Thread 🧶 on Investment/trading mistake and way to overcome it

You lost money in Trading or Investment

Here how can you overcome from it

Potential Reason :

What the reason of failure 👎

What fault in system 💻

Traded by stock tips 💡

Not put stoploss 🔴

You lost money in Trading or Investment

Here how can you overcome from it

Potential Reason :

What the reason of failure 👎

What fault in system 💻

Traded by stock tips 💡

Not put stoploss 🔴

Emotional trade 👀

Loss-covering trade 😤

Not manage risk-management 🎲

Outsized capital allocation 📦

Enter after run-up too much (FOMO)

Holding stock even after hit stoploss Buy from wrong entry zone ❌

Many more still would be

Loss-covering trade 😤

Not manage risk-management 🎲

Outsized capital allocation 📦

Enter after run-up too much (FOMO)

Holding stock even after hit stoploss Buy from wrong entry zone ❌

Many more still would be

If you have any problem just solve out that like do invert always if you still holding stock after stoploss hit, square off position after hit,

Do proper risk management

Do follow trading system

Never rely on other's system

Only trade if it is fit on your system

Do proper risk management

Do follow trading system

Never rely on other's system

Only trade if it is fit on your system

Never trade just for recover losses

Glad to know yours too,

@TraderHarneet @SJosephBurns @MarketScientist @Rishikesh_ADX @ST_PYI @VRtrendfollower @RajarshitaS

Glad to know yours too,

@TraderHarneet @SJosephBurns @MarketScientist @Rishikesh_ADX @ST_PYI @VRtrendfollower @RajarshitaS

Wrong Investment :

Reason :

Buy from tips 💡

Buy without due diligence ✍

Buy without know company's business

Buy without know company's finance

Buy after Business news reportet suggest 📰

Buy just it's on 52w 📊 📉

Buy because of low P/E in sector🧸

Reason :

Buy from tips 💡

Buy without due diligence ✍

Buy without know company's business

Buy without know company's finance

Buy after Business news reportet suggest 📰

Buy just it's on 52w 📊 📉

Buy because of low P/E in sector🧸

Cheap stock buy 🔦

Buy because of FOMO 🚀

Averaging down loser 📉

Hope turnaround story 📸

Ignoring fundamental 🧬

Buying penny stock in hope of multibagger 💰

Buying just because of it is rising then and now trapped at TOP 📈

Buying commodity stock at peak 📍

Still so much...

Buy because of FOMO 🚀

Averaging down loser 📉

Hope turnaround story 📸

Ignoring fundamental 🧬

Buying penny stock in hope of multibagger 💰

Buying just because of it is rising then and now trapped at TOP 📈

Buying commodity stock at peak 📍

Still so much...

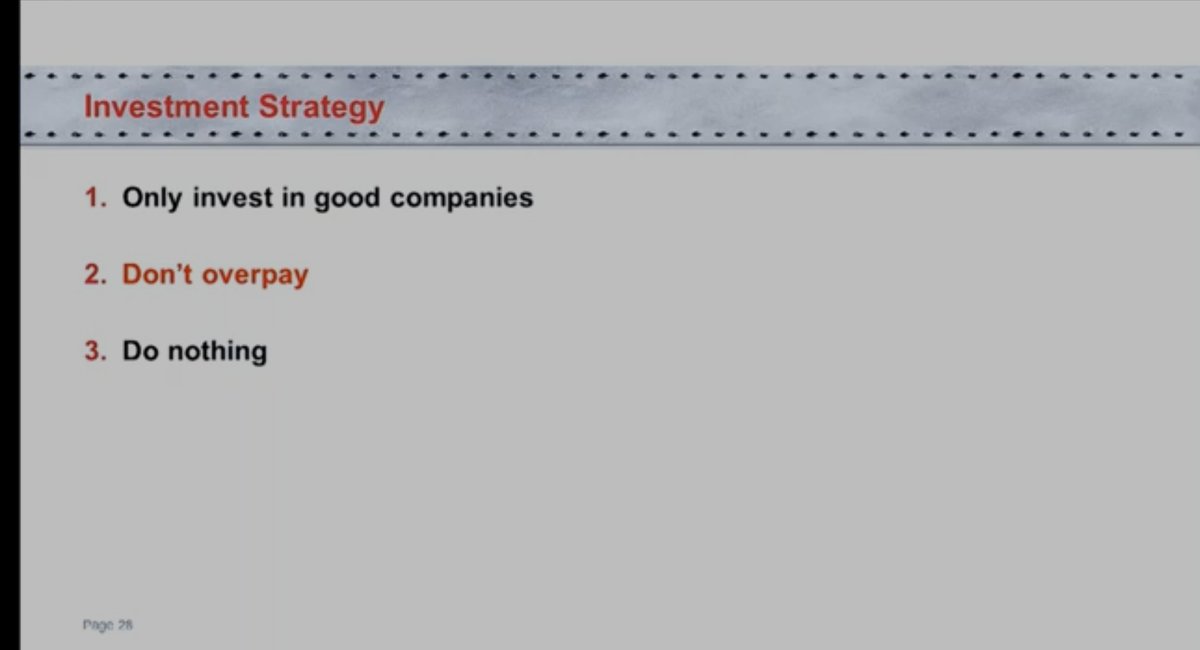

Just make sure next you will never buy any stocks based on above reason, that's it always research at your end,

Never buy on borrowed conviction

Never buy only for rising/down

Never buy commodity stocks

Never hold hope turnaround story

Never buy any penny stock

Never buy on borrowed conviction

Never buy only for rising/down

Never buy commodity stocks

Never hold hope turnaround story

Never buy any penny stock

Never buy any stock based on Business news recommendations

Want to learn Trading/Investing

1. Learn free from YouTube but try always from small, And learn method not direct stock

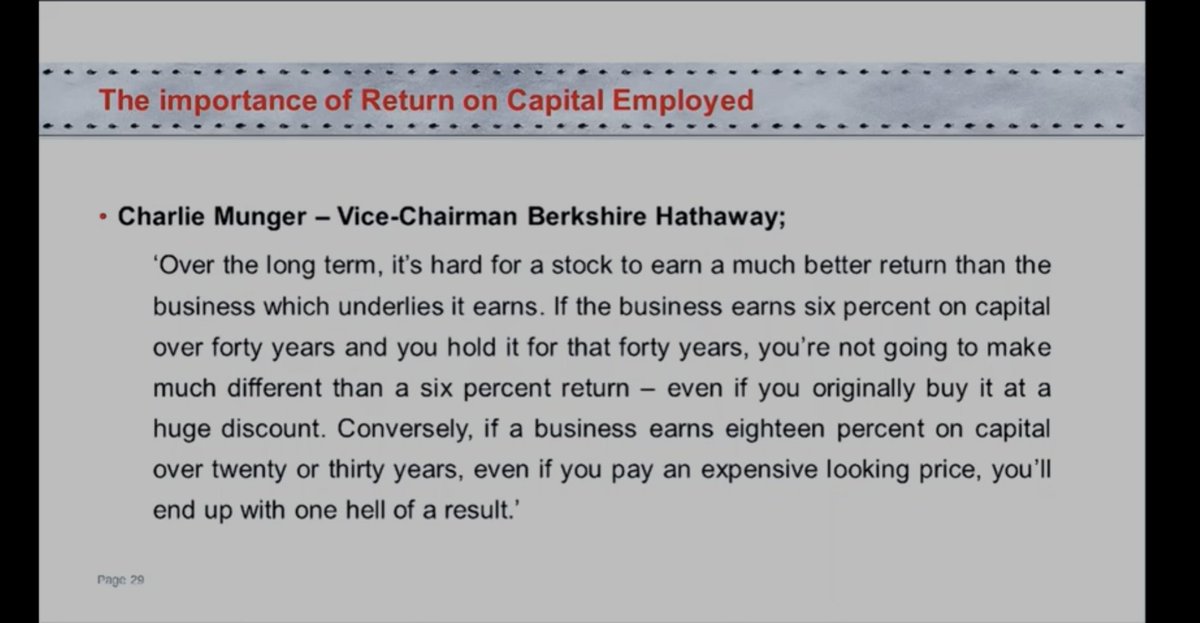

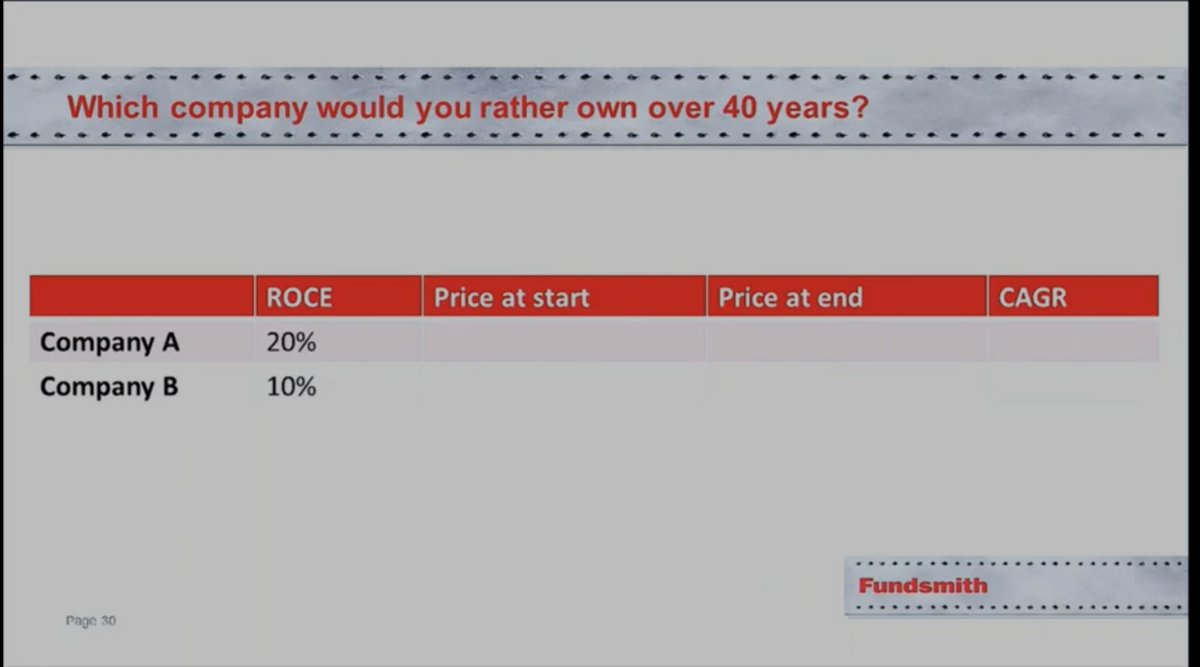

2. Read Any good quality company's past data, audit report, Balance sheet, Concall, etc

Want to learn Trading/Investing

1. Learn free from YouTube but try always from small, And learn method not direct stock

2. Read Any good quality company's past data, audit report, Balance sheet, Concall, etc

3. Read good books on investing / Trading

4. Follow your own method always

5. Learn from twitter community there are so many good handle who always try to learn you how to do investing and trading, Tell reason behind selection kf specific stocks

4. Follow your own method always

5. Learn from twitter community there are so many good handle who always try to learn you how to do investing and trading, Tell reason behind selection kf specific stocks

You can add your comments too here,

Mutual Learning

Just want your views on my thread sirji 😇

@FI_InvestIndia @Vivek_Investor @RichifyMeClub @VJ_Rabindranath @dmuthuk @EWFA_ @AnishA_Moonka @BaluGorade @contrarianEPS @unseenvalue @ms89_meet

Mutual Learning

Just want your views on my thread sirji 😇

@FI_InvestIndia @Vivek_Investor @RichifyMeClub @VJ_Rabindranath @dmuthuk @EWFA_ @AnishA_Moonka @BaluGorade @contrarianEPS @unseenvalue @ms89_meet

I deeply respect all of above and learnt a lot from them,

You should also follow them for good leaning 📏

End.

You should also follow them for good leaning 📏

End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh