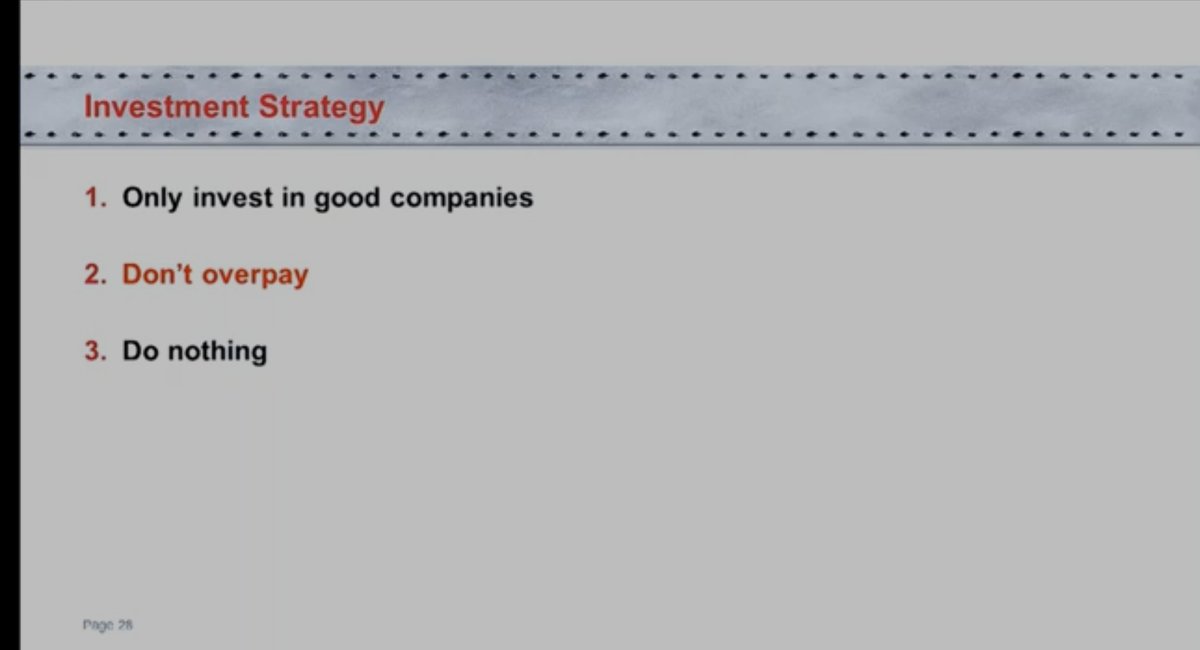

Basic ratio which you look before you made any Investment, Many times your money will be save if you look out at your end,

https://twitter.com/InvestmentBook1/status/1331611151054958592

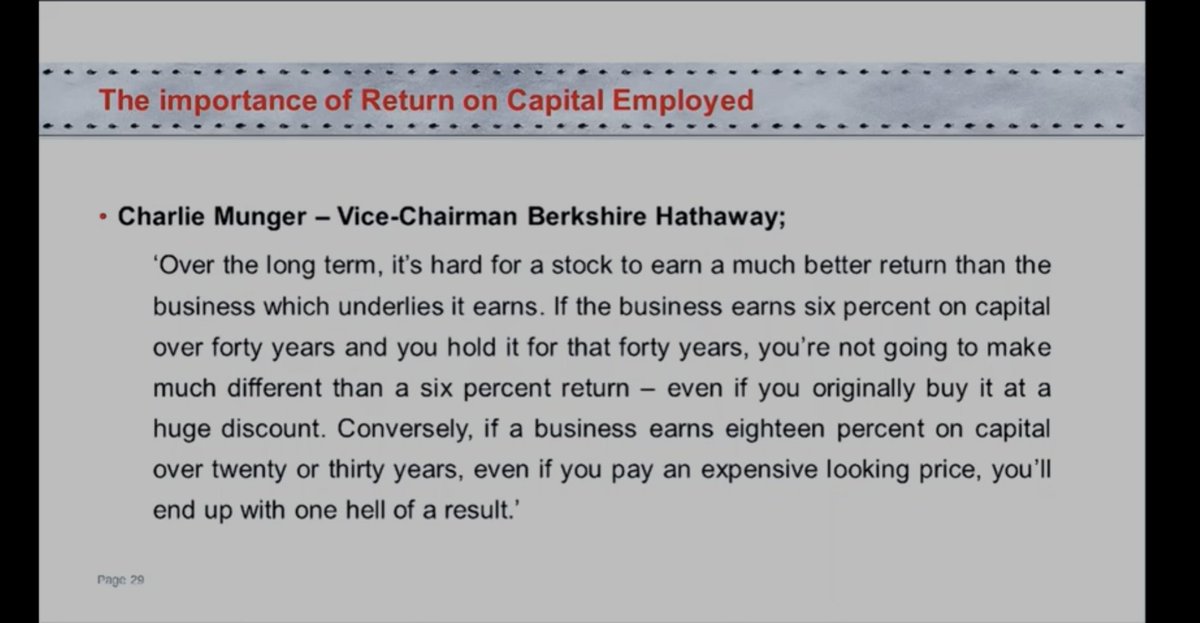

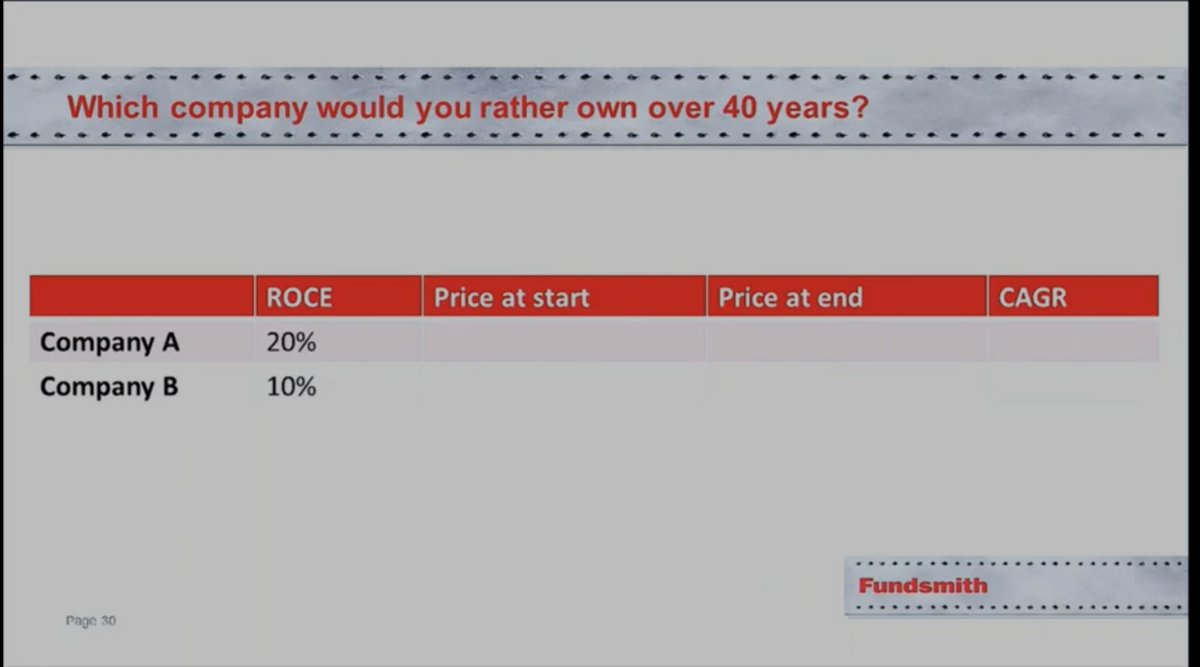

ROCE :

Return on capital employed means how much company making profit of employed capital (Equity + debt), Just on safer side, It should be above 12-15% , If company consistently earning higher ROCE means company making higher profit from Invested capital and If debt.

Return on capital employed means how much company making profit of employed capital (Equity + debt), Just on safer side, It should be above 12-15% , If company consistently earning higher ROCE means company making higher profit from Invested capital and If debt.

Debt to Equity :

Debt to Equity ratio quantify that how much debt company have in comparison to equity, For example company have 100 Rs Equity and 100 Rs. Debt then ratio is 1, and ideal ratio should be 1 (There is many if and but

Debt to Equity ratio quantify that how much debt company have in comparison to equity, For example company have 100 Rs Equity and 100 Rs. Debt then ratio is 1, and ideal ratio should be 1 (There is many if and but

,But just on safer side if it is below 1 then it would be best

ROE :

Return on equity , Defines how much company making on invested equity, It should be ideally 12-15% , If it is way below than capital cost then it’s hard to company to maintain healthy balancesheet.

ROE :

Return on equity , Defines how much company making on invested equity, It should be ideally 12-15% , If it is way below than capital cost then it’s hard to company to maintain healthy balancesheet.

If it low there are so many reason if you want to invest either then 1st find why it is low, is there any R&D and Capex running which is transferring to P&L, There to be many reason.

Cash conversion cyle :

Defines times company takes to convert sales into cash. As lower as it is better

Interest coverage ratio :

Interest coverage ratio means how much company’s profit covers it’s debt’s interest, It is ideally should be above 2.

Defines times company takes to convert sales into cash. As lower as it is better

Interest coverage ratio :

Interest coverage ratio means how much company’s profit covers it’s debt’s interest, It is ideally should be above 2.

We not included P/E ratio because there is so many noise around P/E and invest only on P/E is not a good thing, Usually growth company’s P/E is high because Market already knew about growth and that’s why earning pre-determined and reflating in P/E ratio ,

if you are comparing Commodity company’s P/E with growth company’s P/E , there is always differ that’s why we not included.

Above ratio not garrented you best company but will you give you good company for sure and you also will understand what to avoid.

Above ratio not garrented you best company but will you give you good company for sure and you also will understand what to avoid.

Before Invest in any company there also be checked 3/5 Years sales growth and Profit growth , If profit growth is above sales growth it is good.

Many other criteria you should check like

Management capability (TOP Most Priority)

Related Party Transcations

Contingent Liability

Gross block of PPE

Operation Cash flow (Measure for Profit converting into cash or not)

Management capability (TOP Most Priority)

Related Party Transcations

Contingent Liability

Gross block of PPE

Operation Cash flow (Measure for Profit converting into cash or not)

There is so many things that I forgot to mention or very long so sorry for that, It’s just a small Demo which maybe help you to decide what to avoid and which is good.

For Management , Check previous year’s Audit report and concall and compare what they told actually happen or not , Easy way to check walk the talk.

You can add your points too

Above is only some basic level not only criteria for Investment.

Maybe some extent helpful

You can add your points too

Above is only some basic level not only criteria for Investment.

Maybe some extent helpful

If you like thread make sure Like and retweet,

@dmuthuk @vineetpatawari @investometry @Vivek_Investor @pankajbaid17

@dmuthuk @vineetpatawari @investometry @Vivek_Investor @pankajbaid17

• • •

Missing some Tweet in this thread? You can try to

force a refresh