Long Thread on Farmers protests & Agri reforms: What is the protest all about? Who gets impacted & how? Why are protests concentrated in Punjab & Haryana? Are these really farmers or traders losing grip on monopoly? Are farmers being misled? Let numbers do the talking. Here we go

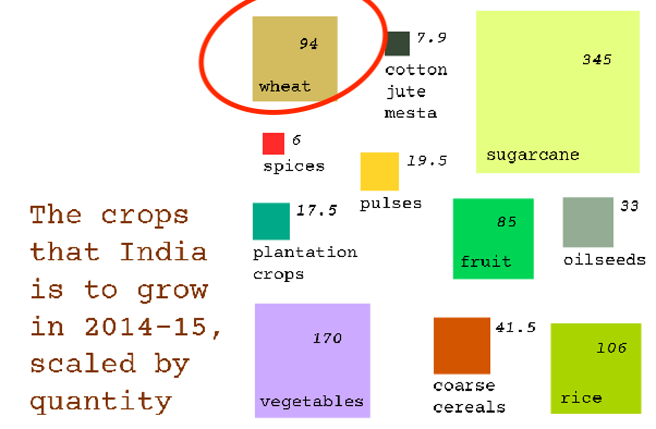

A top-down view of Indian production is in order here. What does India’s agriculture produce in a year? I like the below chart for FY 2015. Now to understand the complexity, we’ll have to work with one crop & dig details. Let’s work with Wheat.

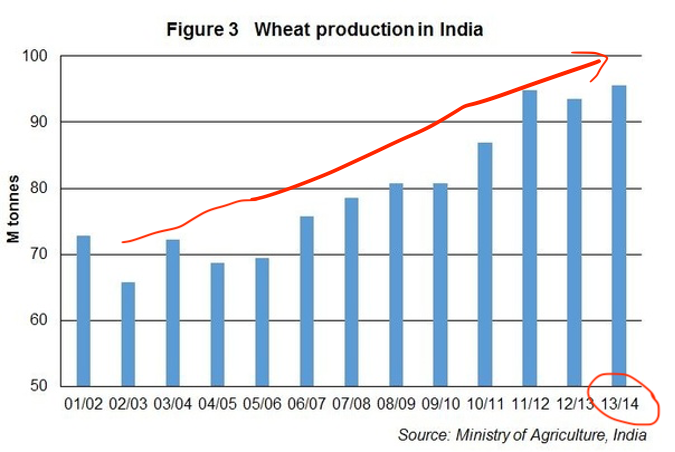

In 2020, India is looking at 105 million tons of Wheat produce vs 94 mn tons in 2015. What does the growth look like? See below the YoY growth of wheat in India. A 105 mn tons in 2020 will bust the chart below. Forget nay-sayers,Indian agriculture is doing great production.

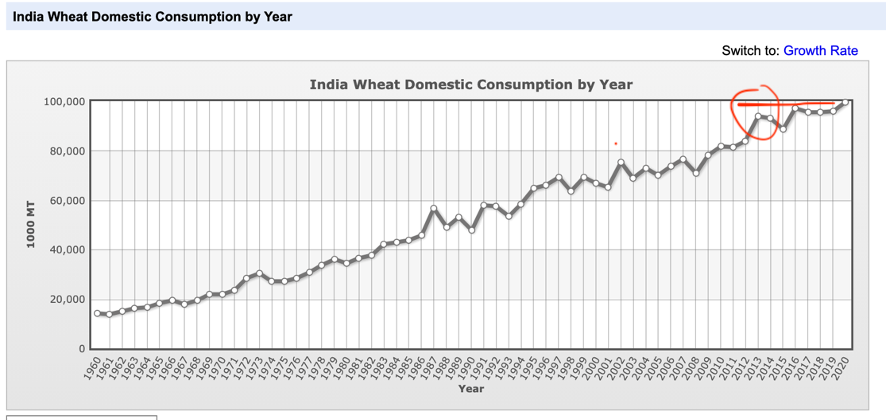

Something is working well when production goes up consistently. However,while supply is great, demand is not growing as much. Look at the wheat consumption in India. As you see, the demand is consistently below supply by ~ 10 mn tons. Who needs this extra 10% wheat? Not Indians.

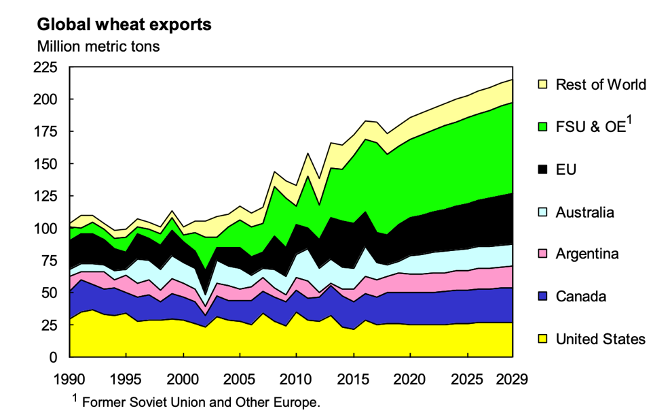

Can we export? Unlikely! This is where it gets complicated. Let’s see the United States Dept of Agriculture report on agriculture.The European Union, China, and India accounted for a little over 50 percent of the world’s wheat production (762 mn tons) in 2018/19.

However, we hardly export any wheat. India doesn’t even feature as a wheat exporter in chart below. India is expected to be a marginal net wheat exporter during the projection period. This implies that India is a price taker in wheat trade. We can't set the price internationally.

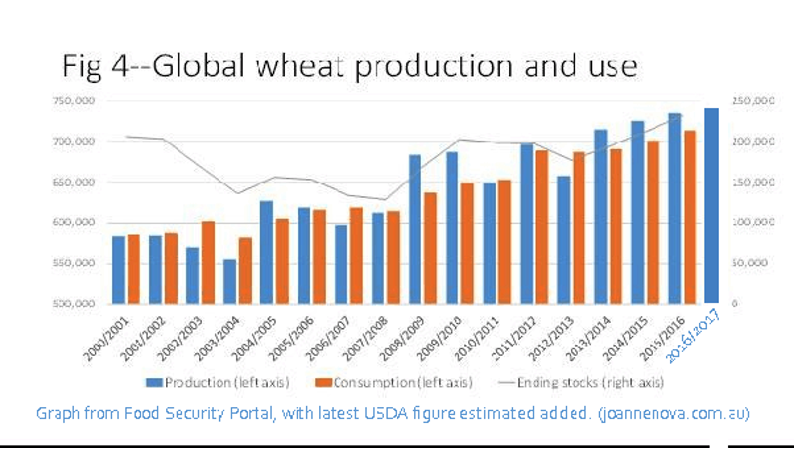

Even if we want to export, there is a major problem. Growth in wheat imports is concentrated in developing countries. Most developed nations with better purchasing are wheat surplus. Globally, the consumption of wheat is falling below the production as we see in the below graphic

Since developed nations have surplus, major wheat importers will be African nations. Hardly lucrative markets. It keeps the wheat prices depressed, closing the exports door for us. See the international prices of wheat & how these are relatively stable at $ 200 per ton.

This translates to Rs 1400 per quintal vs the MSP of Rs 1975 per quintal. So, MSP is a good 40% above the international prices! No exports can happen at this rate. MSP appears to be the root of current agitation. Farmers ask for a min price guarantee so he can predict his income.

We have already established the following (1)India already has wheat surplus & we need less of it (2)Advanced seeds are causing yields to explode resulting in bumper harvests which aggravate the problem (3) Since exports potential is absent, all produce has to be paid by Indians

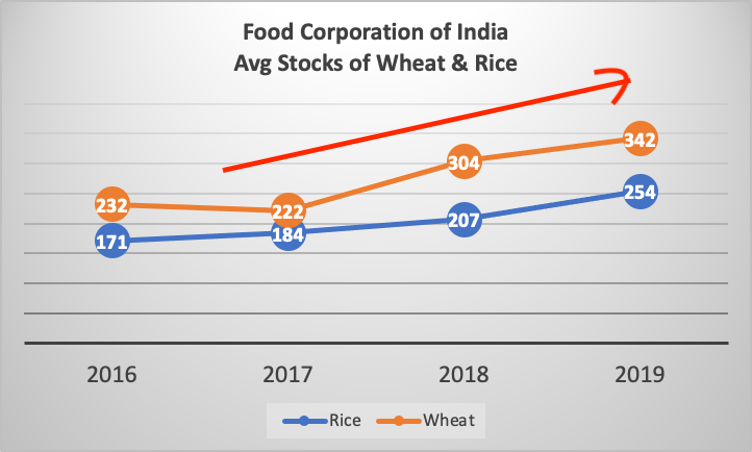

If all produce is bought at MSP, farmers can look at an increasing production & rising income. Sounds good, except that the someone has to pay for wheat which we don’t need. Because if govt procures excess wheat, this is what happens. See the avg stocks of FCI for Wheat & Rice.

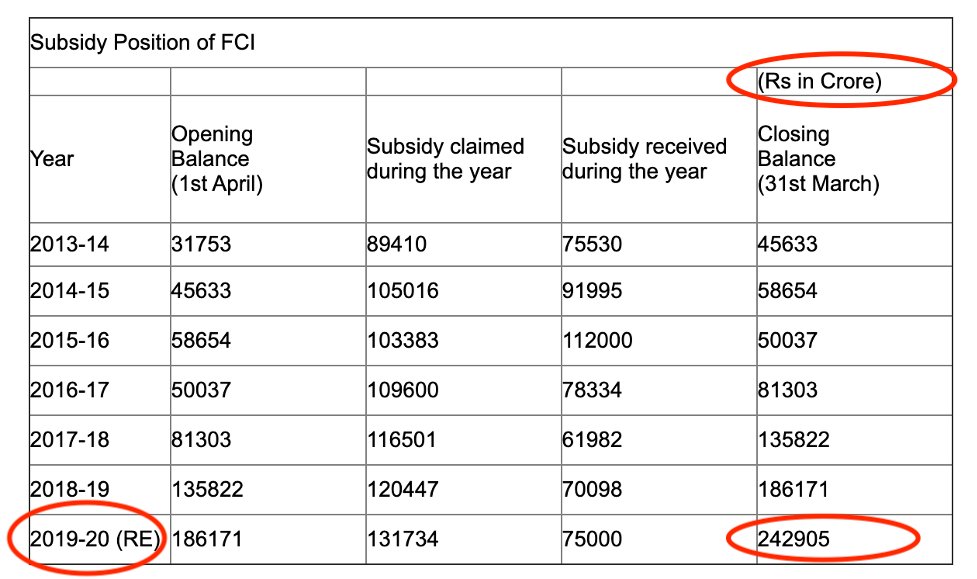

This stock is appx 3 yrs of production. These are absurd holding levels. Add to this the sudden spike in MSP rates in last 5 years & we’re looking at substantial deficits for the Food Corporation of India. How much deficit? Well, Rs 2.5 lac crores.

And look at the pace it is growing over the last 5 years. FCI’s borrowing from nation small savings fund has already risen from R 70,000 crore in FY 2017 to Rs 191,000 crore in FY 20. This is in addition to the food subsidy bill of Rs 184,000 crore for FY 20.

Who pays for this money? Well, we the people. And I’m fine for it if it does well for the farmer.

However, the challenges are much bigger & rarely solved by throwing money at the problem. As with most things, India is diverse & so are the issues.

However, the challenges are much bigger & rarely solved by throwing money at the problem. As with most things, India is diverse & so are the issues.

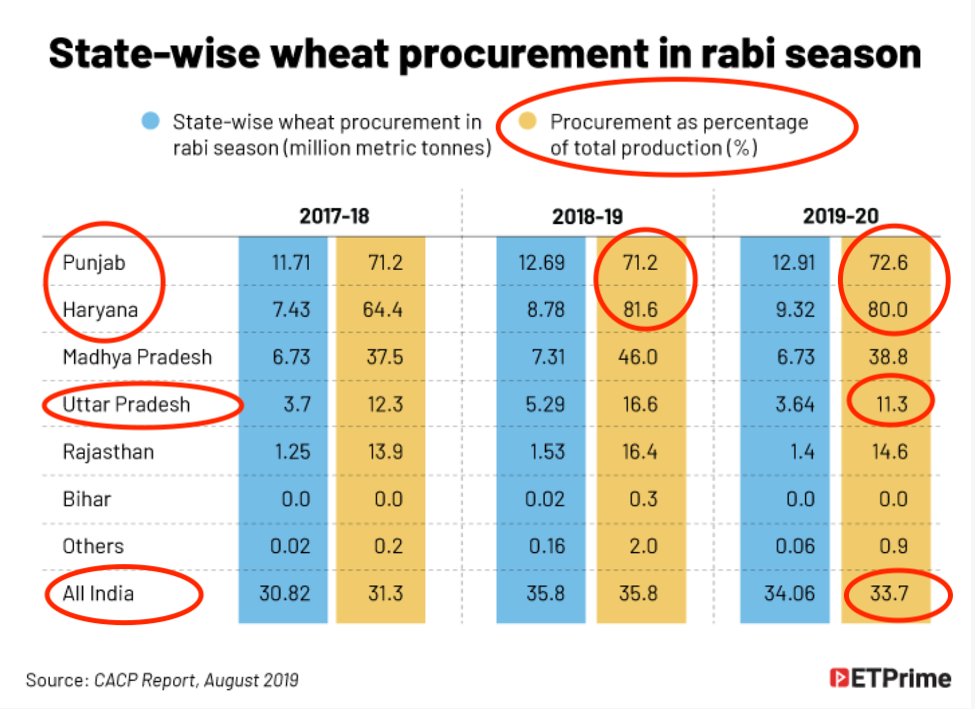

Why are protests concentrated in Punjab+Haryana? I tried to explore the money trail (credit to G. Madhavankutty@ ET prime).Grapgic below indicates the % of wheat bought thru MSP in each state. As is obvious, 70%-80% of wheat sells at MSP in the 2 states. Rest of India,not so much

So, MSP is solving only for Punjab & Haryana farmers. It is irrelevant for rest of India. No wonder we don’t see others in this protest. So, do you still recommend MSP as the holy grail for Indian farmer? I doubt it.

MSP is breeding the same inequality that is manifested in every aspect of our system. Rich farmer gets richer & lobbies to maintain status quo. If APMCs stay, who gains more? Recall license Raj of the 1970s ? This brings us to the economics of APMCs.

Are APMCs really inefficient or have they been a victim here? Do farmers want APMCs or have they been propped up by trading lobby behind the scenes? I was also intrigued by the great deal of support coming from Punjab CM to the protest. Tax money trail could offer some clues

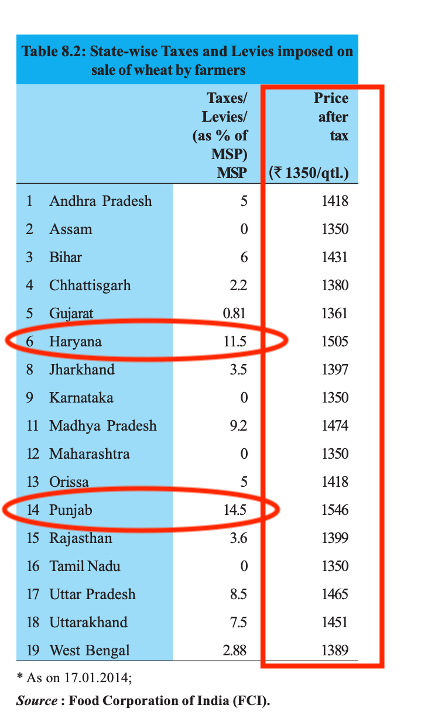

Look at the 2014 report of FCI published in the economic survey of India. We see that although Punjab & Haryana lead in MSP procurements, the net result for the farmers is almost the same across the country. This is due to the arbitrary taxes & fees that APMCs levy on the trade.

Punjab leads with 15% levies as % of MSP. In the end, farmers get a net Rs 1546 per quintal, which is not much different than his counterpart in UP or even Bihar. So, while MSP works for some, it certainly doesn’t work for the farmer!

That explains the huge political support “behind” the farmers. At 15% taxes/levies on Rs 64,000 trade annually, Rs 9600 crore is on the table here for stakeholders in Punjab, including the state govt. It can move a lot of mountains & yes, a protest as well.

Conclusion: So where does that leave us? We can increase overall prices & guarantee MSPs, but APMC brokerages & taxes ruin it for the farmer. The middlemen, including the state gets richer via brokerage on farmer’s produce. So much for being pro farmer govt.

Additionally, the FCI keeps getting bankrupt & will eventually eat into our taxes. I take the liberty of assuming that most urban consumers are not willing to pay more for agri produce, else onion prices wouldn’t have changed govts in the past.

Also pls don’t forget about PM Kissan scheme that pays fixed income to all farmers across India. Direct transfer thru such schemes is always much beneficial in India vs the inefficient APMC & FCI procurement doles thru MSPs.

The only way to pay farmers more is to cut the broker & state taxes. Just compare the mandi prices & what retailer sells for & you would know the potential. I think the new laws do exactly that. But of course, it will hurt some along the way. Just like every disruption does.

Thanks to @republic TV for the opportunity to speak about farm acts and how the farmers are being misled. Watch repeat telecast today at 4.30 PM Sunday on R.Commentary with Abhishek Kapoor @itootweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh