To understand economic phenomena we must analyse human action, rather than material objects and their properties.

Inanimate objects are dead matter.

It is human reason shaping humans’ actions that rearranges matter and gives it value, meaning, and purpose.

1/8

Inanimate objects are dead matter.

It is human reason shaping humans’ actions that rearranges matter and gives it value, meaning, and purpose.

1/8

Attempts to explain social phenomena by reference to objects, abstract nouns, or collectivist entities are ultimately futile.

Entities do not act, only individuals do.

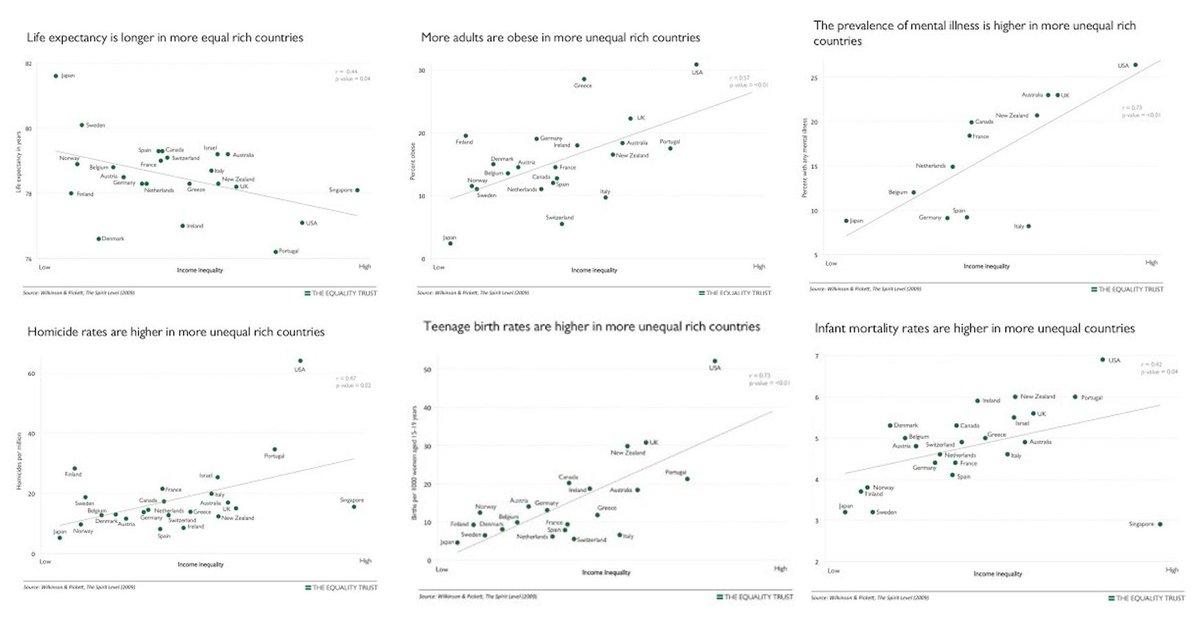

Quantitative economic methods neglect the fact that there are no constant relations in human action.

2/8

Entities do not act, only individuals do.

Quantitative economic methods neglect the fact that there are no constant relations in human action.

2/8

In the natural sciences, establishing a constant relationship like the Ideal Gas Law is possible because measurements are made in fixed units.

Clearly defined and inter-personally agreed-upon units of measurement like joules and kilograms have no equivalent in economics.

3/8

Clearly defined and inter-personally agreed-upon units of measurement like joules and kilograms have no equivalent in economics.

3/8

There are no clearly defined units of measurement in economics.

"Value" (the raw material of economics) is not a physically defined quantity, but a psychologically experienced judgement.

Currencies can't serve as units because both their supply and demand changes.

4/8

"Value" (the raw material of economics) is not a physically defined quantity, but a psychologically experienced judgement.

Currencies can't serve as units because both their supply and demand changes.

4/8

Ill-defined units make it impossible for economists to conduct comparable and reproducible experiments.

Furthermore, societies are complex and control conditions can’t be held constant between experiments.

This is the reason modern macroeconomic models repeatedly fail.

5/8

Furthermore, societies are complex and control conditions can’t be held constant between experiments.

This is the reason modern macroeconomic models repeatedly fail.

5/8

In reality, macroeconomists don't try to falsify their sophisticated equations.

Economic "laws" come and go with academic fashion and are believed on the basis of authority.

When 1970s stagflation disproved Keynes’ theories, they were not thrown out but simply “modified”.

6/8

Economic "laws" come and go with academic fashion and are believed on the basis of authority.

When 1970s stagflation disproved Keynes’ theories, they were not thrown out but simply “modified”.

6/8

Human action shapes economic outcomes, not the aggregate measures constructed in government statistical offices.

Macro statistics are not worthless, but Austrians object to treating them as causal factors and assuming their relationships can be extrapolated predictively.

7/8

Macro statistics are not worthless, but Austrians object to treating them as causal factors and assuming their relationships can be extrapolated predictively.

7/8

Economists have spent the last century running down a blind alley trying to find precise scientific laws that govern economic relationships.

Austrians have escaped this error because they understand that economic phenomena are but manifestations of underlying human action.

8/8

Austrians have escaped this error because they understand that economic phenomena are but manifestations of underlying human action.

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh