ETH 2.0 transforms Ethereum the blockchain, but what about ETH the asset?

In ETH 1.x ETH is used as a money and commodity.

In ETH 2.0 ETH will also be used to produce income through staking.

The combination of the 3 will make ETH one of the most unique assets in crypto.

1/

In ETH 1.x ETH is used as a money and commodity.

In ETH 2.0 ETH will also be used to produce income through staking.

The combination of the 3 will make ETH one of the most unique assets in crypto.

1/

Let’s start with ETH’s properties in ETH 1.x.

In ETH 1.x ETH possesses store of value properties through its use as collateral in DeFi and use as Ethereum’s native currency.

In ETH 1.x ETH possesses store of value properties through its use as collateral in DeFi and use as Ethereum’s native currency.

In ETH 1.x ETH possesses commodity properties through its use as “digital oil”, being used to pay for block space.

This analogy to oil will be especially powerful once EIP-1559 is implemented and the majority of tx fees are burned - literally converting ETH into block space.

This analogy to oil will be especially powerful once EIP-1559 is implemented and the majority of tx fees are burned - literally converting ETH into block space.

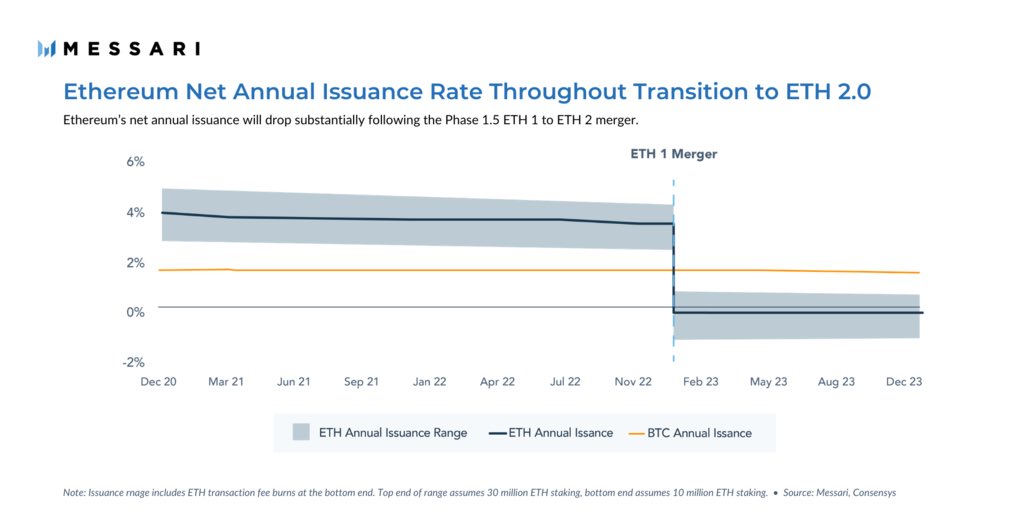

ETH 2.0 introduces staking which will provide ETH with capital asset properties - it will be used to generate income through staking.

Annual yields stakers can expect to get at maturity will likely be in the 4-6% range.

Currently they’re around 20%.

Annual yields stakers can expect to get at maturity will likely be in the 4-6% range.

Currently they’re around 20%.

Staking provides ETH with both sovereign bond and equity like characteristics.

It’s like a sovereign bond because Ethereum, the issuer, pays out stakers, the bond holders, in its own native currency...

It’s like a sovereign bond because Ethereum, the issuer, pays out stakers, the bond holders, in its own native currency...

...and the reason why Ethereum issues this “bond” in the first place is to raise capital for security.

The relationship can be analogized to a nation state that issues bonds to pay for its defense budget and in return pays bond holders additional currency that it creates.

The relationship can be analogized to a nation state that issues bonds to pay for its defense budget and in return pays bond holders additional currency that it creates.

Like sovereign bonds that are issued in a sovereigns own currency, there is no default risk (nominally) with an Ethereum bond.

Ethereum can guarantee to pay out stakers so long as the Ethereum blockchain remains alive

because it pays stakers in its own currency.

Ethereum can guarantee to pay out stakers so long as the Ethereum blockchain remains alive

because it pays stakers in its own currency.

However, Ethereum’s bond-like characteristics are only half the picture.

Two key features that make ETH equity-like as well are its perpetual nature and its claim on Ethereum’s transaction fees.

Two key features that make ETH equity-like as well are its perpetual nature and its claim on Ethereum’s transaction fees.

Unlike bonds which have maturity dates at which time bond holders are paid back their principal, stakers can stake their ETH and receive yield forever.

Similarly ETH’s claim on transaction fees makes ETH act more like equity in that it has a claim on future fees from users demanding to transact on Ethereum.

EIP 1559 will likely burn the majority of transaction fees, but some variable portion of fees will be paid to stakers.

EIP 1559 will likely burn the majority of transaction fees, but some variable portion of fees will be paid to stakers.

Taking the above into consideration @MaraSchmiedt and @StakeETH conceptualized ETH as:

“The Internet Bond [which is] an entirely new asset for financial markets. It allows anyone in the world to invest, participate, and profit off an open-sourced, decentralized digital economy.”

“The Internet Bond [which is] an entirely new asset for financial markets. It allows anyone in the world to invest, participate, and profit off an open-sourced, decentralized digital economy.”

https://twitter.com/stakeeth/status/1324472374784270337

Why do all these properties matter?

They all are sources of demand for ETH in ETH 2.0.

It may not be a stretch to say there’s never quite been an asset like ETH.

They all are sources of demand for ETH in ETH 2.0.

It may not be a stretch to say there’s never quite been an asset like ETH.

https://twitter.com/ryanwatkins_/status/1331025191246454784

The takeaway for investors?

ETH does not fit into a neatly defined bucket.

It is a complete re-imagination of what money is in a blockchain-based economy.

The best way to understand ETH is just to look at it from first principles and appreciate its various drivers of value.

ETH does not fit into a neatly defined bucket.

It is a complete re-imagination of what money is in a blockchain-based economy.

The best way to understand ETH is just to look at it from first principles and appreciate its various drivers of value.

https://twitter.com/spencernoon/status/1330597384385155072

Still the above is just scratching the surface on all the change ETH 2.0 will bring to ETH the asset.

Check out our full ETH 2.0 report here: bit.ly/2KXLKcj

Check out our full ETH 2.0 report here: bit.ly/2KXLKcj

And tune in tomorrow for a discussion on how the shift to Proof-of-Stake will change the economics of Ethereum.

Featuring: @CamiRusso, @TrustlessState, @MaraSchmiedt

📺 bit.ly/39mPPRC

Featuring: @CamiRusso, @TrustlessState, @MaraSchmiedt

📺 bit.ly/39mPPRC

• • •

Missing some Tweet in this thread? You can try to

force a refresh