On November 18, Zcash will undergo its first halving which will drop its inflation rate from 25% to 12.5%.

But will it matter?

And where does Zcash fit into the crypto monetary stores of value anyways?

1/

But will it matter?

And where does Zcash fit into the crypto monetary stores of value anyways?

1/

The problem with Bitcoin, and nearly every other cryptocurrency, is that they’re completely transparent.

Even just making a simple payment to a counterparty may reveal your entire financial history on Bitcoin - a status quo that is unacceptable to many.

messari.io/article/zcash-…

Even just making a simple payment to a counterparty may reveal your entire financial history on Bitcoin - a status quo that is unacceptable to many.

messari.io/article/zcash-…

Storing your assets in transparent addresses and attempting to “anonymize” them through technologies like mixers only to return to transparent addresses doesn’t solve this issue.

https://twitter.com/zooko/status/1284945680356667392

This is why Zcash was invented.

Storing your assets privately, not just transacting them privately, may be the only way to ensure absolute financial privacy in the world of cryptocurrency.

Storing your assets privately, not just transacting them privately, may be the only way to ensure absolute financial privacy in the world of cryptocurrency.

When Zcash (ZEC) launched in 2016 it was one of the most hyped cryptocurrencies ever (it was momentarily worth more than Bitcoin, in its first day of very low-liquidity trading).

However, since its launch, ZEC has declined significantly in price to say the least.

However, since its launch, ZEC has declined significantly in price to say the least.

Beyond general educational issues around Zcash, some Zcash observers suspect ZEC’s downward price action has been attributable to miners selling their newly mined ZEC.

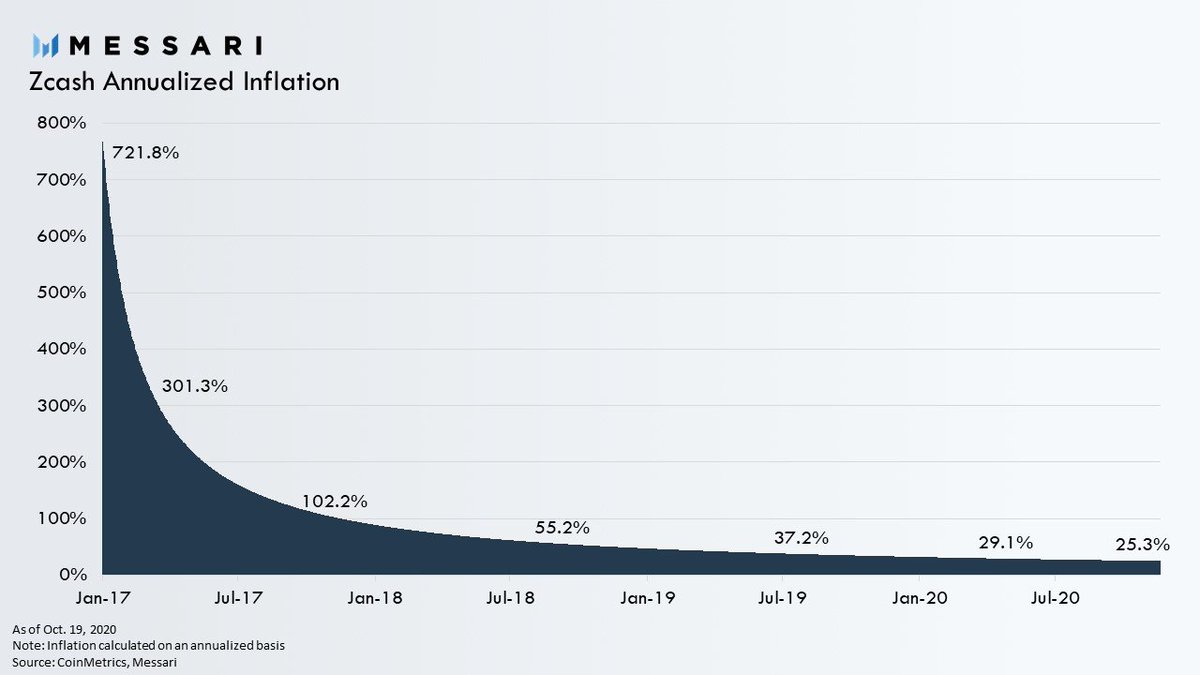

Zcash's annual inflation has been extremely high in its early years.

Zcash's annual inflation has been extremely high in its early years.

The hope then is that Zcash’s first halving set to occur on November 18, 2020 could provide important relief in this respect.

However data indicates hope for this specific reason may not be rewarded.

However data indicates hope for this specific reason may not be rewarded.

Assuming miners sell all their ZEC as they mine it, they still have only historically made up less than 5% of ZEC daily trading volumes over the past year.

The measure isn't perfect, but its a good enough proxy to show that miners may not be what's holding ZEC back.

The measure isn't perfect, but its a good enough proxy to show that miners may not be what's holding ZEC back.

A more interesting narrative for Zcash’s halving is that it may reinforce ZEC’s sound money principles.

While I’d somewhat agree with this view, focusing on the halving as a catalyst misses the point.

While I’d somewhat agree with this view, focusing on the halving as a catalyst misses the point.

Fixed supply cryptocurrencies like Zcash and Bitcoin aren’t interesting because their issuance rate halves every four years, they’re interesting because their issuance schedule is predictable and deterministic.

This is why from a narrative perspective it's not incredibly noteworthy that Zcash’s annualized inflation rate will drop to 12.5% on November 18.

This is all predetermined.

This is all predetermined.

What then does matter for Zcash this month?

In my latest I cover Zcash's upcoming Canopy upgrade, Zcash's roadmap beyond 2020, and commentary on monetary maximalism.

messari.io/article/zcash-…

In my latest I cover Zcash's upcoming Canopy upgrade, Zcash's roadmap beyond 2020, and commentary on monetary maximalism.

messari.io/article/zcash-…

Zcash may be finally reaching a light at the end of the tunnel.

But only time will tell what’s on the other side of it.

But only time will tell what’s on the other side of it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh