The trader who turned $400 account into $200 million account.

10 lessons from Richard dennis, which can help you become a better trader-

Thread:

10 lessons from Richard dennis, which can help you become a better trader-

Thread:

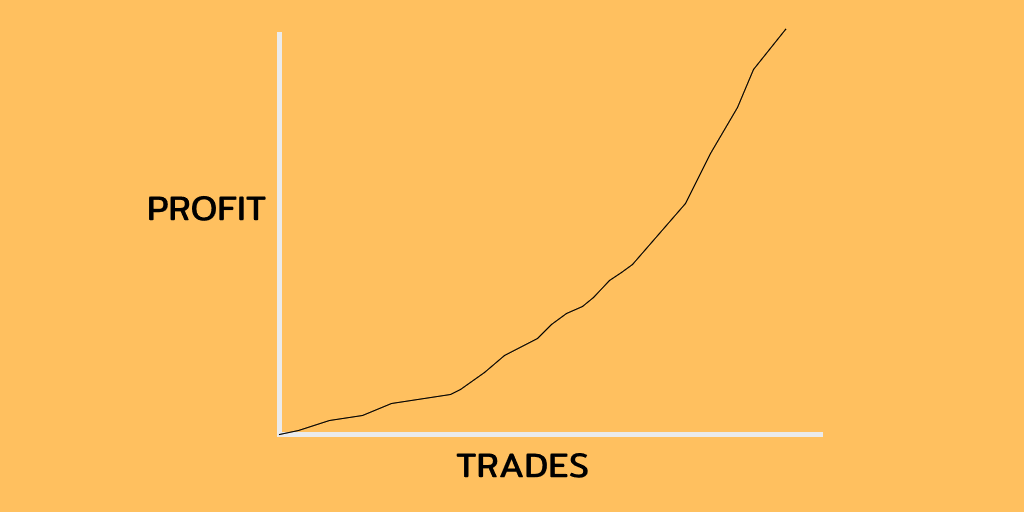

1. Whatever method you use to enter trades, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend.

2. A good trend following system will keep you in the market until there is evidence that the trend has changed.

2. A good trend following system will keep you in the market until there is evidence that the trend has changed.

3. When you have a position, you put it on for a reason, and you’ve got to keep it until the reason no longer exists.

4. You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do.

4. You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do.

5. Trading decisions should be made as unemotionally as possible.

6. Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

6. Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

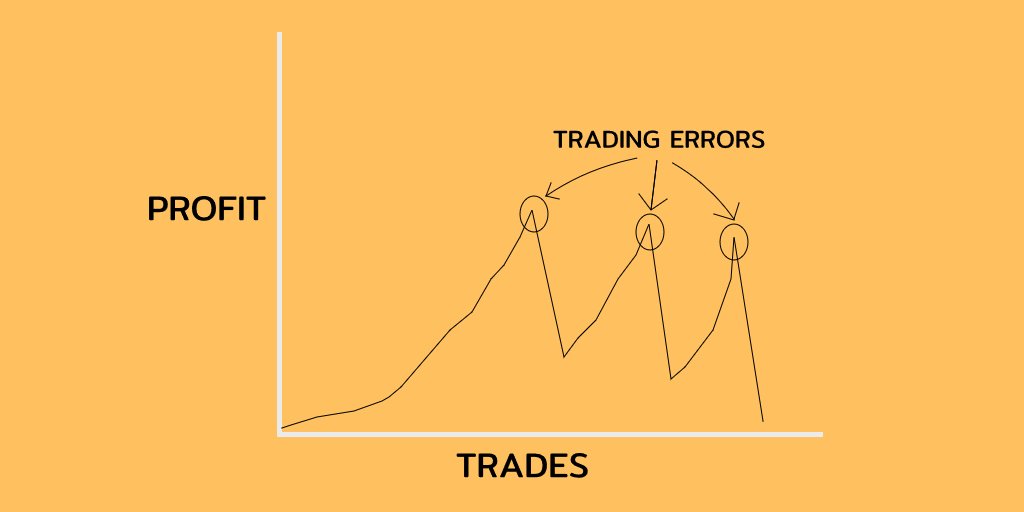

7. You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time.

What you can’t afford to do is throw away your capital on sub-optimal trades.

What you can’t afford to do is throw away your capital on sub-optimal trades.

8. I learned that a certain amount of loss will affect your judgment, so you have to put some time between that loss and the next trade.

9. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people.

9. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people.

10. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh