1) We are short OrthoPediatrics $KIDS, which we believe has engaged in a channel stuffing scheme that has systematically and significantly overstated revenues. Full report now available at culperresearch.com

2) $KIDS claims to consign inventory and recognize revenues when products are used in procedures. However, we interviewed 4 Company distributors and 2 fmr. $KIDS executives who all stated that KIDS sells excess product directly to distributors, recognizing revenue on shipment.

3) 4 of these 6 interviewees also described that $KIDS induces distributors to purchase product direct from the Company in exchange for (a) equity-based awards, (b) the opportunity to return product, and/or (c) product discounts or increased commission schedules.

4) In every one of our conversations, each source characterized these practices by $KIDS as frequent and pervasive.

5) We also discovered at least 6 $KIDS employees who have formed their own distributorships, some while still employed at the Company, while $KIDS "third party" Northeast distributor Trauma-Recon maintains $KIDS email addresses.

6) To us, these practices ring eerily familiar to those at ArthroCare, MiMedx, and Valeant. We find it telling that $KIDS Senior Managing Director Mike Pritchard previously worked at ArthroCare, and CFO Fred Hite's Symmetry Medical received SEC charges for accounting fraud.

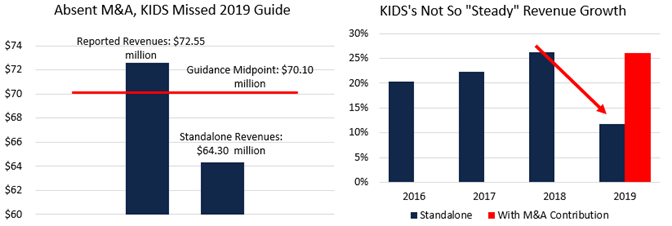

7) We also see $KIDS as structurally broken, and think mgmt. has lied to investors about slowing growth. CEO Throdahl said "growth is steady", yet using $KIDS own disclosures, we est. $KIDS grew just 11.7% organically in 2019, well short of the touted 20%+ rate and guidance.

8) $KIDS holds 1,135 days inventory, up from sub-600 in Q3 2017 & a shocking outlier vs. peers at 341 days. Thus to curb further inventory bloat against slowing growth, $KIDS has turned to M&A and a "Loaner Program." However, we view both as futile as cash burn has only worsened.

9/9) $KIDS CEO Throdahl once characterized the business as "needing to be on a treadmill to oblivion", and we couldn't agree more. At ~$45 per share, investors now pay over 11x revenues for this elaborate scheme. We view shares as uninvestible.

• • •

Missing some Tweet in this thread? You can try to

force a refresh