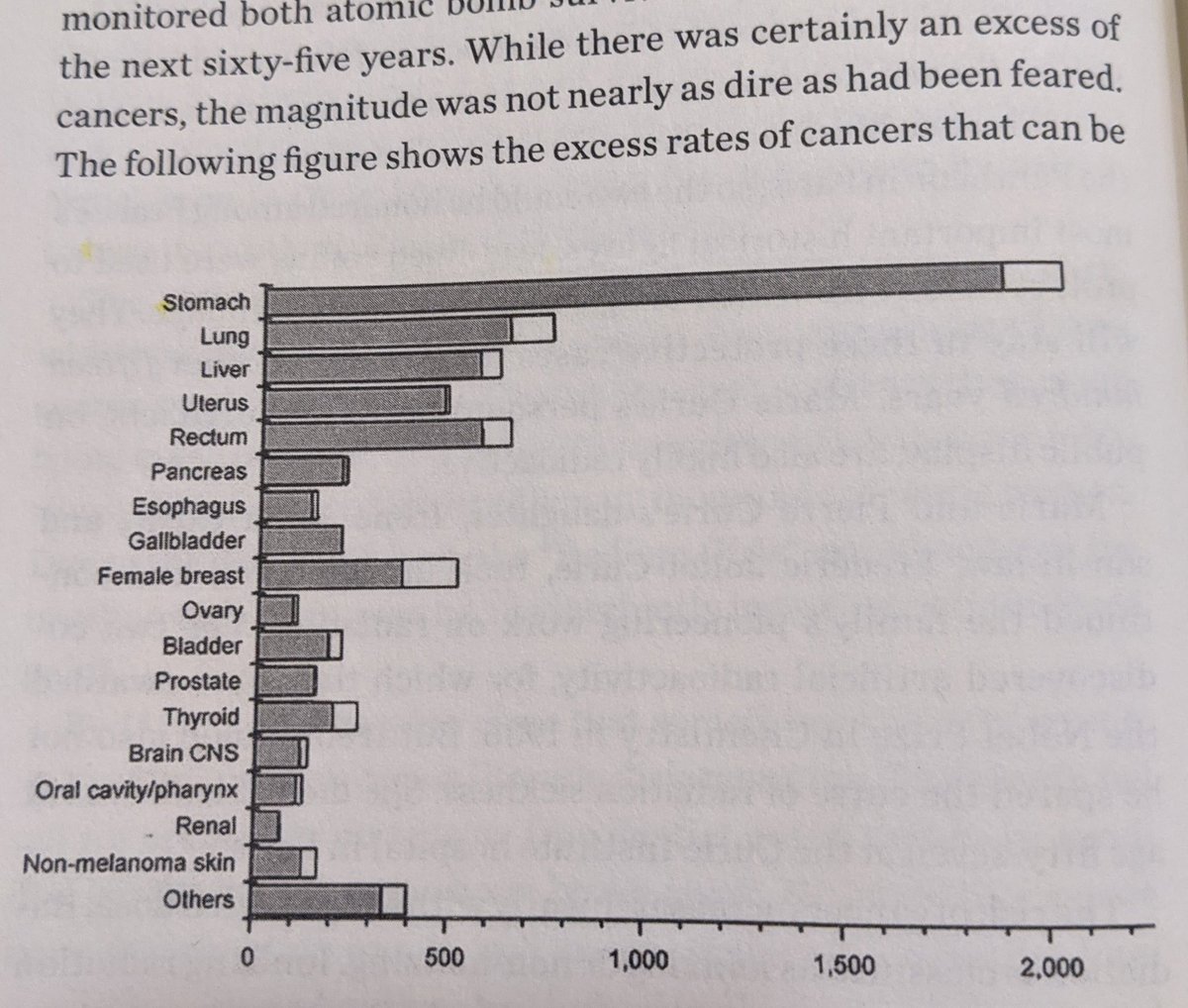

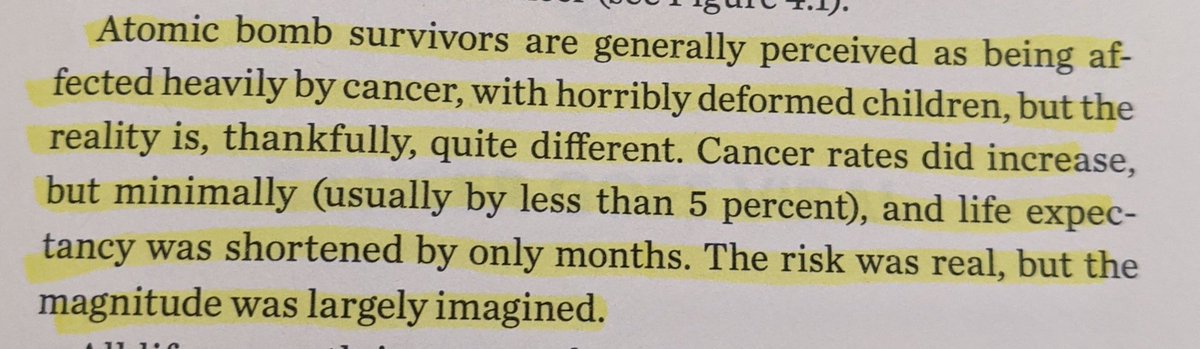

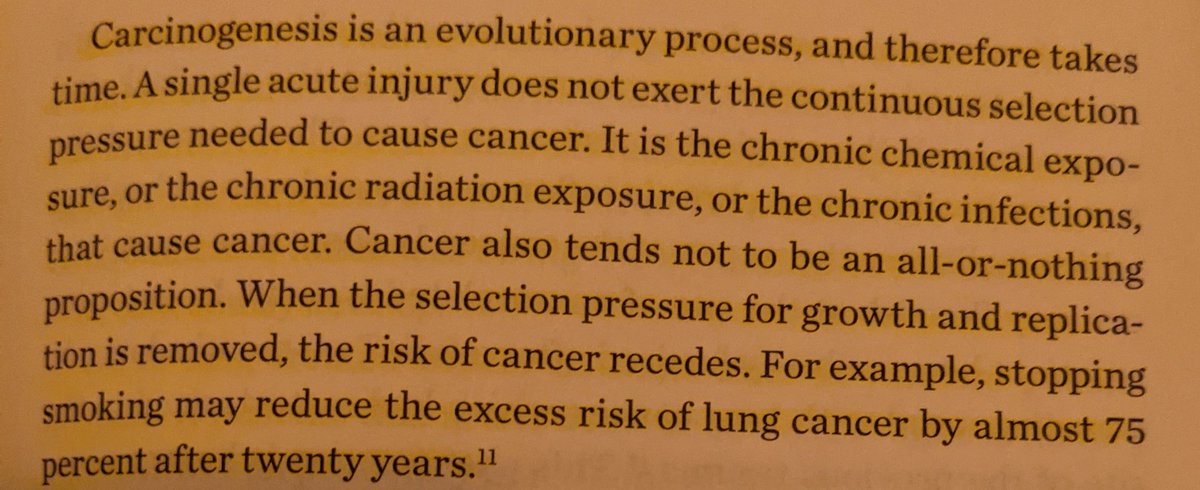

Atomic bomb survivor cancer rates increased only modestly, with "life expectancy shortened by months, not years".

Chronic exposure is what matters.

Chronic exposure is what matters.

"Indigenous societies such as the Native Americans at the beginning of the 20th century were largely considered immune to cancer... Cancer rates of the native Ojibwa population rose sharply in the 1980s, coinciding with increasing western influence on their lifestyle"

Requiring *evidence* isn't scientific, peer review is the search for consensus, medicine is unfortunately not physics.

What causes cancers are the bad things you do everyday, not typically the one off events. Audit anything unnatural you do daily (drinks, vitamins, shampoos, soaps, deodorants, make-up, food, household cleaning products, etc).

They *all* give you cancer.

They *all* give you cancer.

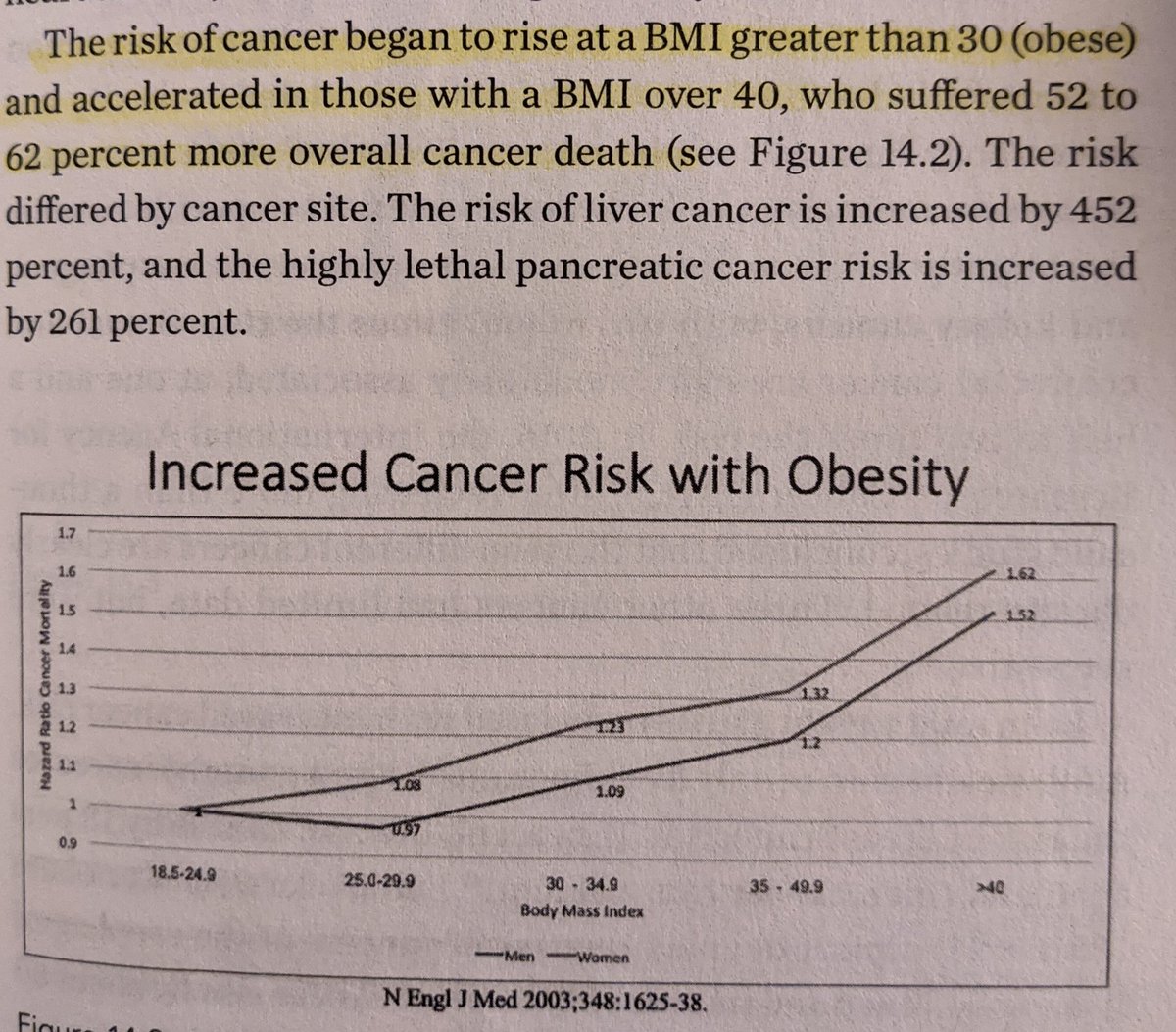

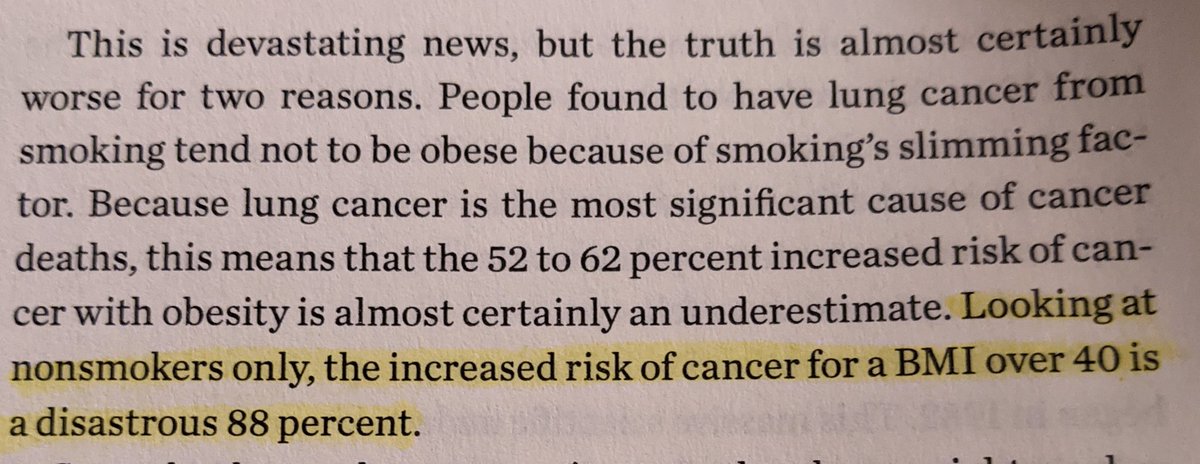

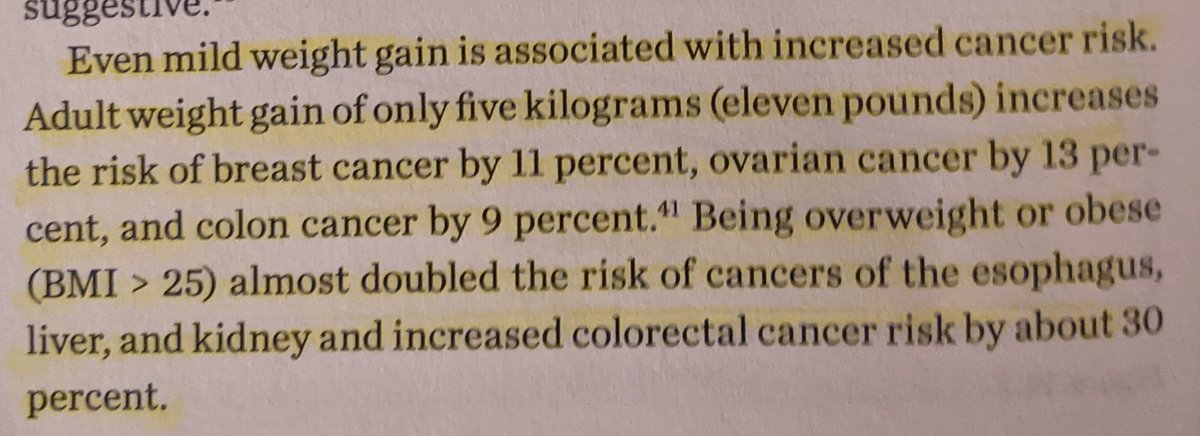

"Our steady progress against many cancers is being significantly impeded by the obesity epidemic"

$KO $MCD = Cancer Stocks just like $MO

Obviously the inverse is helpful = fast

$KO $MCD = Cancer Stocks just like $MO

Obviously the inverse is helpful = fast

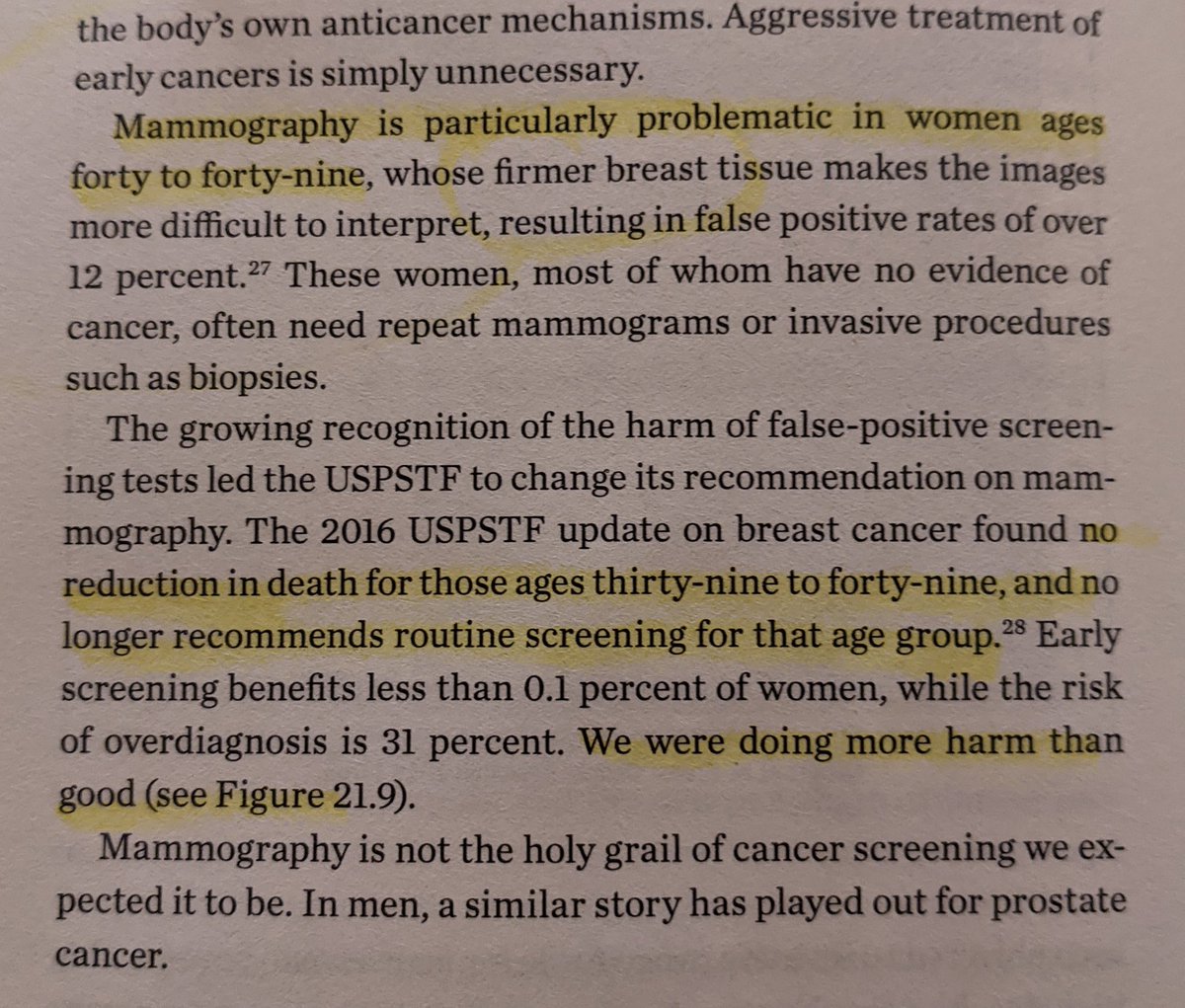

"Primum non nocere, which means "First do no harm". The perspective offered by today's cancer paradigm explains why many national agencies are beginning to scale back on the amount of screening they recommend"

I've ordered Jason's other two books "The Obesity Code" and "The Diabetes Code" I hope they are as good as this one. At a minimum I know they are written be a very clear thinker and a great writer!

• • •

Missing some Tweet in this thread? You can try to

force a refresh