1/ This was a very interesting case study so it deserves its own little tweetstorm.

Q: What is the proper way to analyze a SaaS company that has revenue from both Individual and Team plans?

Founders: I'm about to reveal a trade secret of Craft.

Other VCs: pease stop reading.

Q: What is the proper way to analyze a SaaS company that has revenue from both Individual and Team plans?

Founders: I'm about to reveal a trade secret of Craft.

Other VCs: pease stop reading.

https://twitter.com/nbt/status/1336114610122846208

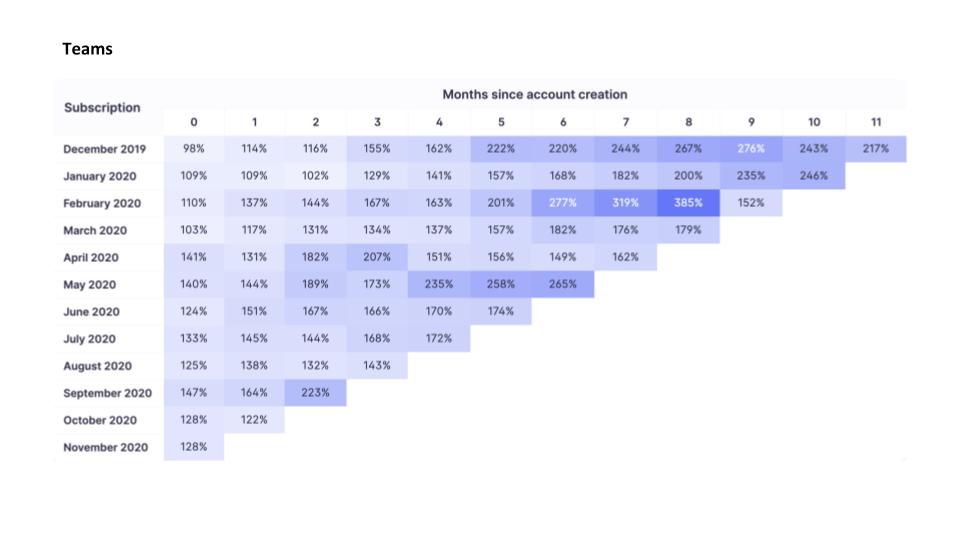

2/ Craft evaluated a Series A investment that had 85% annual revenue retention across the Overall business. It didn't look particularly impressive.

But when we separated cohorts for Individual and Team plans, we saw a very different picture. The average masked two extremes.

But when we separated cohorts for Individual and Team plans, we saw a very different picture. The average masked two extremes.

3/ The Individual plan had about 60% annual revenue retention, which is poor (but not uncommon for Individual plans). The Team product had roughly 200%+ net revenue retention, which is fantastic.

4/ Most importantly, revenue cohorts for the Team product were compounding over time whereas revenue cohorts for the Individual product were shrinking. This is the key point: The Team product was creating a growing revenue base while the Individual base was deteriorating.

5/ How does Craft value a business like this? We placed 0 value on ARR from the Individual business but valued the Team business at a very high ARR multiple. We led the Series A. VCs that didn’t separate Teams vs Overall may have missed why we are so excited about this one.

6/ Moral of the story: when a SaaS business has both B2B/Team plans and B2C/Individual plans, break your analysis into two separate buckets. If B2B has compounding cohorts and B2C has deteriorating cohorts, place all the value on B2B and view B2C as lead gen. //

• • •

Missing some Tweet in this thread? You can try to

force a refresh